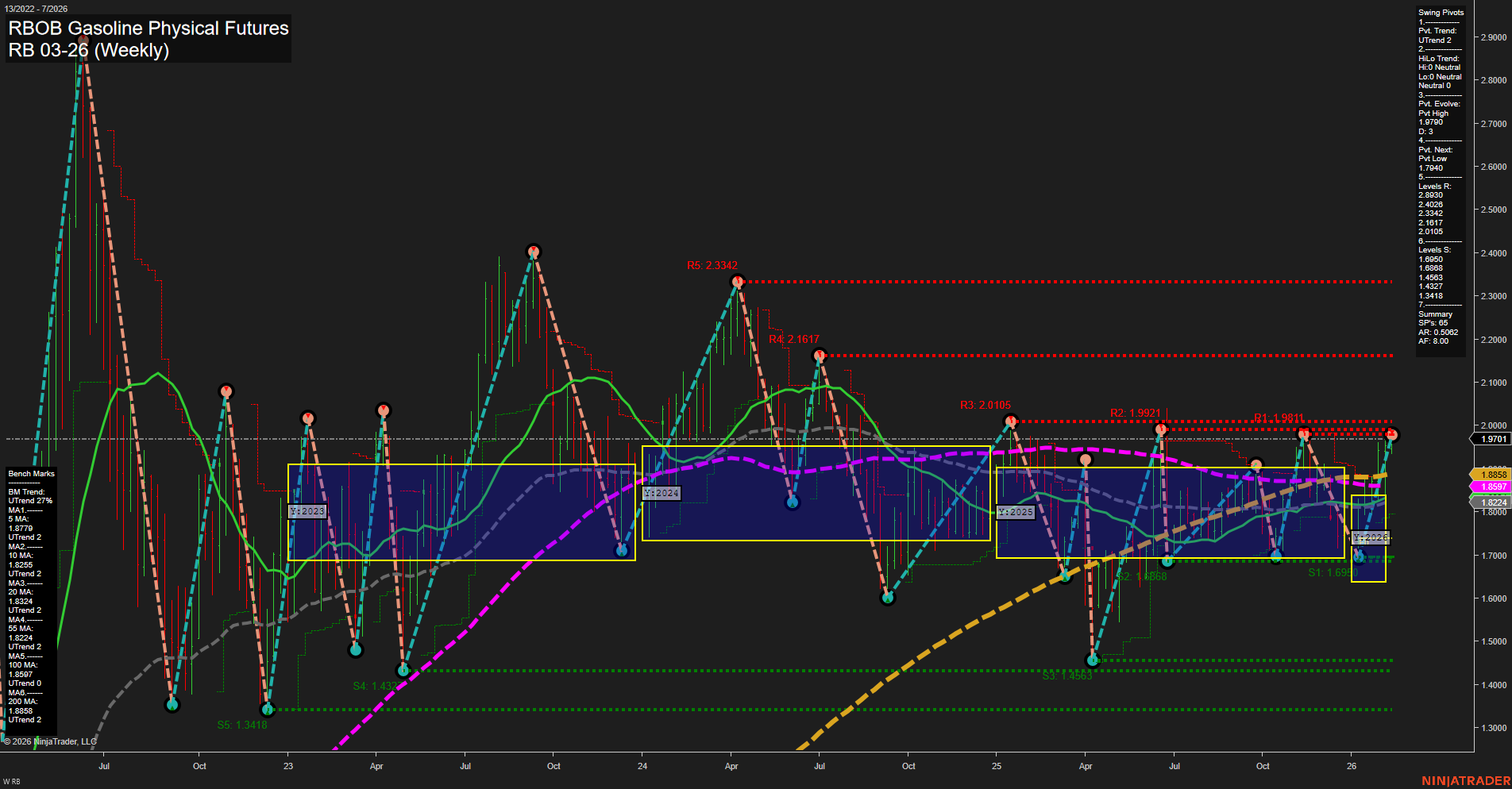

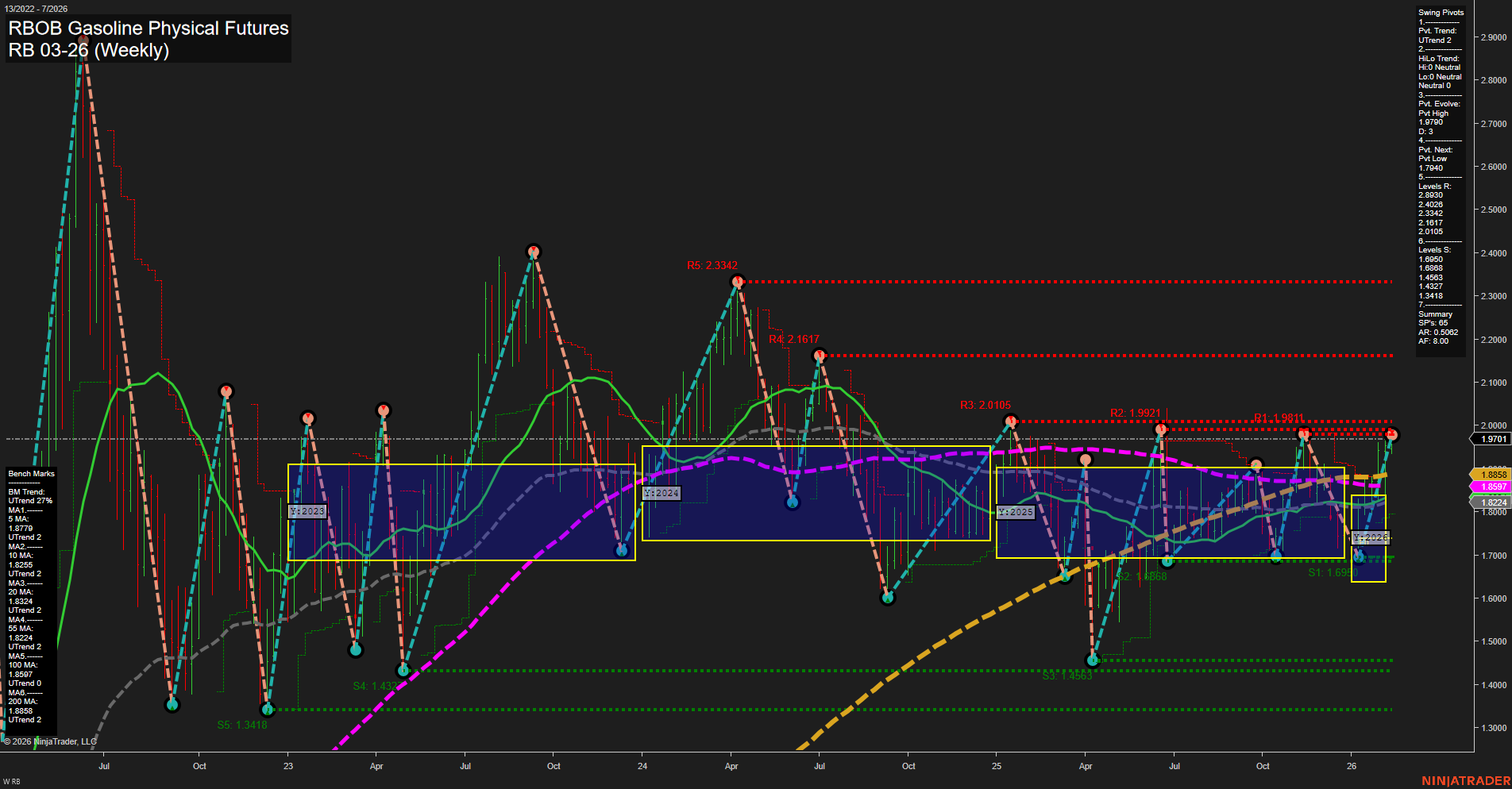

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2026-Feb-09 07:18 CT

Price Action

- Last: 1.9701,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt high 1.9701,

- 4. Pvt. Next: Pvt low 1.7740,

- 5. Levels R: 2.3342, 2.1617, 2.0105, 1.9921, 1.9811,

- 6. Levels S: 1.6980, 1.4683, 1.4327, 1.3418.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8770 Up Trend,

- (Intermediate-Term) 10 Week: 1.8224 Up Trend,

- (Long-Term) 20 Week: 1.8597 Up Trend,

- (Long-Term) 55 Week: 1.8224 Up Trend,

- (Long-Term) 100 Week: 1.8607 Up Trend,

- (Long-Term) 200 Week: 1.8858 Up Trend.

Recent Trade Signals

- 09 Feb 2026: Long RB 03-26 @ 1.9732 Signals.USAR-MSFG

- 06 Feb 2026: Short RB 03-26 @ 1.915 Signals.USAR-WSFG

- 03 Feb 2026: Long RB 03-26 @ 1.9162 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures weekly chart is showing a constructive bullish structure across all timeframes. Price is currently above the NTZ center and all major session fib grid levels, with the WSFG, MSFG, and YSFG trends all pointing up. The most recent swing pivot is a high at 1.9701, with the next key support at 1.7740, indicating a higher low structure. Resistance levels are stacked above, with the nearest at 1.9811 and 1.9921, suggesting potential for further upside if these are breached. All benchmark moving averages are trending up, confirming the underlying strength. Recent trade signals have been mixed but lean bullish, with the latest signal being a long entry. The chart reflects a market that has transitioned from a period of consolidation to a more directional move, with momentum building and volatility increasing. The overall technical landscape supports a bullish outlook, with the potential for continued rallies if resistance levels are overcome and higher lows are maintained.

Chart Analysis ATS AI Generated: 2026-02-09 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.