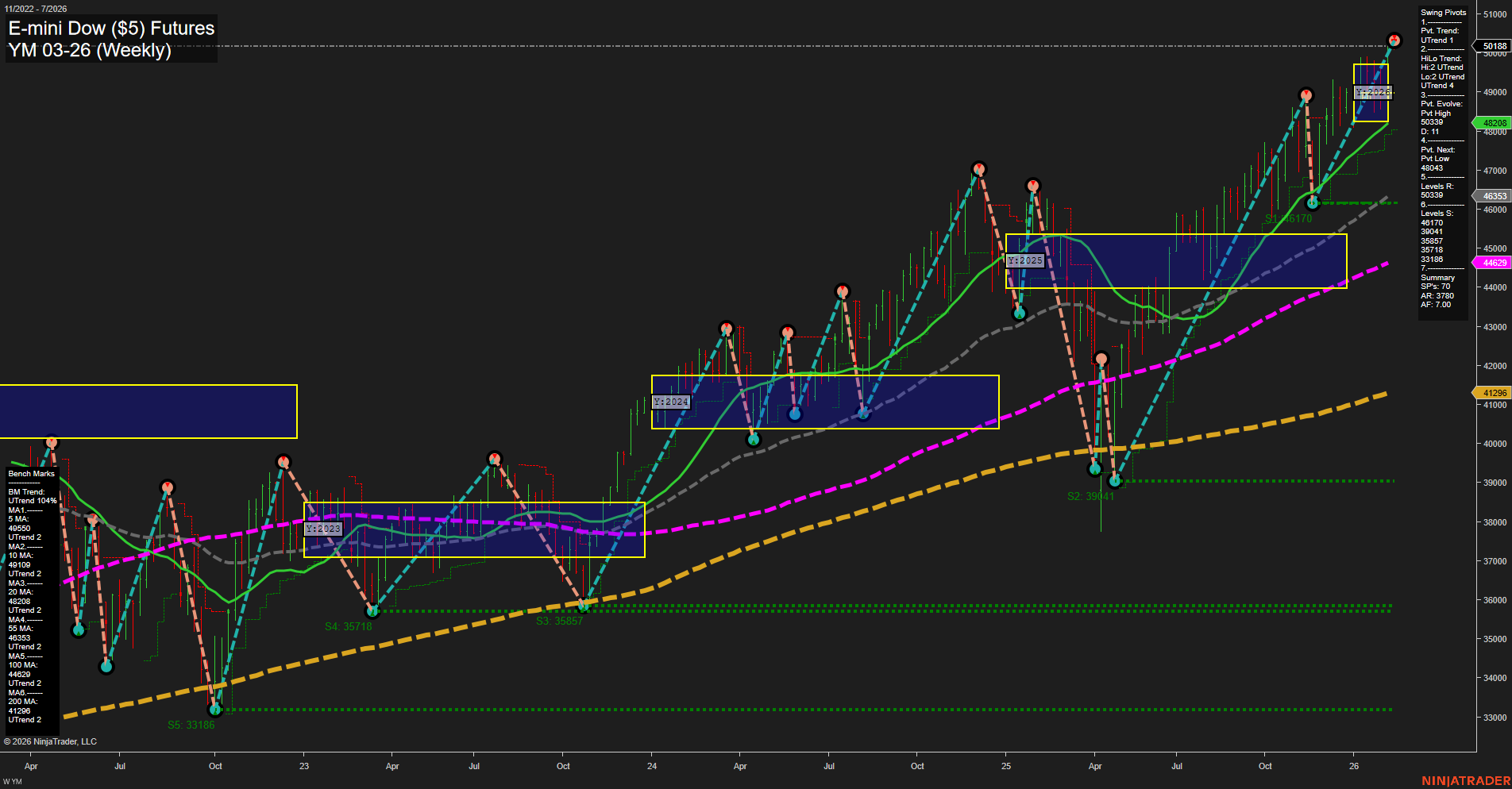

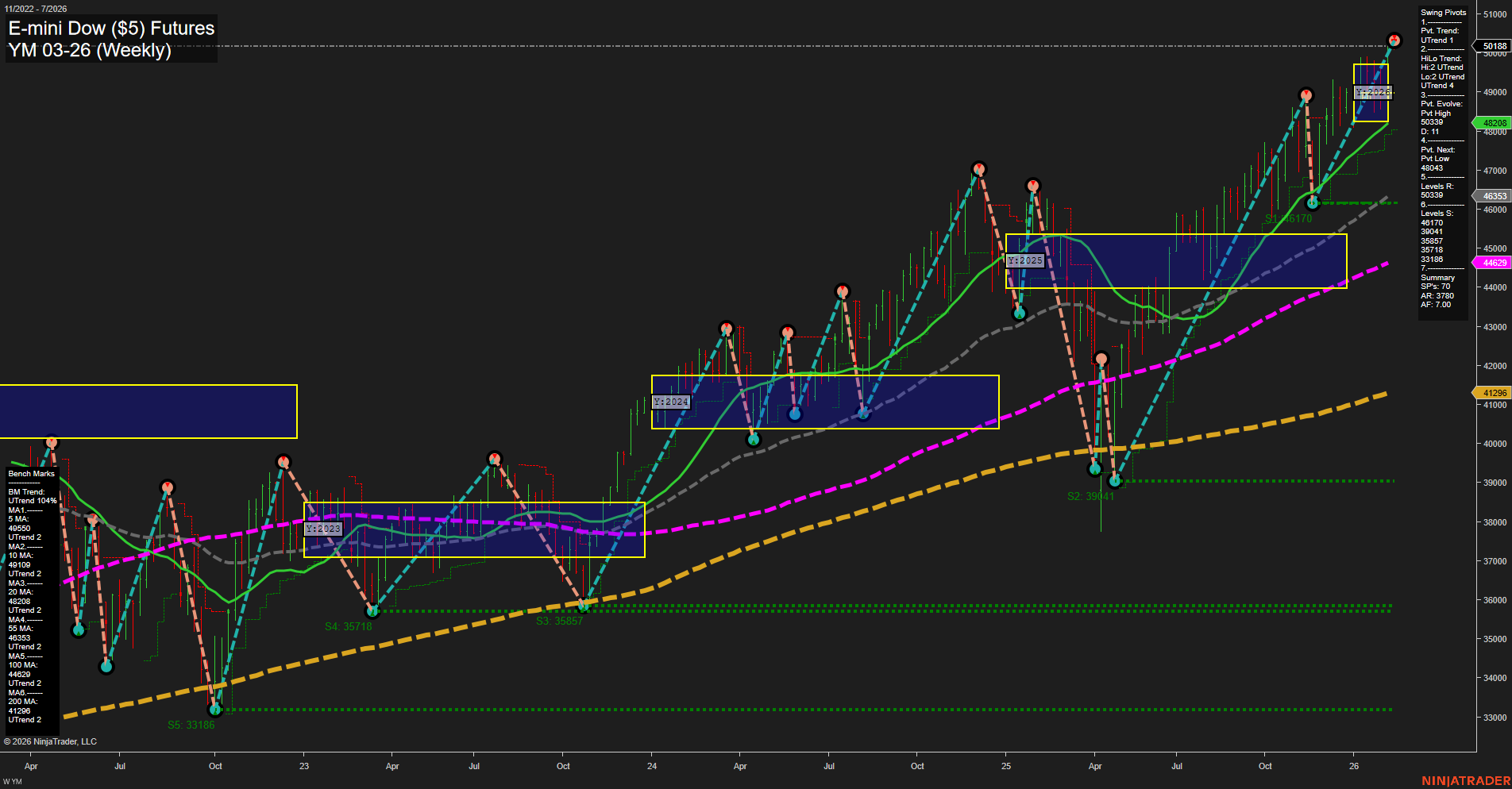

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2026-Feb-09 07:24 CT

Price Action

- Last: 50188,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 62%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 50188,

- 4. Pvt. Next: Pvt low 48443,

- 5. Levels R: 50188, 49361, 48987, 48761,

- 6. Levels S: 48443, 46353, 39941, 35857, 33186.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 48208 Up Trend,

- (Intermediate-Term) 10 Week: 46353 Up Trend,

- (Long-Term) 20 Week: 44962 Up Trend,

- (Long-Term) 55 Week: 45533 Up Trend,

- (Long-Term) 100 Week: 41296 Up Trend,

- (Long-Term) 200 Week: 41296 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Long YM 03-26 @ 49949 Signals.USAR.TR120

- 03 Feb 2026: Long YM 03-26 @ 49342 Signals.USAR-MSFG

- 02 Feb 2026: Short YM 03-26 @ 48642 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures are exhibiting strong upward momentum, with the most recent weekly bar closing at a new swing high (50188) and showing fast momentum and large bar size. Despite a short-term WSFG downtrend and price currently below the weekly NTZ center, the intermediate and long-term trends remain firmly bullish, supported by all major moving averages trending upward and price well above these benchmarks. Swing pivot analysis confirms an uptrend in both short- and intermediate-term structures, with resistance at the new highs and multiple support levels below, indicating a healthy trend structure with room for pullbacks. Recent trade signals reflect active participation in both directions, but the prevailing bias is upward, especially on the monthly and yearly frameworks. The market is in a strong rally phase, with higher lows and higher highs, and is currently testing new highs after a period of consolidation and breakout. Volatility remains elevated, and the technical structure supports the continuation of the broader uptrend.

Chart Analysis ATS AI Generated: 2026-02-09 07:25 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.