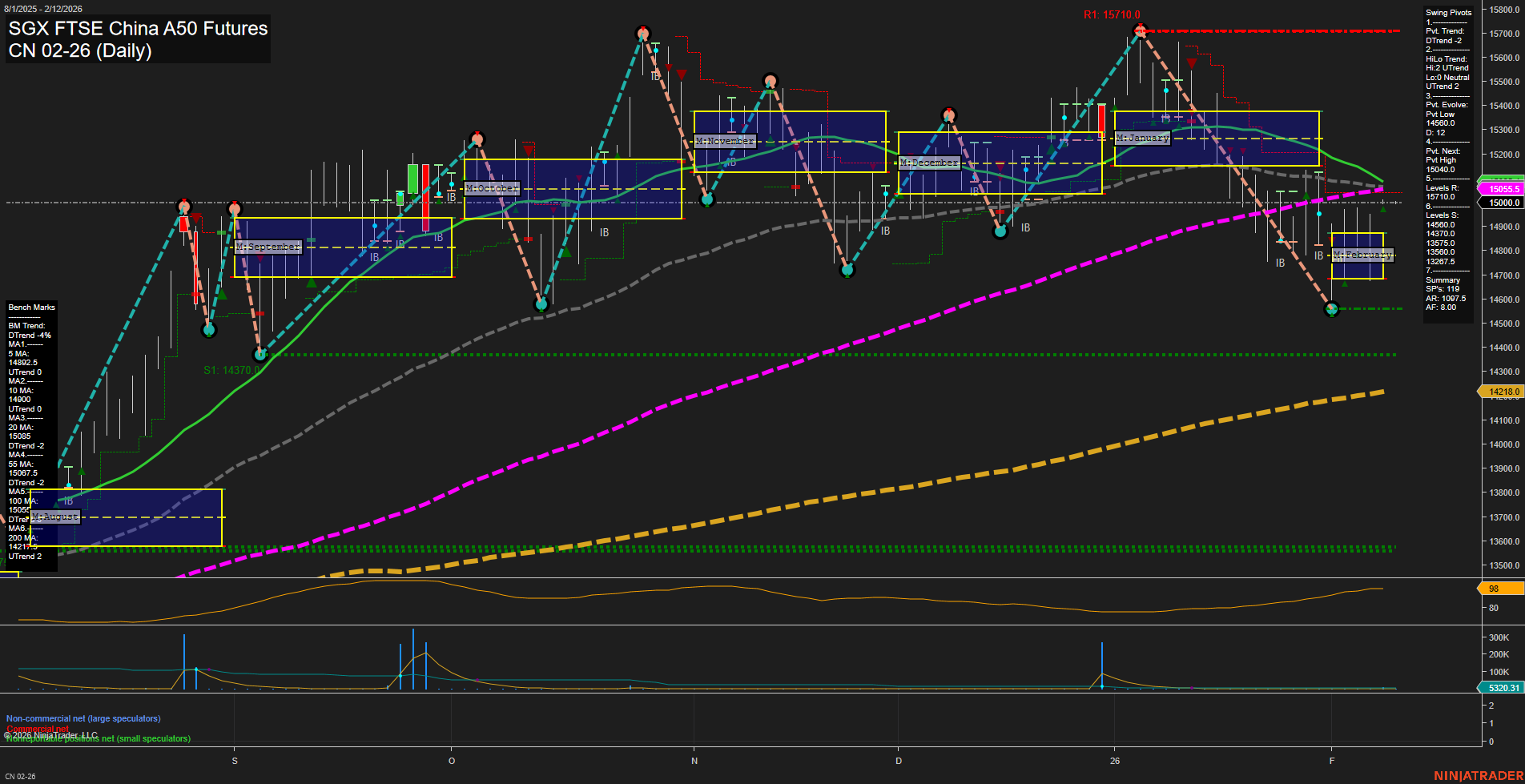

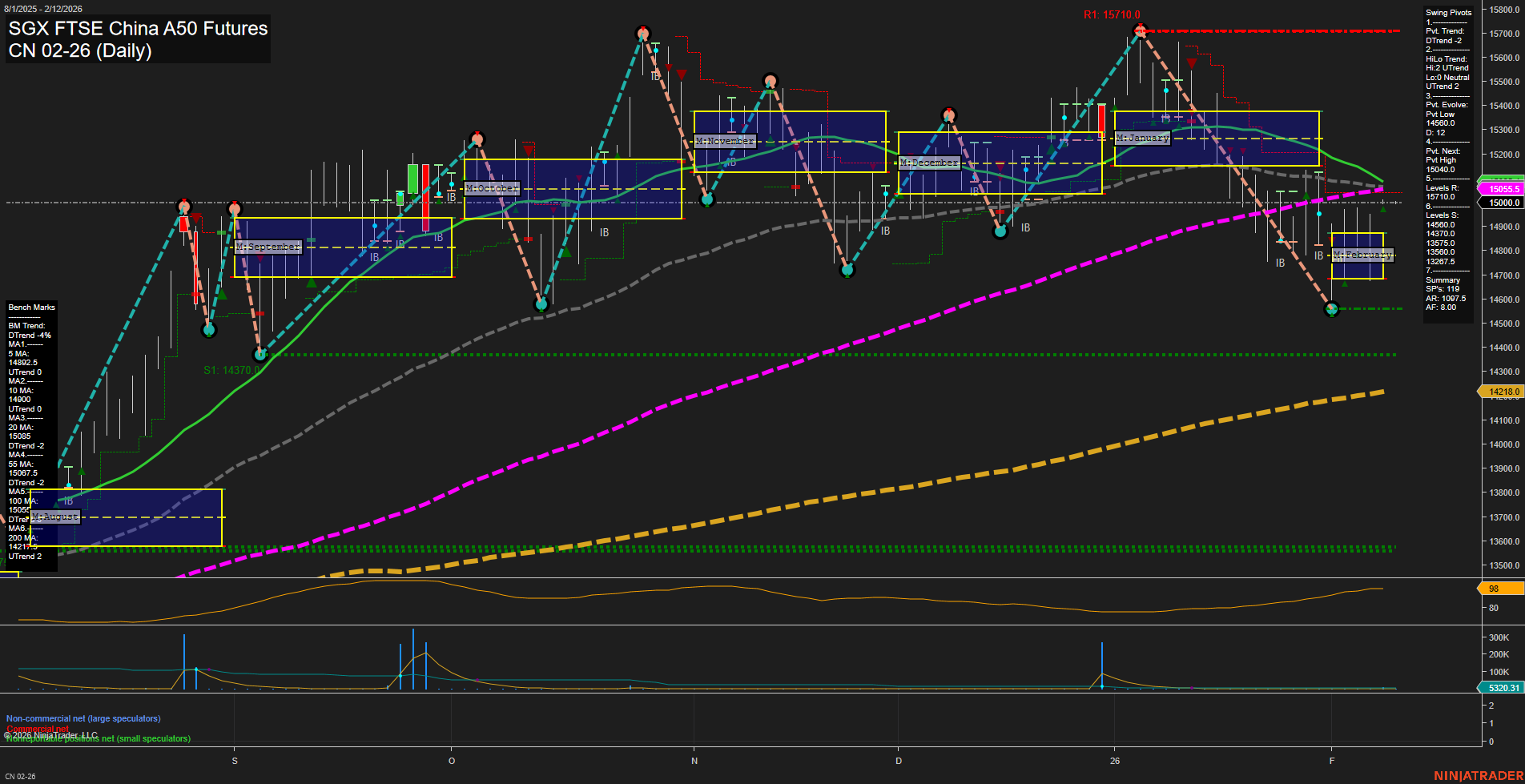

CN SGX FTSE China A50 Futures Daily Chart Analysis: 2026-Feb-10 07:06 CT

Price Action

- Last: 15095.5,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 14500.0,

- 4. Pvt. Next: Pvt high 15040.0,

- 5. Levels R: 15710.0, 15040.0,

- 6. Levels S: 14500.0, 14370.0, 13755.0, 13575.0, 13275.0.

Daily Benchmarks

- (Short-Term) 5 Day: 14982.5 Down Trend,

- (Short-Term) 10 Day: 15044.0 Down Trend,

- (Intermediate-Term) 20 Day: 15107.5 Down Trend,

- (Intermediate-Term) 55 Day: 15184.0 Down Trend,

- (Long-Term) 100 Day: 15095.5 Down Trend,

- (Long-Term) 200 Day: 14218.0 Up Trend.

Additional Metrics

- ATR: 87.5,

- VOLMA: 261842.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The CN SGX FTSE China A50 Futures daily chart shows a market in a corrective phase after a significant swing high at 15710.0, with price currently at 15095.5. Short-term momentum is slow, and price bars are medium-sized, reflecting a lack of strong directional conviction. The short-term swing pivot trend is down (DTrend), with the next potential reversal at 15040.0, while the intermediate-term HiLo trend remains up (UTrend), suggesting a possible underlying support for the market. All short- and intermediate-term moving averages are trending down, reinforcing the short-term bearish bias, while the 200-day MA remains in an uptrend, indicating that the longer-term structure is still intact. Key resistance is at 15710.0 and 15040.0, with support levels at 14500.0 and below. ATR and volume metrics indicate moderate volatility and participation. Overall, the market is in a short-term bearish correction within a broader neutral to bullish context, with no clear breakout or breakdown, and price action is consolidating near key support and resistance levels.

Chart Analysis ATS AI Generated: 2026-02-10 07:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.