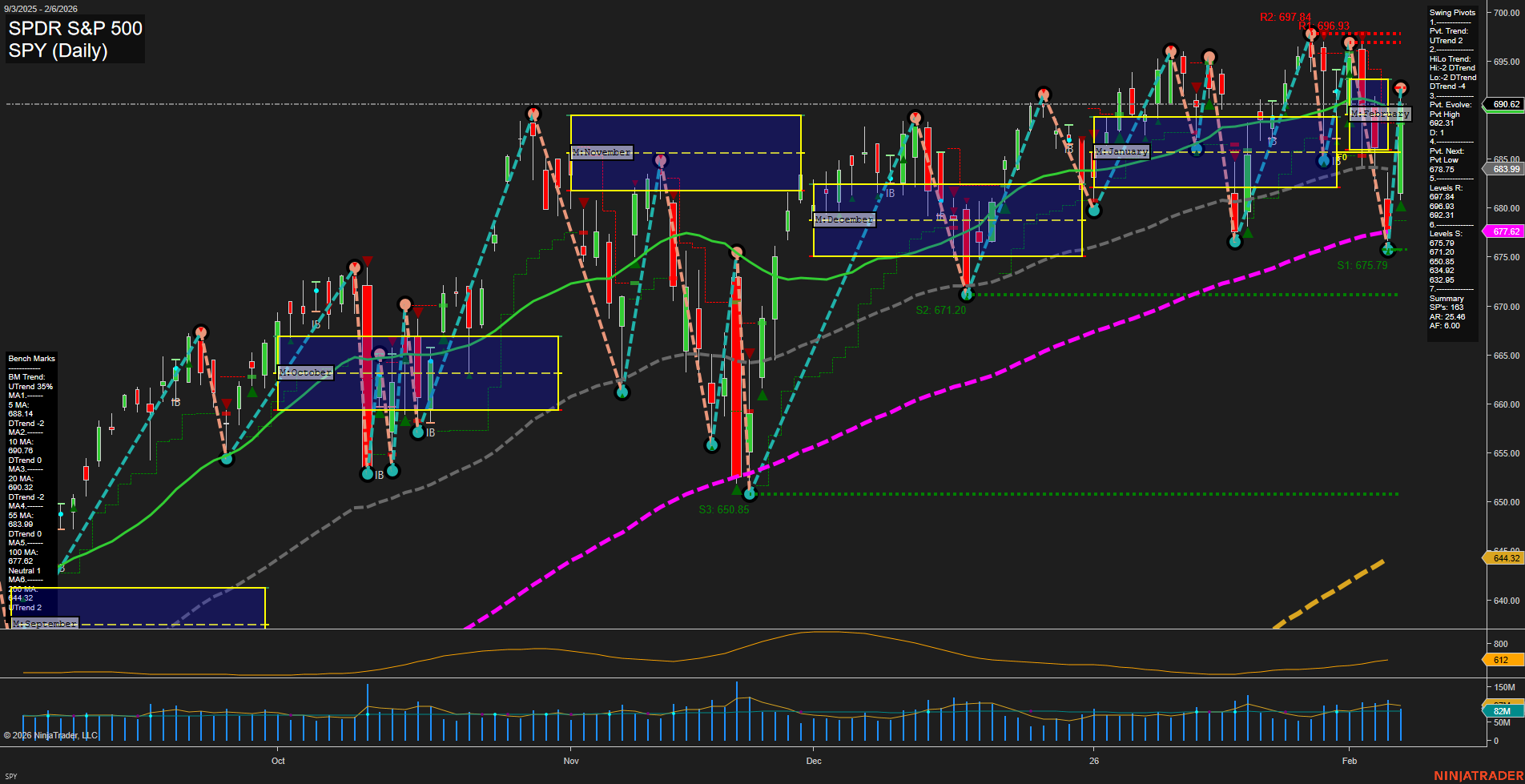

The SPY daily chart currently reflects a high-volatility environment, with large bars and fast momentum indicating strong price movement. The short-term and intermediate-term trends have shifted bearish, as confirmed by the downtrends in the 5, 10, and 20-day moving averages, and the swing pivot structure showing a recent pivot high with the next key level at a lower pivot low. Resistance is stacked above at 697.84, 696.93, and 690.62, while support is found at 675.79, 671.20, and 650.85, suggesting a wide trading range and potential for further swings. Despite the short- and intermediate-term bearishness, the long-term trend remains bullish, with the 55, 100, and 200-day moving averages all trending upward, indicating that the broader uptrend is still intact. The neutral readings on the session fib grids (weekly, monthly, yearly) suggest a lack of clear directional bias from a session perspective, reinforcing the idea of a market in transition or consolidation after a strong move. Volume and ATR are elevated, pointing to increased participation and volatility, which is typical during corrective phases or trend reversals. For a futures swing trader, this environment favors tactical trading—watching for potential mean reversion bounces at support or further breakdowns if support fails, while keeping an eye on the broader bullish context for signs of trend resumption. The market is currently in a corrective or pullback phase within a larger uptrend, with the potential for choppy price action and sharp reversals as the market tests key support and resistance levels.