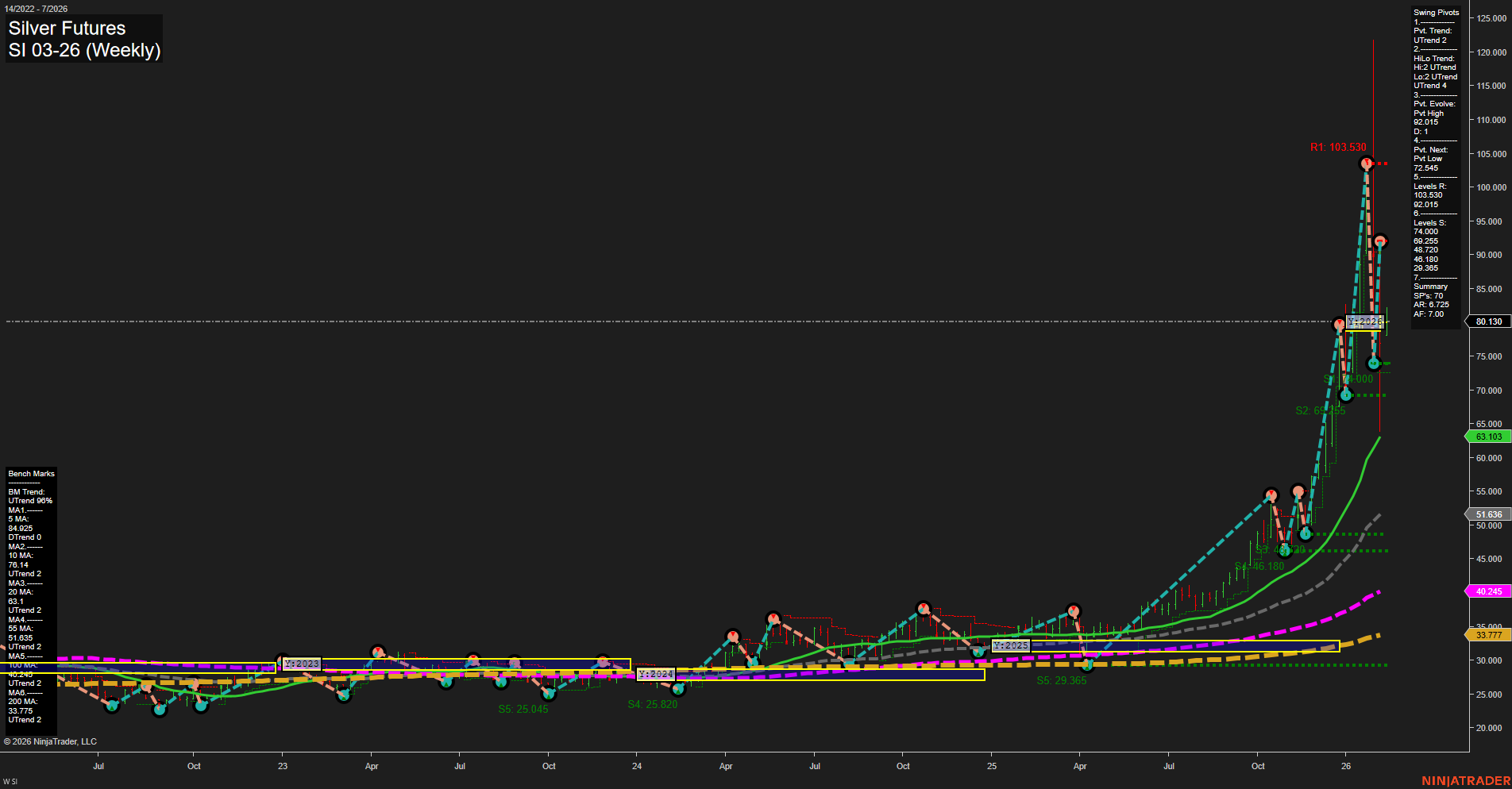

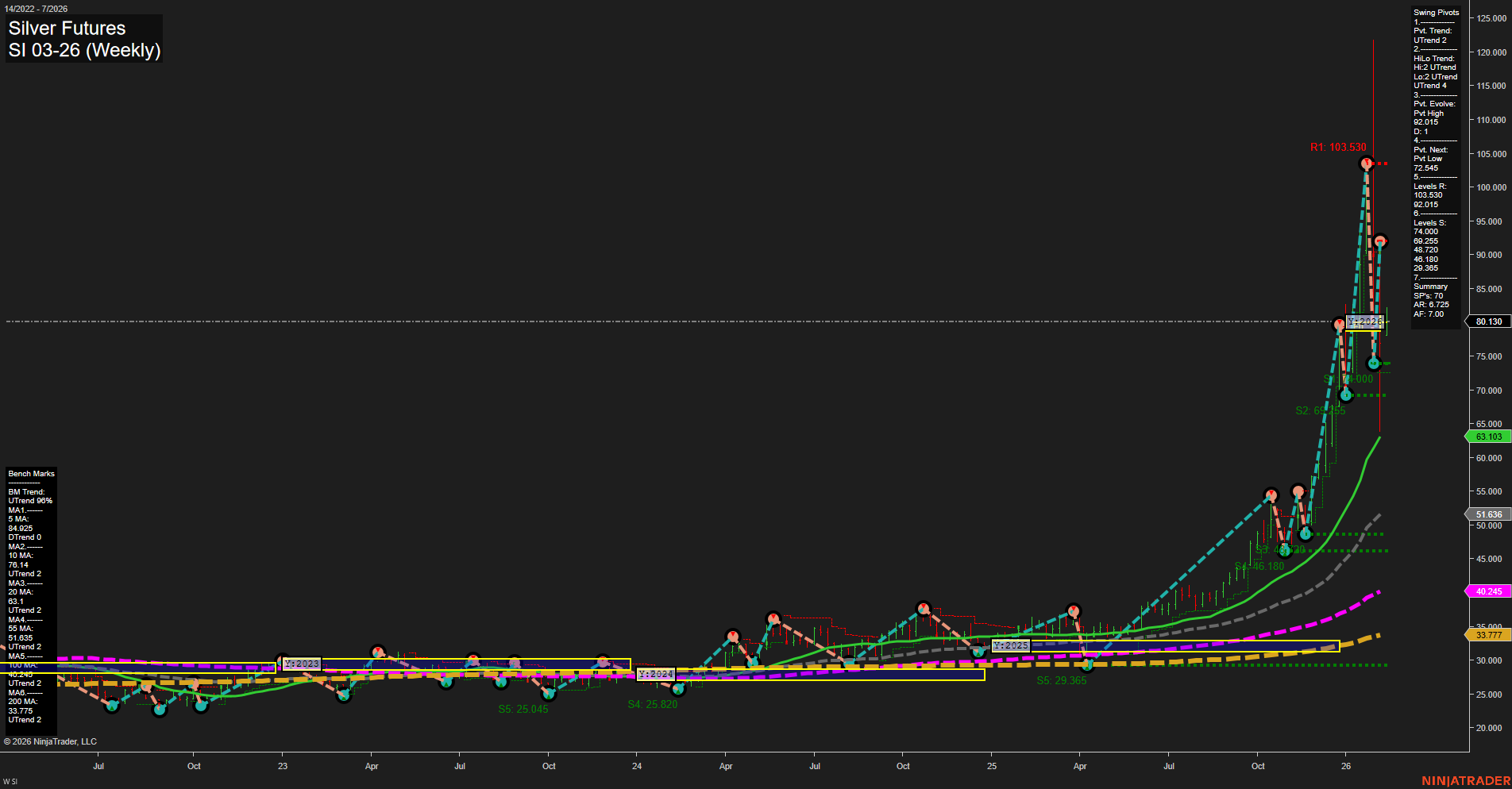

SI Silver Futures Weekly Chart Analysis: 2026-Feb-09 07:20 CT

Price Action

- Last: 80.130,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -15%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend 2,

- (Intermediate-Term) 2. HiLo Trend: UTrend 4,

- 3. Pvt. Evolve: Pvt high 102.015,

- 4. Pvt. Next: Pvt low 77.545,

- 5. Levels R: 103.530, 102.015,

- 6. Levels S: 77.545, 66.000, 56.615, 46.180, 40.285, 29.365, 25.820, 25.045.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 84.925 Up Trend,

- (Intermediate-Term) 10 Week: 74.124 Up Trend,

- (Long-Term) 20 Week: 63.100 Up Trend,

- (Long-Term) 55 Week: 51.936 Up Trend,

- (Long-Term) 100 Week: 40.245 Up Trend,

- (Long-Term) 200 Week: 33.777 Up Trend.

Recent Trade Signals

- 09 Feb 2026: Long SI 03-26 @ 81.55 Signals.USAR-WSFG

- 02 Feb 2026: Short SI 03-26 @ 78.655 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

Silver futures have experienced a dramatic rally, with price action showing large, fast momentum bars and a strong upward trend in the short and long term. The weekly session fib grid (WSFG) confirms a bullish short-term bias, with price well above the NTZ center and a clear uptrend. However, the monthly session fib grid (MSFG) indicates a counter-trend pullback or consolidation phase in the intermediate term, as price is below the NTZ and the trend is down. Yearly fib grid (YSFG) is neutral, suggesting the market is at a key inflection point for the long-term cycle. Swing pivots highlight a recent pivot high at 102.015 and a next support at 77.545, with multiple support levels below, indicating potential for volatility and retracement. All benchmark moving averages are trending up, confirming the underlying strength of the long-term trend. Recent trade signals show both long and short entries, reflecting the choppy, high-volatility environment and the presence of both trend continuation and counter-trend opportunities. Overall, the market is bullish in the short and long term, but the intermediate-term trend is neutral as the market digests recent gains and consolidates after a parabolic move.

Chart Analysis ATS AI Generated: 2026-02-09 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.