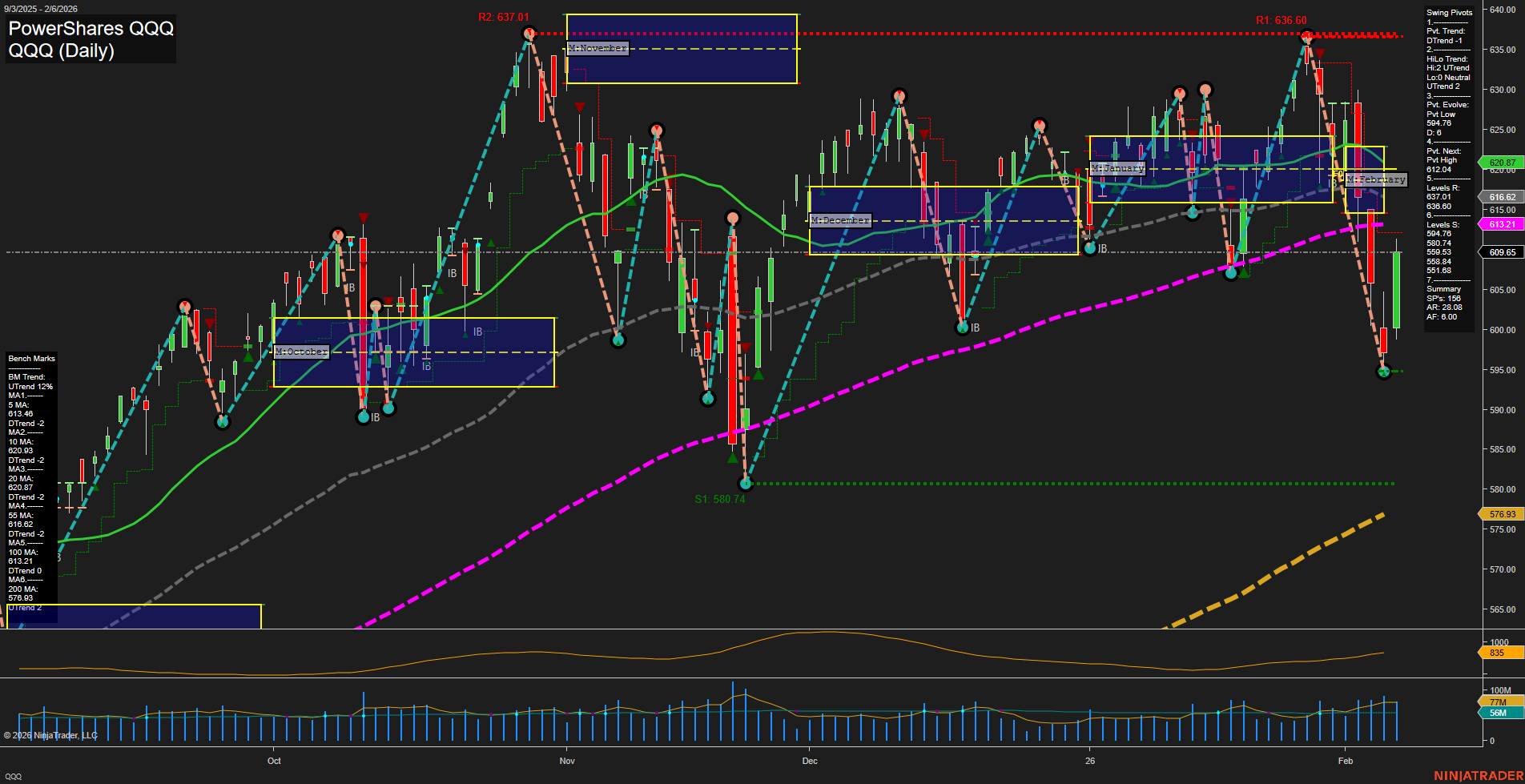

The QQQ daily chart currently reflects a sharp momentum shift to the downside, with large bars and fast momentum indicating heightened volatility. The short-term swing pivot trend has turned down (DTrend), and all short- and intermediate-term moving averages (5, 10, 20, 55, 100-day) are in a downtrend, confirming recent bearish price action. However, the intermediate-term HiLo trend remains up (UTrend), suggesting the broader swing structure is still holding higher lows, and the 200-day moving average is still trending up, providing a longer-term support base. Resistance is clustered at 612.04, 631.21, and 636.60, while support is found at 604.96, 580.74, and 561.68. The ATR is elevated, and volume remains robust, signaling active participation and potential for continued volatility. The neutral readings on the session fib grids (weekly, monthly, yearly) indicate a lack of clear directional bias from a broader perspective, with price currently oscillating around key levels. From a futures swing trader’s perspective, the market is in a corrective phase within a larger uptrend, with the potential for further downside tests toward support. The environment is characterized by choppy, volatile swings, and the recent breakdown may be a reaction to external catalysts or a technical retracement after an extended rally. The next key inflection will be whether price can reclaim resistance or if it continues to probe lower support zones.