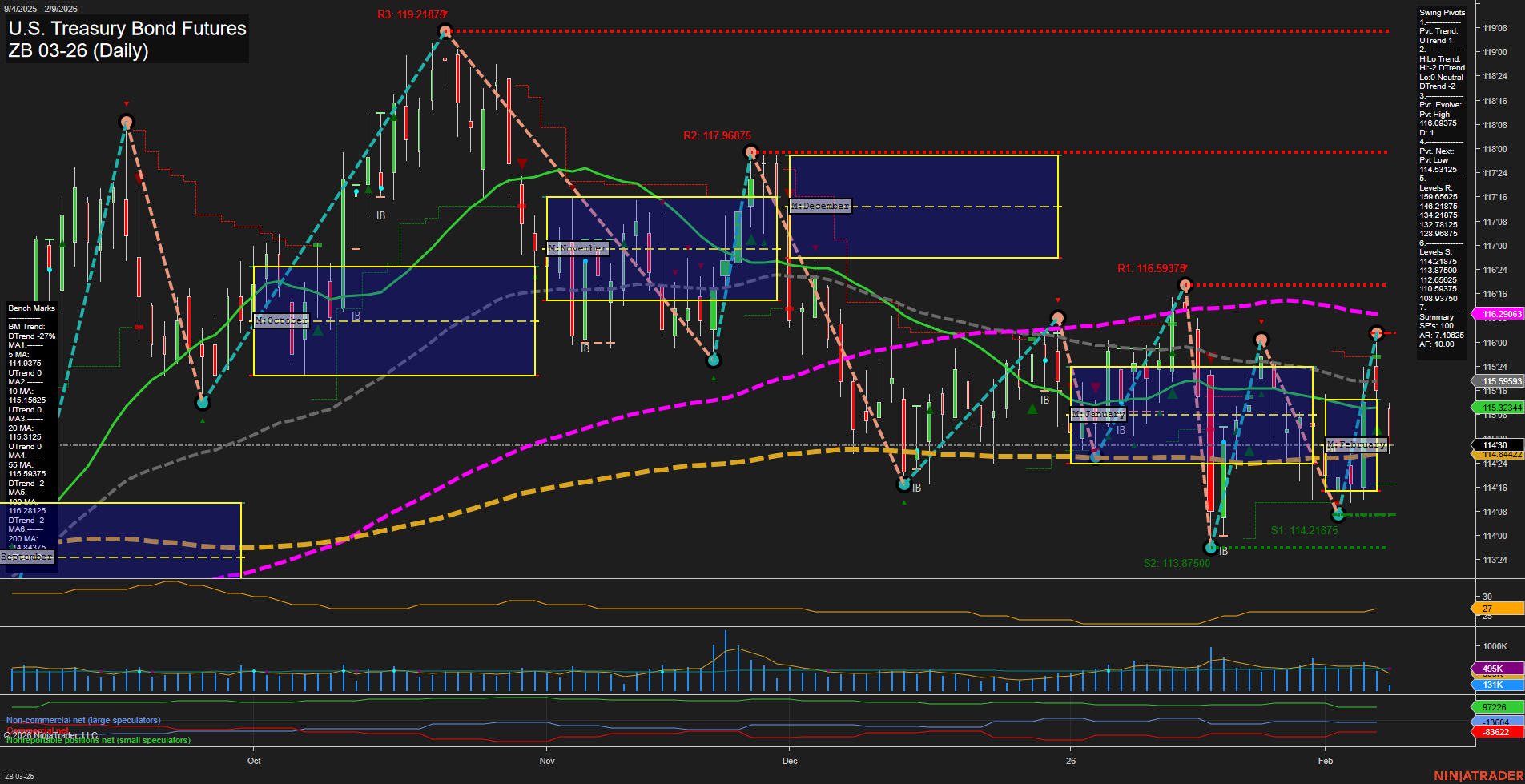

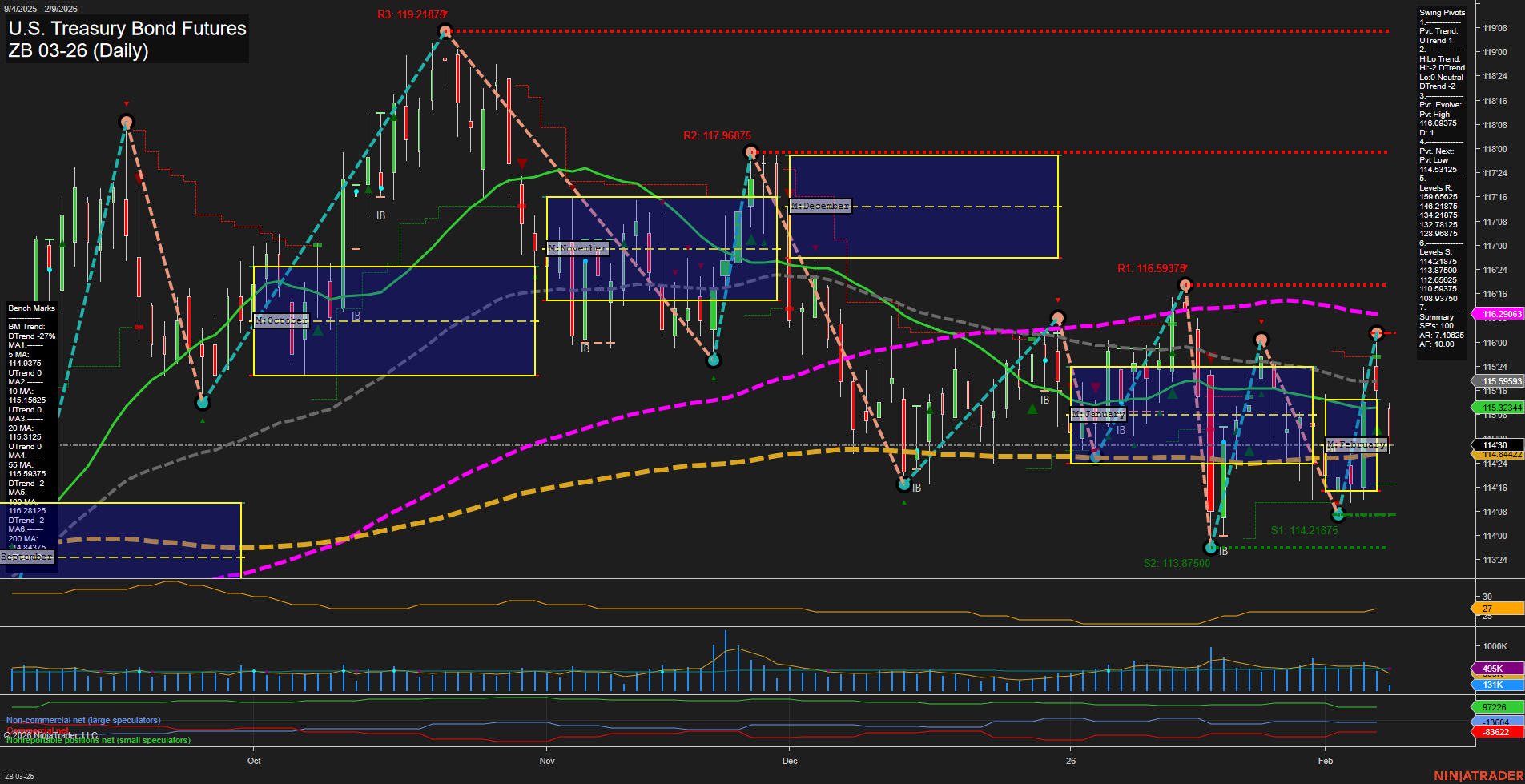

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2026-Feb-09 07:25 CT

Price Action

- Last: 115.3234,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 116.09375,

- 4. Pvt. Next: Pvt Low 114.53125,

- 5. Levels R: 116.09375, 115.6875, 115.3125, 114.96875, 114.6875,

- 6. Levels S: 114.21875, 113.875, 113.6875, 113.28125, 112.96875.

Daily Benchmarks

- (Short-Term) 5 Day: 114.9375 Up Trend,

- (Short-Term) 10 Day: 115.15625 Up Trend,

- (Intermediate-Term) 20 Day: 115.59593 Up Trend,

- (Intermediate-Term) 55 Day: 115.32434 Up Trend,

- (Long-Term) 100 Day: 116.29063 Down Trend,

- (Long-Term) 200 Day: 116.88125 Down Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in transition. Short-term momentum has shifted to an uptrend, supported by rising 5, 10, 20, and 55-day moving averages, and a recent swing pivot high. However, the intermediate-term HiLo trend remains down, indicating that the broader swing structure is still under pressure from previous declines. Long-term moving averages (100 and 200-day) are trending down, reinforcing a bearish outlook for the larger cycle. Price is consolidating within the monthly and weekly session fib grids, with no clear directional bias from the NTZ zones, suggesting a neutral stance in both short and intermediate timeframes. Volatility (ATR) is moderate, and volume is steady, indicating neither panic nor exuberance. The market appears to be in a corrective phase, with short-term bullish momentum potentially facing resistance from higher timeframe bearish trends. Swing traders should note the key resistance at 116.09375 and support at 114.21875 as pivotal levels for the next directional move.

Chart Analysis ATS AI Generated: 2026-02-09 07:25 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.