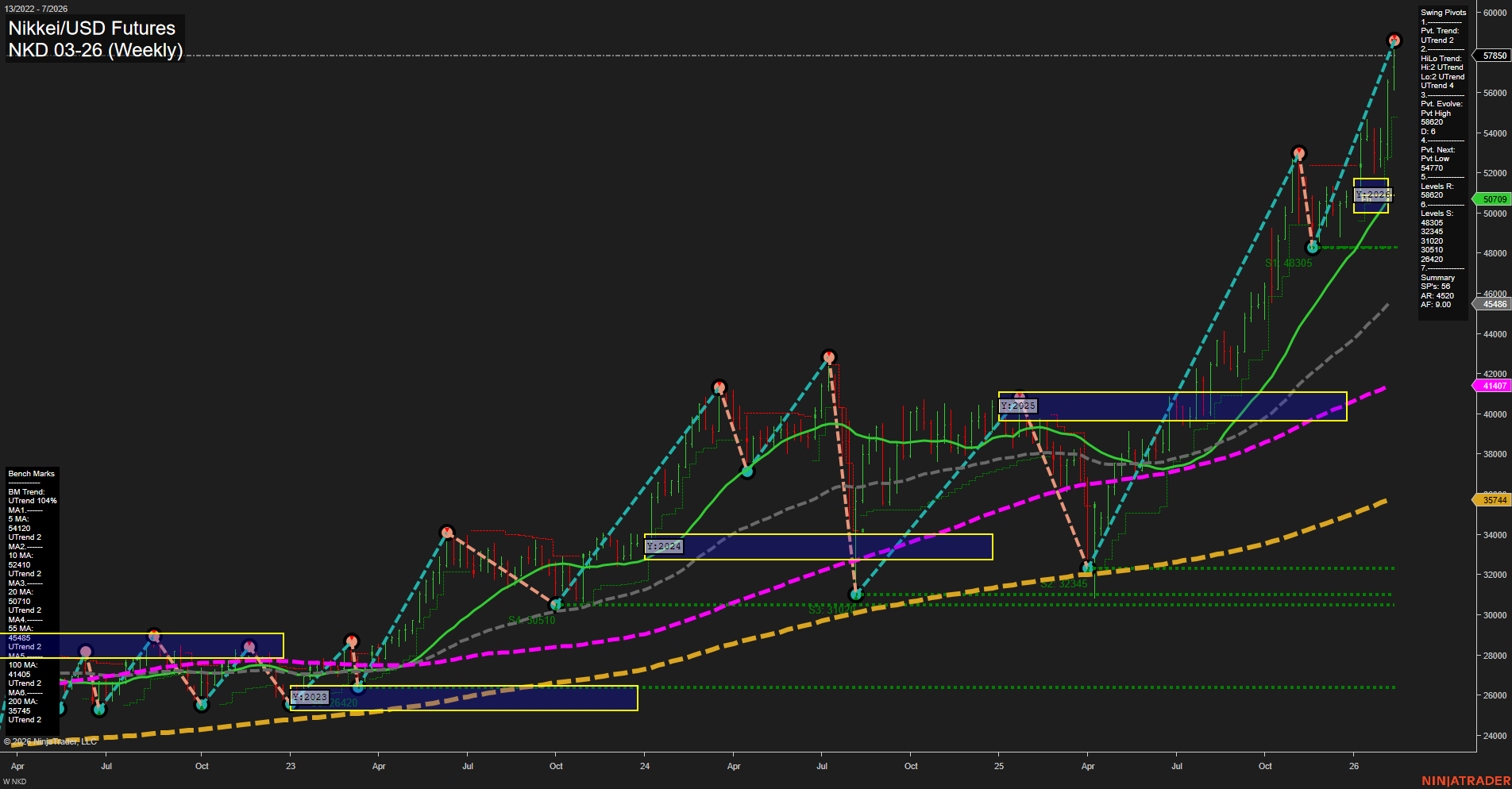

The NKD Nikkei/USD Futures weekly chart is displaying a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating aggressive buying and a powerful uptrend. The market is trading well above all key Fibonacci grid levels (weekly, monthly, yearly), with the price consistently above the NTZ (neutral zone) center lines, reinforcing the prevailing upward bias. Swing pivot analysis confirms the uptrend, with both short-term and intermediate-term trends showing higher highs and higher lows. The most recent pivot high at 57,850 marks a new resistance, while multiple support levels are stacked below, suggesting a solid foundation for the current rally. All benchmark moving averages (from 5-week to 200-week) are trending upward, further validating the strength and sustainability of the move. Recent trade signals have all been to the long side, aligning with the technical picture. The market has broken out from previous consolidation zones and is exhibiting a classic trend continuation pattern, with no immediate signs of exhaustion or reversal. Volatility is elevated, but the structure remains orderly, with higher lows and strong follow-through on breakout moves. This environment is favorable for trend-following swing strategies, as the market continues to reward momentum and breakout participation.