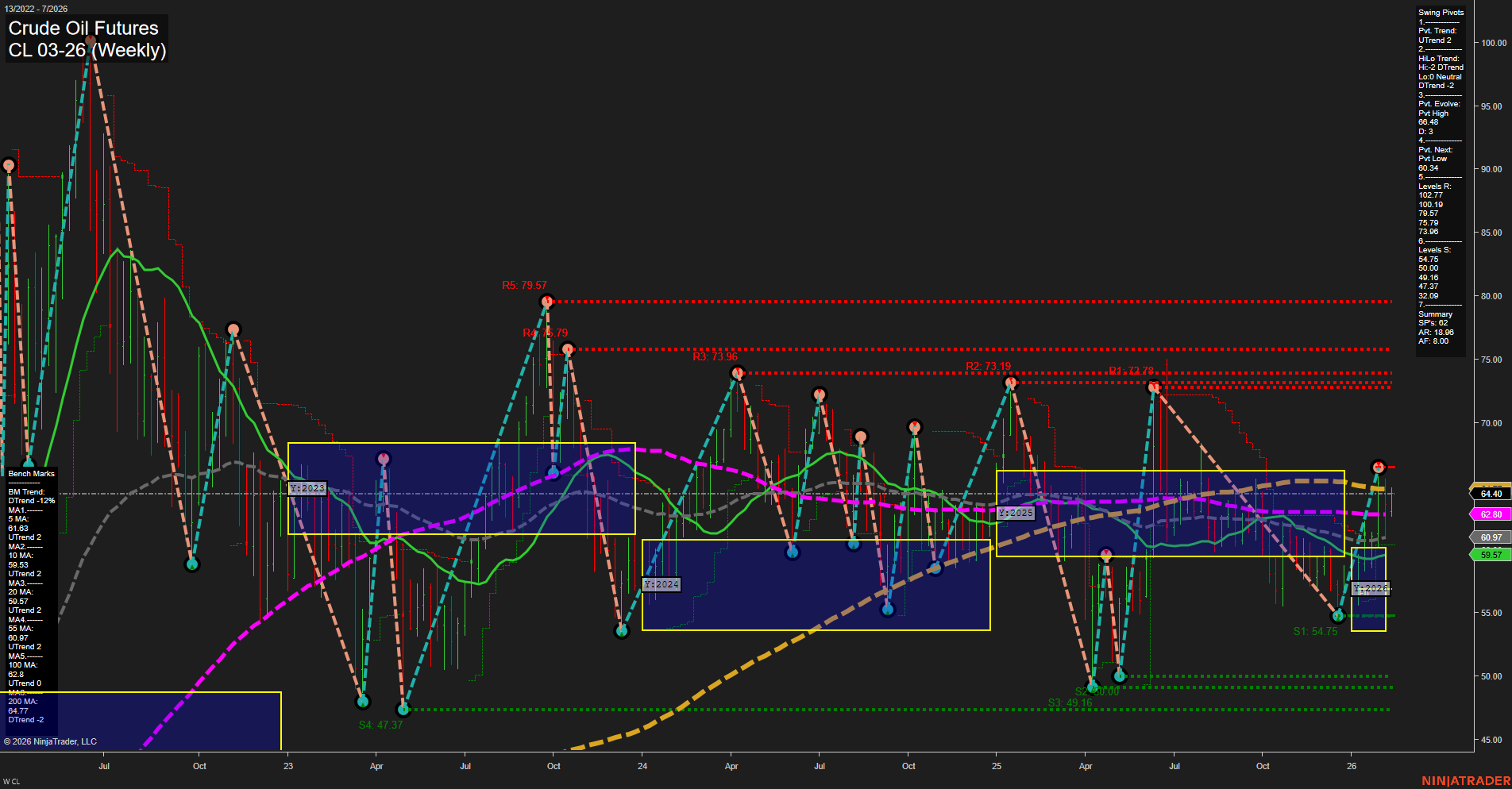

Crude oil futures are currently showing a mixed technical landscape. Short-term momentum is positive, with price action above the weekly session fib grid (WSFG) center and a clear uptrend in the short-term swing pivots. The recent bounce has pushed price above key short-term moving averages, and the 5- and 10-week benchmarks are both trending higher, supporting a bullish short-term outlook. However, the intermediate-term picture is less constructive: the monthly session fib grid (MSFG) trend is down, and the intermediate swing pivot trend remains bearish, indicating that the recent rally is still counter to the prevailing medium-term trend. Long-term signals are neutral, with price hovering near the 200-week moving average and mixed signals from the 55-, 100-, and 200-week benchmarks, all of which are in downtrends. Resistance levels are clustered in the low-to-mid 70s, while support is found in the mid-50s and below. The market appears to be in a recovery phase from a prior sell-off, but faces significant overhead resistance and remains vulnerable to further consolidation or choppy trading as it tests these levels. Recent trade signals reflect this indecision, with both long and short entries triggered in the past week. Overall, the market is in a transitional phase, with short-term strength but unresolved intermediate and long-term direction.