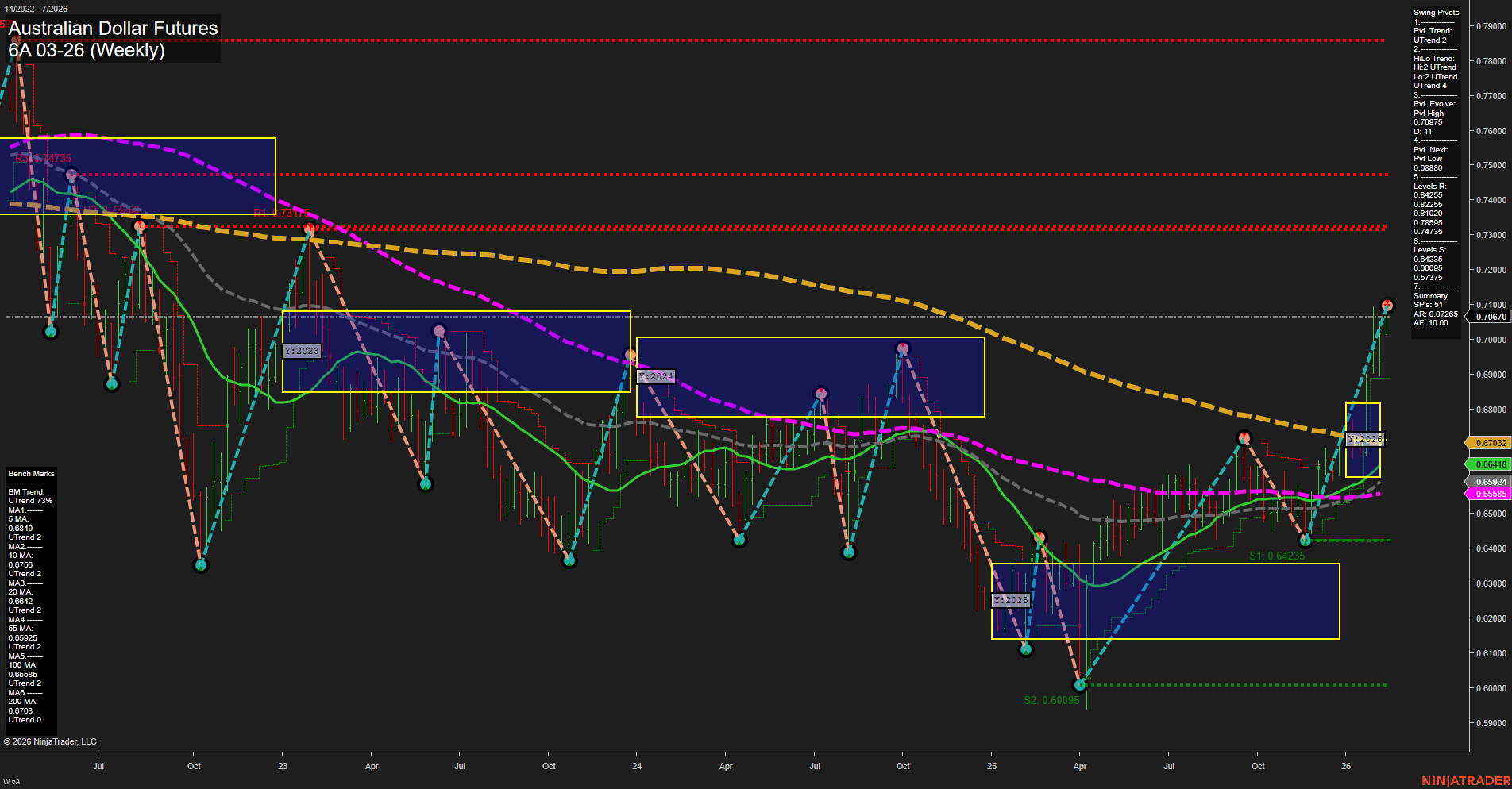

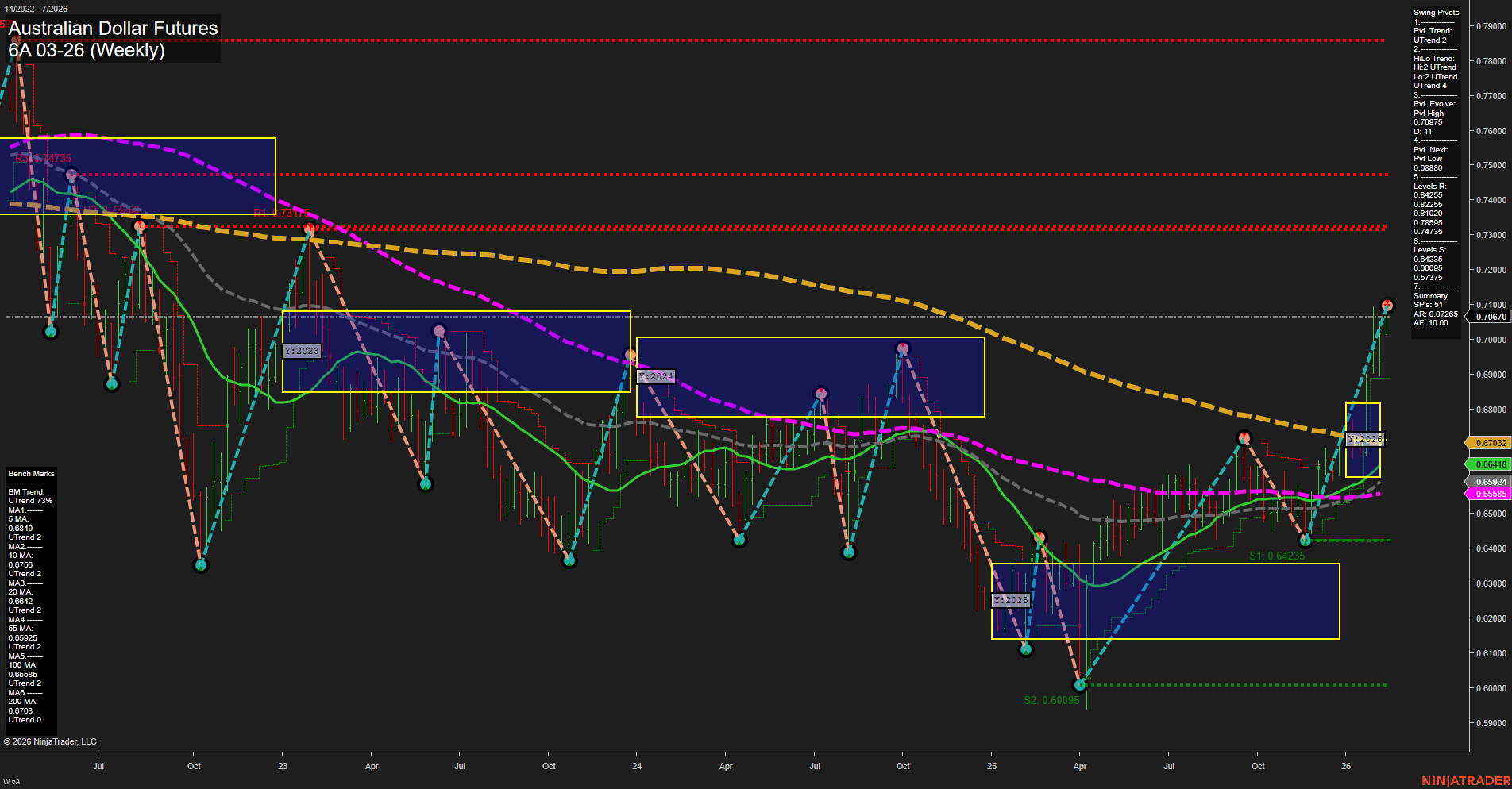

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Feb-10 07:00 CT

Price Action

- Last: 0.70679,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.70679,

- 4. Pvt. Next: Pvt low 0.67032,

- 5. Levels R: 0.77385, 0.74735, 0.68880,

- 6. Levels S: 0.67032, 0.65585, 0.60095, 0.57375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.67096 Up Trend,

- (Intermediate-Term) 10 Week: 0.65922 Up Trend,

- (Long-Term) 20 Week: 0.66148 Up Trend,

- (Long-Term) 55 Week: 0.65585 Up Trend,

- (Long-Term) 100 Week: 0.66083 Up Trend,

- (Long-Term) 200 Week: 0.70643 Down Trend.

Recent Trade Signals

- 09 Feb 2026: Long 6A 03-26 @ 0.70355 Signals.USAR-WSFG

- 06 Feb 2026: Long 6A 03-26 @ 0.7012 Signals.USAR.TR120

- 04 Feb 2026: Long 6A 03-26 @ 0.69955 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) have shown a strong upward move, with the latest weekly bar being large and momentum fast, indicating aggressive buying interest. Both short-term and intermediate-term swing pivot trends are in an uptrend, supported by a series of recent long trade signals. All key moving averages except the 200-week are trending up, confirming broad-based strength across multiple timeframes. The price has broken above recent resistance levels and is currently at a swing high, with the next major resistance at 0.74735 and 0.77385. Support is well-defined below at 0.67032 and 0.65585. The long-term trend remains neutral as the 200-week MA is still in a downtrend, suggesting the market is at a potential inflection point for longer-term participants. Overall, the technical structure favors the bulls in the short and intermediate term, with the market potentially entering a new phase if it can sustain above the 200-week moving average. The current environment reflects a possible trend continuation after a period of consolidation and breakout, with volatility elevated and momentum favoring further upside in the near term.

Chart Analysis ATS AI Generated: 2026-02-10 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.