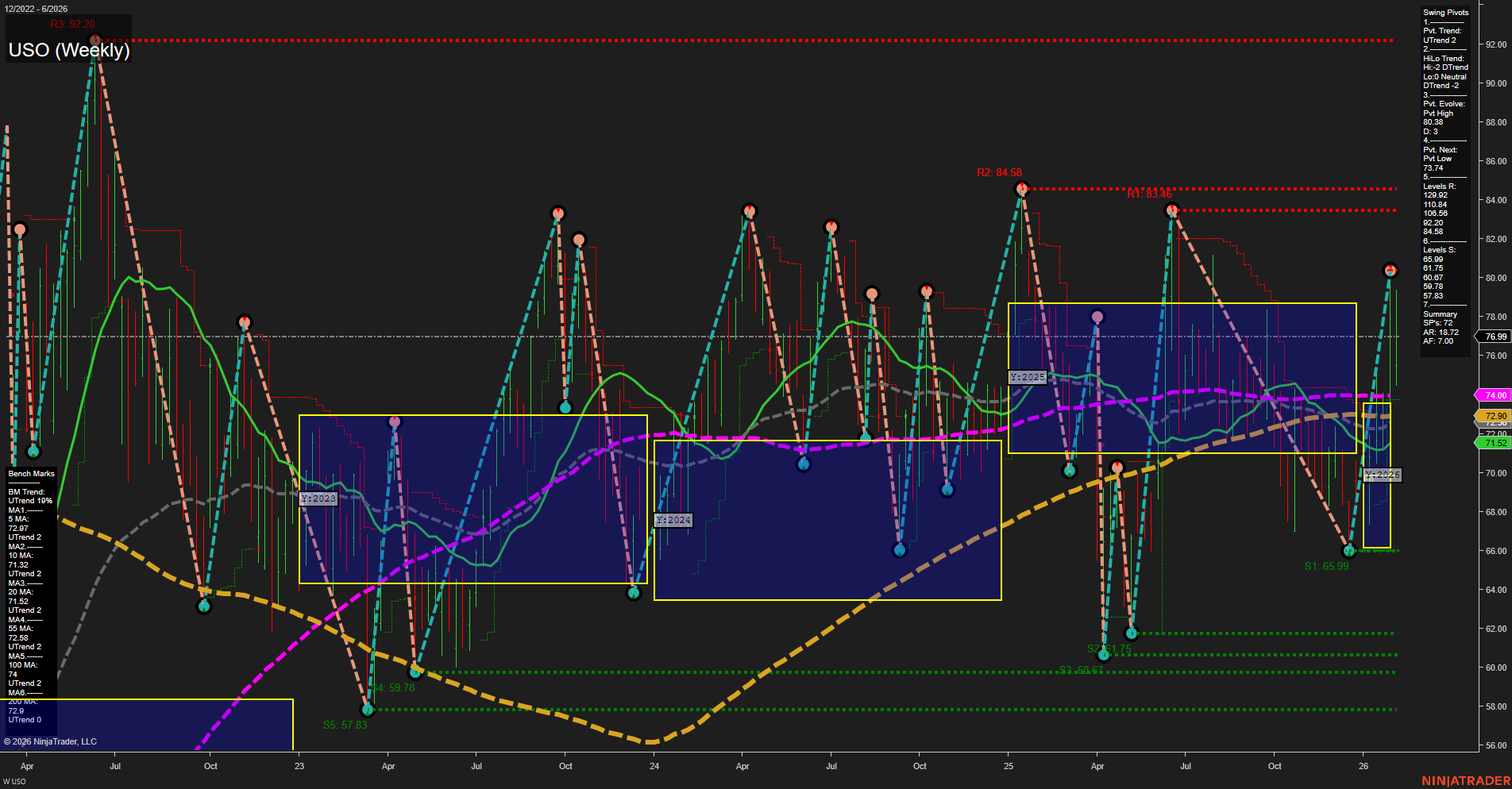

USO is currently exhibiting strong price momentum with large weekly bars and a fast-moving environment, indicating heightened volatility. The short-term swing pivot trend has shifted to an uptrend, supported by a cluster of rising intermediate and long-term moving averages (5, 10, 20, and 200 week MAs all in uptrends), while the 55 and 100 week MAs remain in downtrends, reflecting some lingering longer-term resistance. The price is trading above several key support levels, with the next major resistance at 83.25–84.58 and support at 65.99. The neutral bias across the Weekly, Monthly, and Yearly Session Fib Grids suggests a consolidation phase on higher timeframes, with no clear directional bias. The intermediate-term HiLo trend remains in a downtrend, indicating that while the short-term is bullish, the broader context is still mixed. This environment is typical of a market transitioning from a corrective phase to a potential new trend, with recent price action testing and rebounding from major support. Futures swing traders may note the potential for continued volatility and range expansion, with the possibility of further upside if resistance levels are breached, but with caution warranted due to the mixed signals on longer timeframes and the presence of significant overhead resistance.