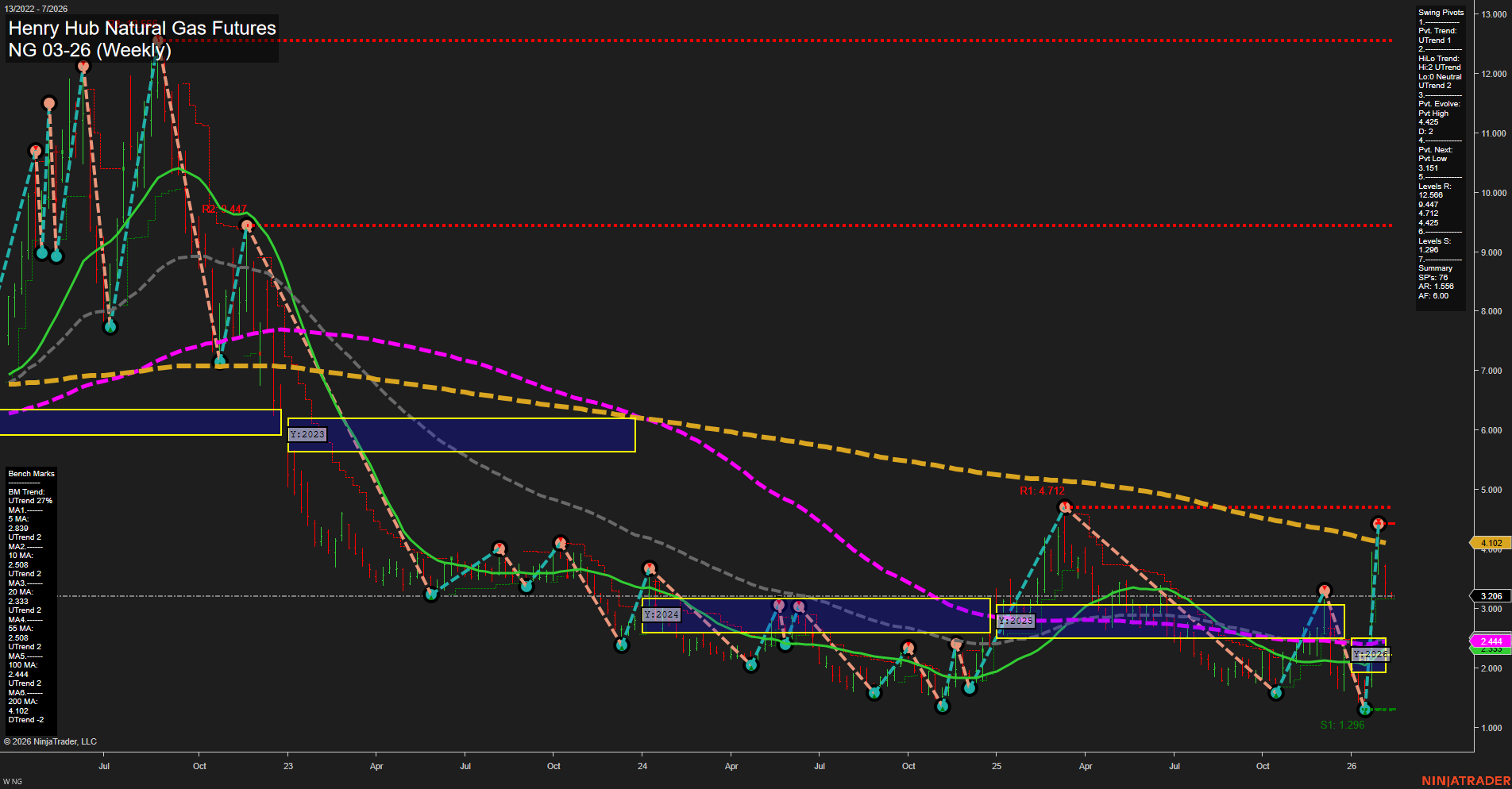

The chart shows a recent surge in volatility with large weekly bars and fast momentum, indicating heightened activity and possible short-term exhaustion. Both the weekly and monthly session fib grids (WSFG, MSFG) are trending down, with price below their respective NTZ/F0% levels, suggesting short- and intermediate-term weakness. However, the yearly session fib grid (YSFG) is trending up, with price above the NTZ/F0%, pointing to a longer-term bullish bias. Swing pivots indicate an uptrend in both short- and intermediate-term trends, but the most recent pivot is a high at 4.129, with the next expected pivot low at 3.115, highlighting a possible retracement or correction phase. Resistance levels are clustered above 3.8 and 4.1, while major support is much lower at 1.296, suggesting a wide trading range. Benchmark moving averages show a strong uptrend in the 5, 10, 20, and 55-week periods, but the 100 and 200-week MAs remain in a downtrend, reflecting the longer-term recovery from a previous bear market. Recent trade signals are mixed, with a short signal following a long, reflecting the choppy and volatile nature of the current market. Overall, the market is in a transition phase: short- and intermediate-term trends are neutralizing after a strong move, while the long-term structure is turning bullish. This environment is characterized by volatility, potential for sharp pullbacks, and the need to watch for confirmation of trend continuation or reversal at key resistance and support levels.