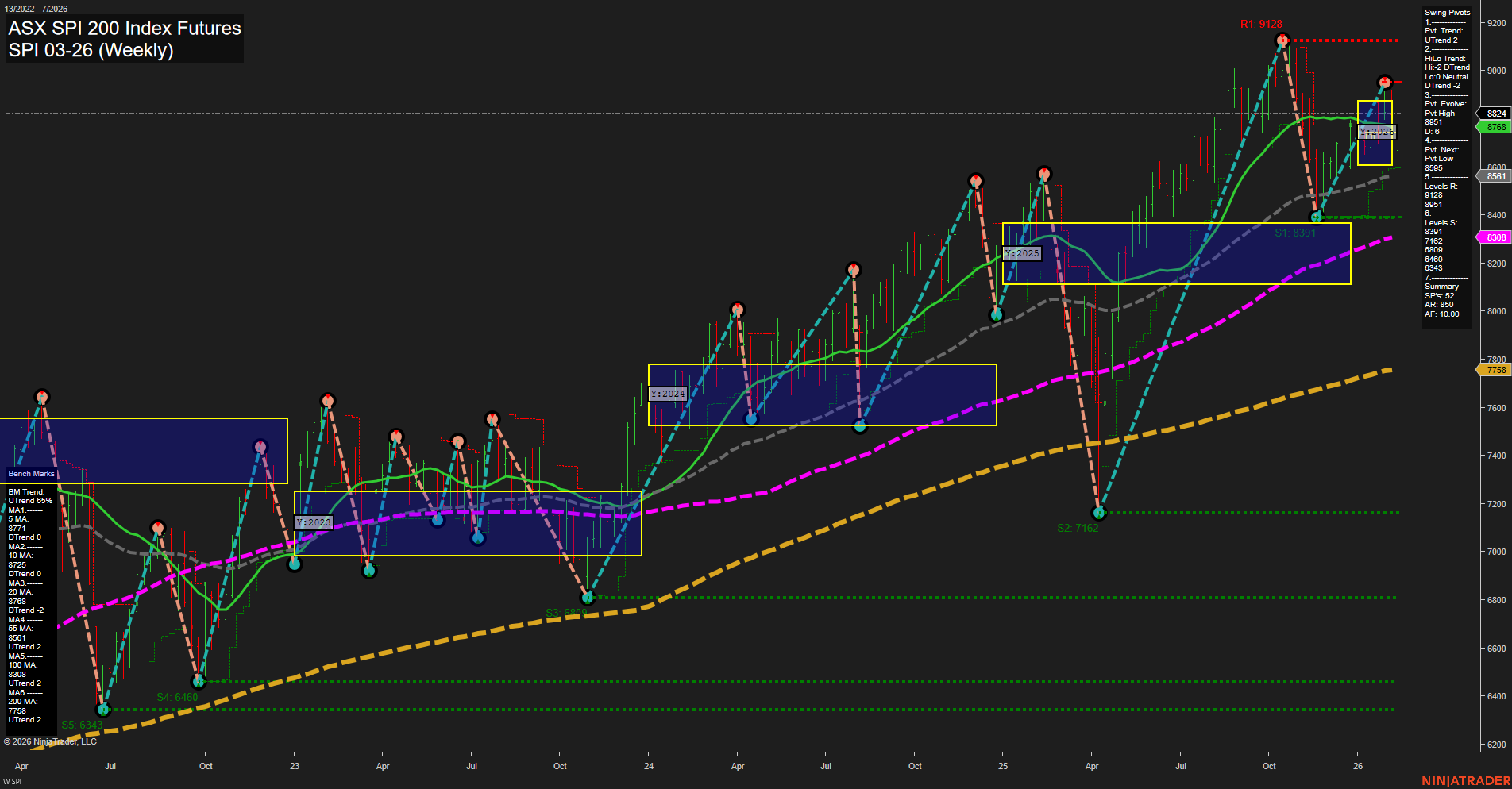

The SPI 200 Index Futures weekly chart shows a market that has recently experienced a strong upward swing, with the last price at 8824 and momentum holding at an average pace. The short-term swing pivot trend is up, supported by all benchmark moving averages trending higher, indicating underlying strength. However, the intermediate-term HiLo trend has shifted to down, suggesting some consolidation or corrective action after the recent highs. The most recent swing high at 9128 acts as resistance, while the next significant support is at 8391, with deeper levels at 7162, 6460, and 6343. The price is currently trading above all major moving averages, reinforcing the long-term bullish structure. The neutral bias in the session fib grids across all timeframes points to a market in a pause or consolidation phase, potentially digesting gains before the next directional move. Overall, the structure remains bullish in the short and long term, but the intermediate-term signals a period of indecision or pullback, typical after a strong rally. The market is in a healthy uptrend, but with some short-term volatility and possible range-bound action as it tests key support and resistance levels.