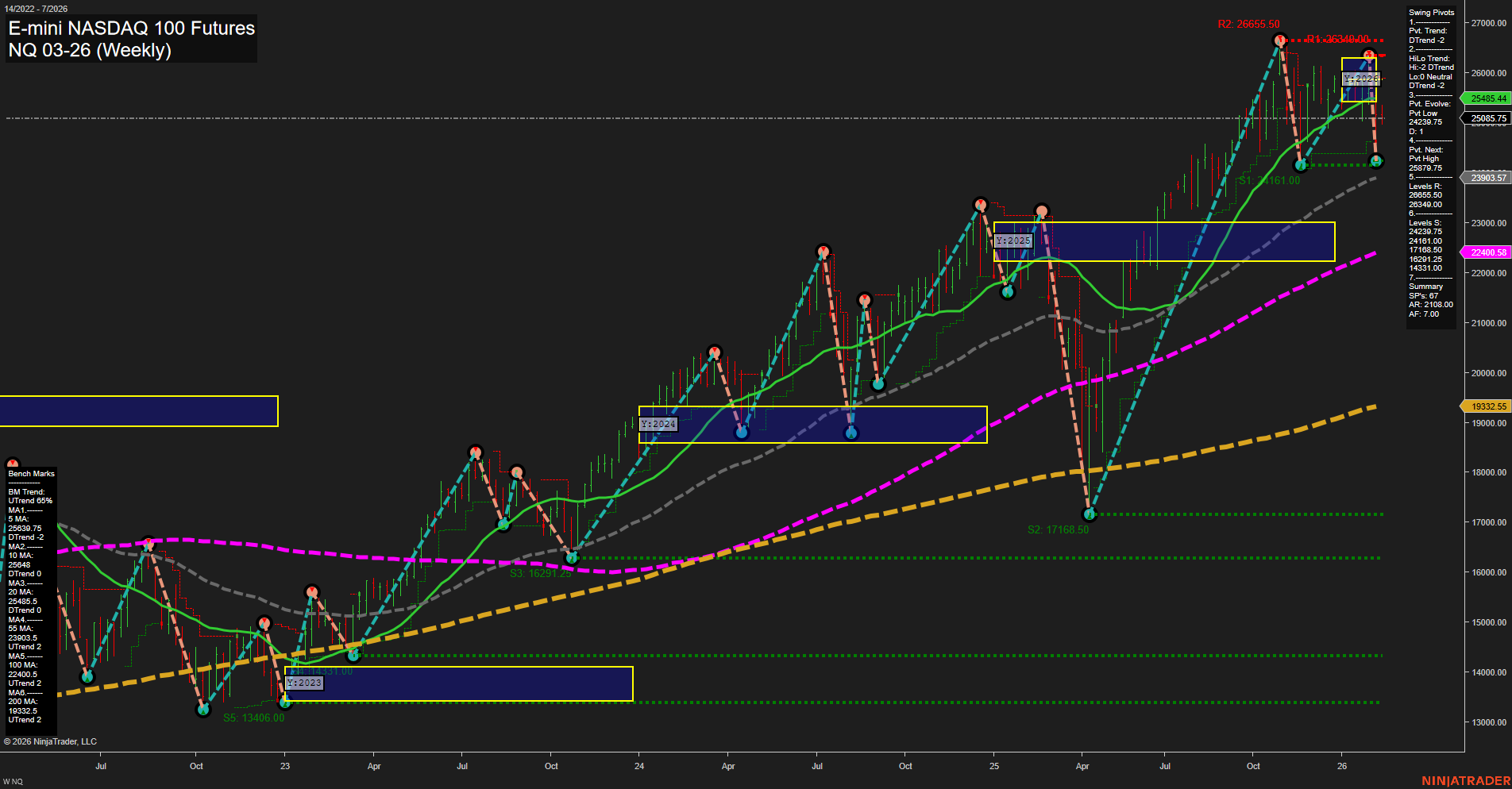

The NQ E-mini NASDAQ 100 Futures are currently experiencing a corrective phase, with price action showing medium-sized bars and slow momentum. All three session Fib grid trends (weekly, monthly, yearly) are aligned to the downside, with price trading below their respective NTZ/F0% levels, indicating persistent short- and intermediate-term weakness. Swing pivot analysis confirms a dominant downtrend in both short- and intermediate-term timeframes, with the most recent pivot low at 25222 acting as immediate support and resistance levels clustered above at 26655.5, 26340.0, and 26048.0. Weekly benchmark moving averages for the 5- and 10-week periods are trending down, reinforcing the short- and intermediate-term bearish bias. However, the longer-term 20-, 55-, 100-, and 200-week moving averages remain in uptrends, suggesting that the broader bullish structure is still intact despite the current pullback. Recent trade signals reflect a mixed environment, with both long and short entries triggered in the past week, highlighting choppy and potentially volatile conditions as the market tests key support and resistance levels. Overall, the market is in a corrective or consolidation phase within a larger uptrend, with the potential for further downside in the short- to intermediate-term before any resumption of the primary bullish trend. Price is currently testing support, and the next directional move will likely be determined by the market's reaction to these key levels.