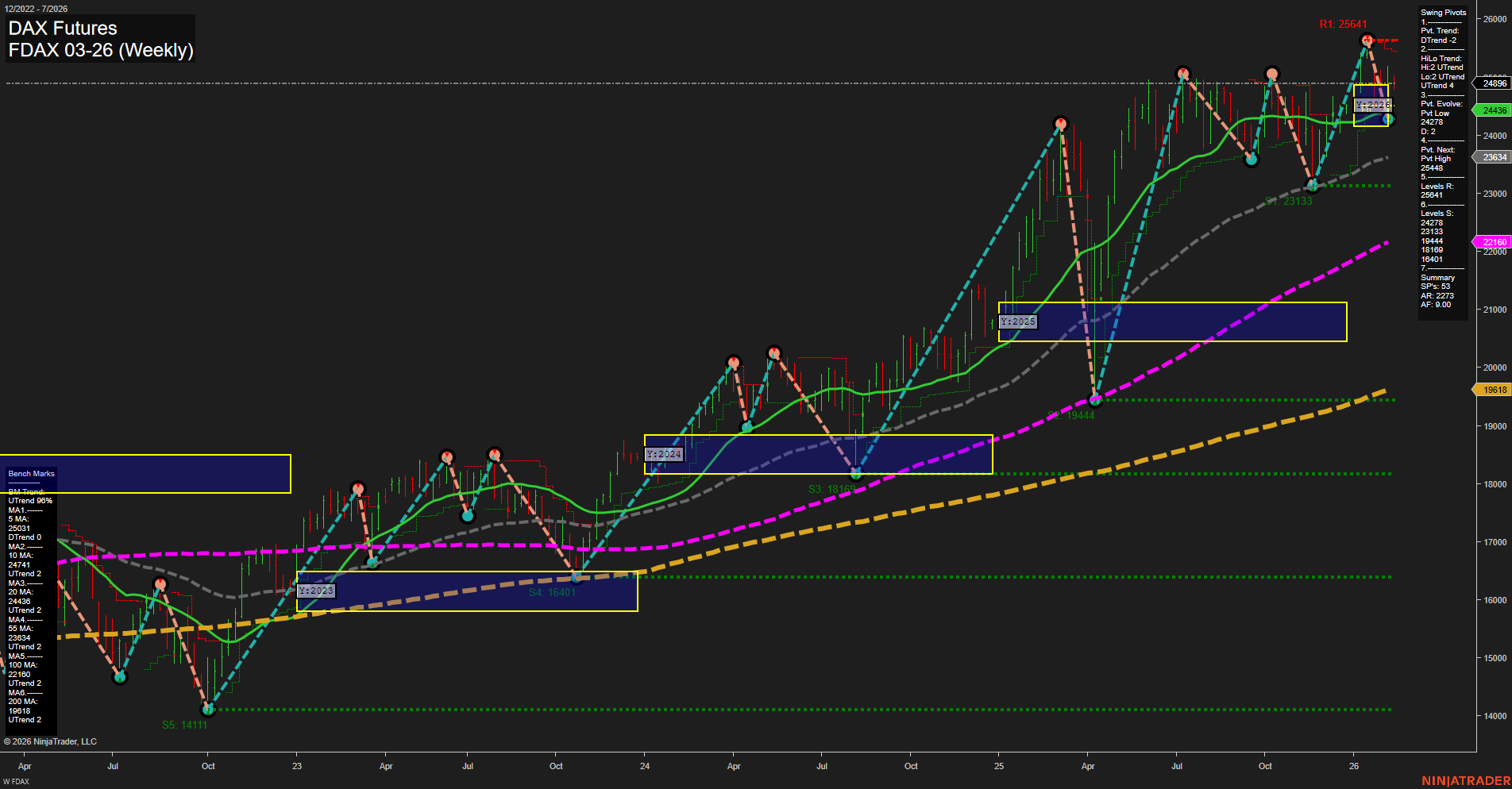

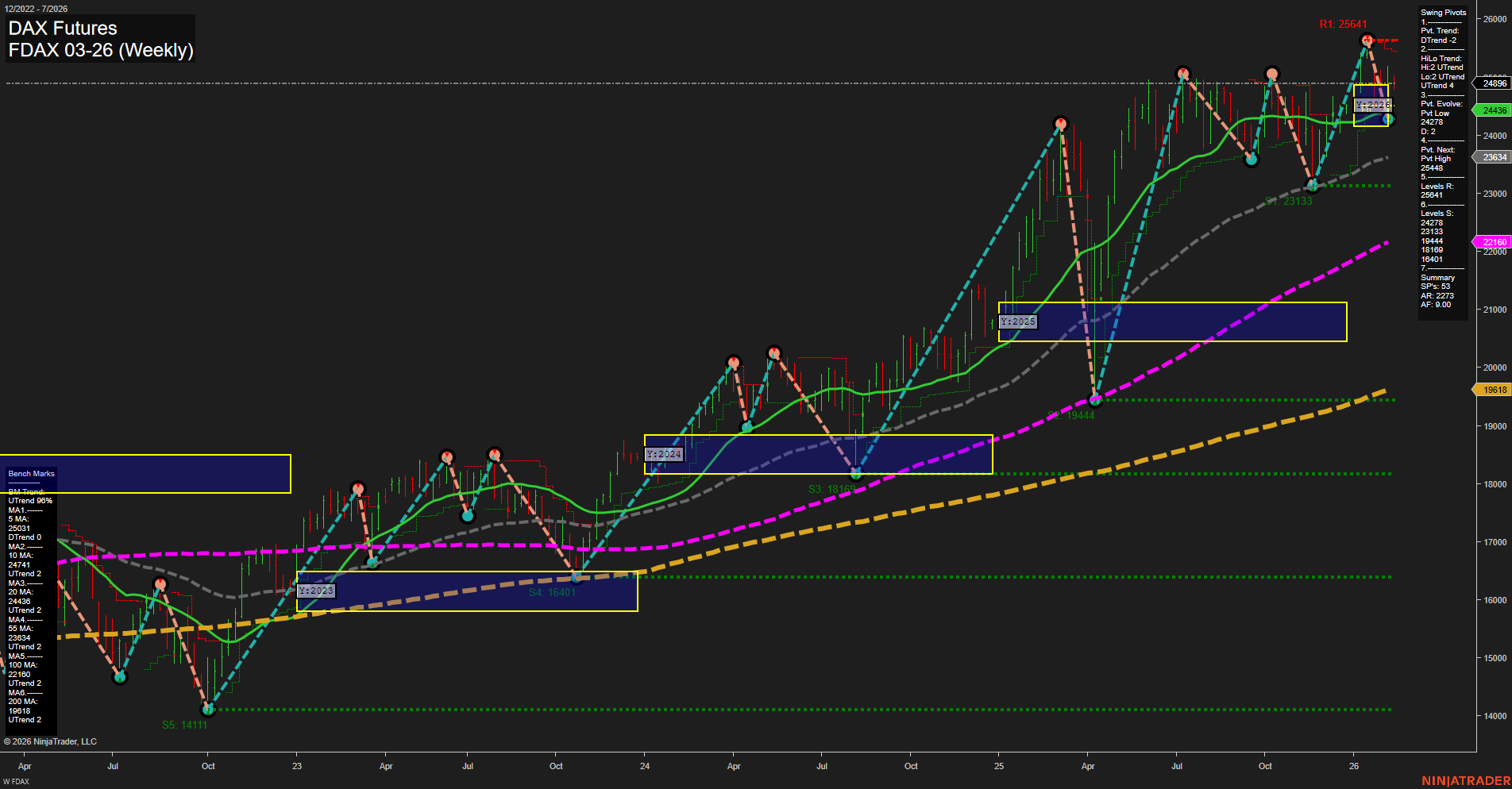

FDAX DAX Futures Weekly Chart Analysis: 2026-Feb-09 07:10 CT

Price Action

- Last: 24,896,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 24,246,

- 4. Pvt. Next: Pvt high 25,641,

- 5. Levels R: 25,641,

- 6. Levels S: 23,133, 19,444, 18,104, 16,401, 14,111.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 25,031 Up Trend,

- (Intermediate-Term) 10 Week: 24,741 Up Trend,

- (Long-Term) 20 Week: 23,264 Up Trend,

- (Long-Term) 55 Week: 21,160 Up Trend,

- (Long-Term) 100 Week: 21,160 Up Trend,

- (Long-Term) 200 Week: 19,618 Up Trend.

Recent Trade Signals

- 09 Feb 2026: Long FDAX 03-26 @ 24,895 Signals.USAR-MSFG

- 06 Feb 2026: Long FDAX 03-26 @ 24,801 Signals.USAR.TR120

- 06 Feb 2026: Long FDAX 03-26 @ 24,710 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures weekly chart shows a market in a strong long-term and intermediate-term uptrend, with all major moving averages trending higher and price action consistently above key Fibonacci grid levels. The short-term swing pivot trend has shifted to a downtrend, indicating a possible pullback or consolidation phase after a recent high at 25,641, but the intermediate-term HiLo trend remains upward, supporting the broader bullish structure. Support levels are well-defined and layered below, with the nearest at 23,133, while resistance is set at the recent swing high. Recent trade signals have all been long, reflecting the prevailing bullish sentiment. Overall, the market is experiencing a healthy uptrend with periodic retracements, typical of a trending environment, and is currently in a short-term pause or correction within a larger bullish cycle.

Chart Analysis ATS AI Generated: 2026-02-09 07:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.