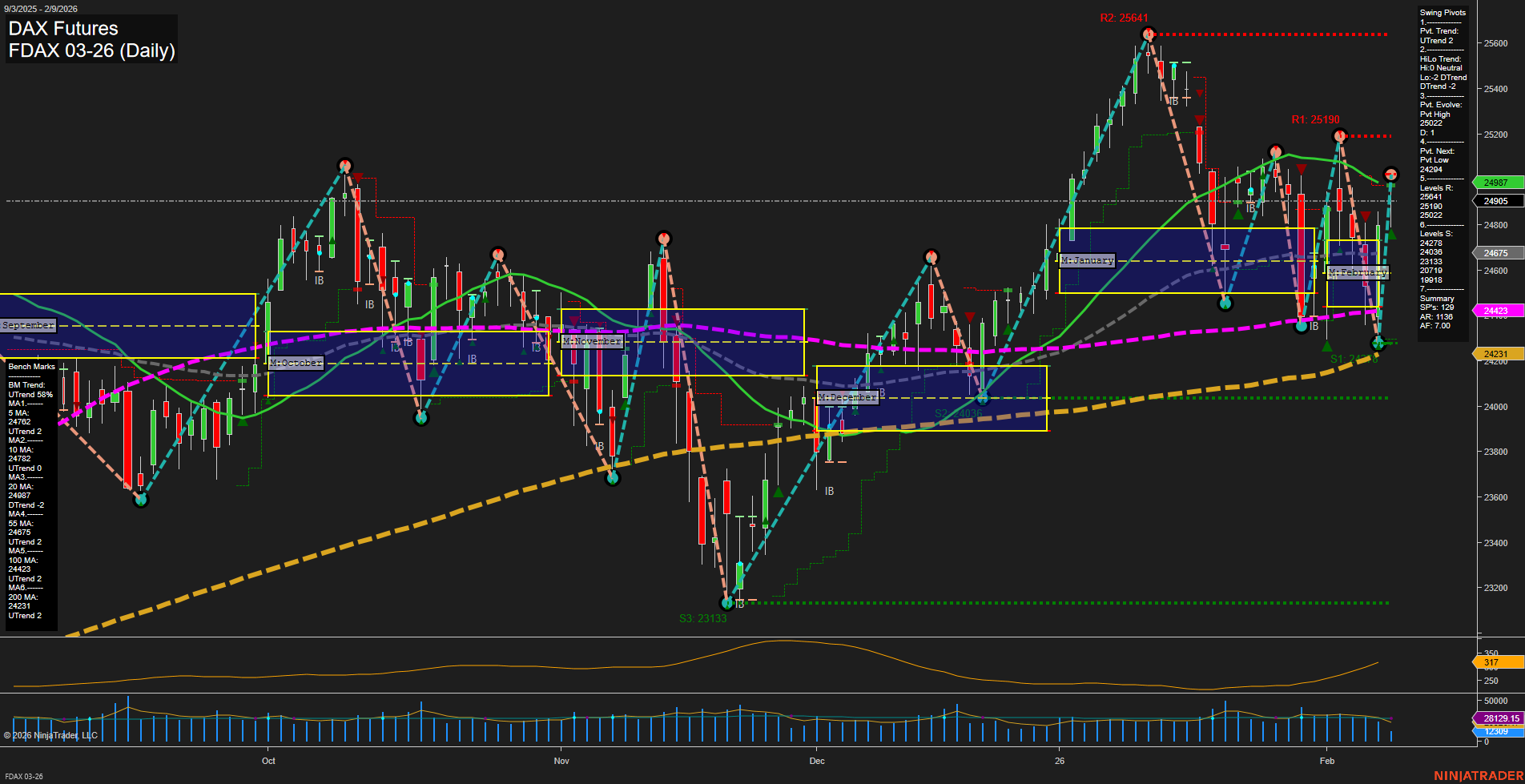

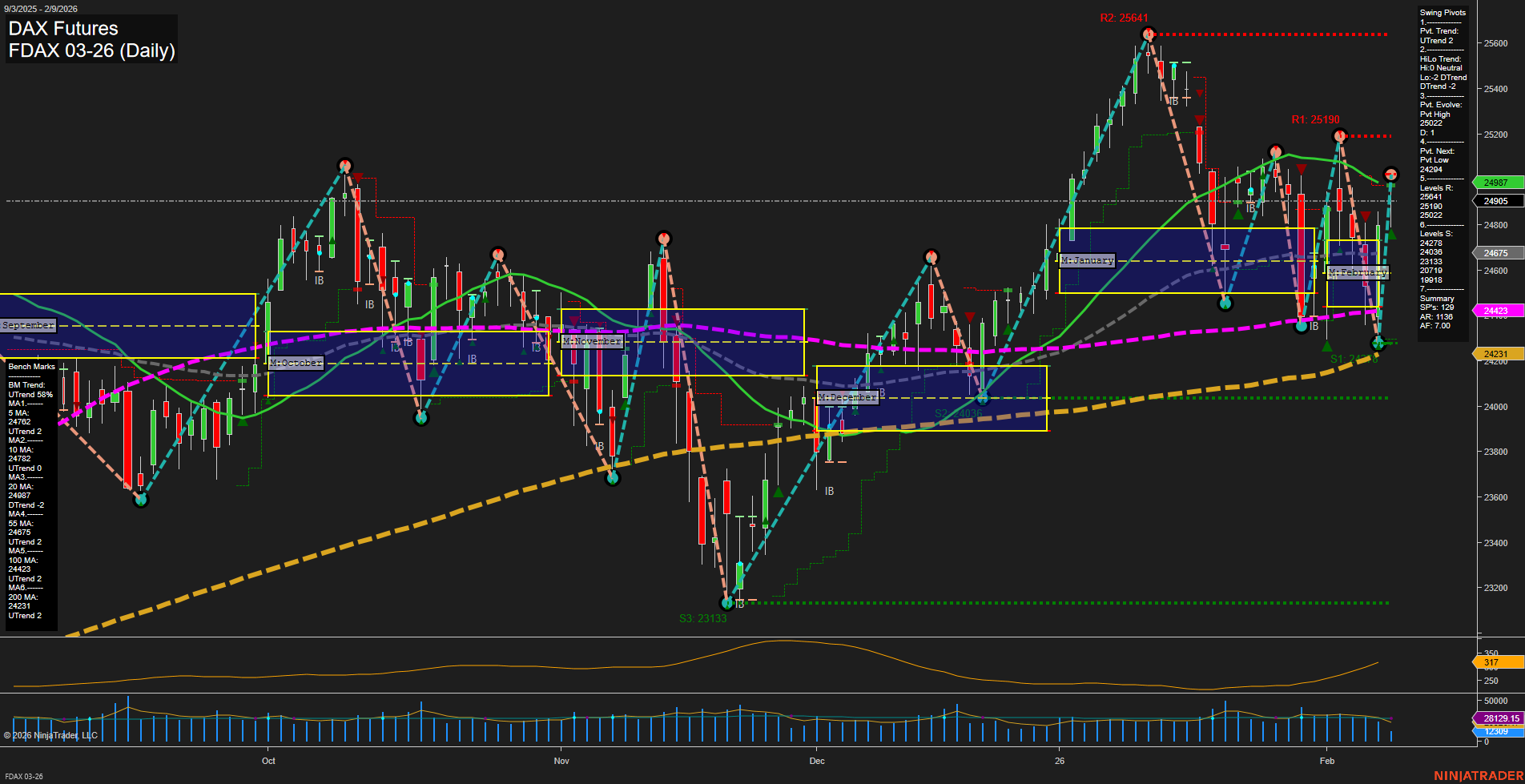

FDAX DAX Futures Daily Chart Analysis: 2026-Feb-09 07:10 CT

Price Action

- Last: 24,895,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 25,092,

- 4. Pvt. Next: Pvt Low 24,244,

- 5. Levels R: 25,641, 25,190,

- 6. Levels S: 24,895, 24,244, 24,078, 23,713, 23,133.

Daily Benchmarks

- (Short-Term) 5 Day: 24,766 Up Trend,

- (Short-Term) 10 Day: 24,742 Up Trend,

- (Intermediate-Term) 20 Day: 24,967 Up Trend,

- (Intermediate-Term) 55 Day: 24,475 Up Trend,

- (Long-Term) 100 Day: 24,423 Up Trend,

- (Long-Term) 200 Day: 24,231 Up Trend.

Additional Metrics

Recent Trade Signals

- 09 Feb 2026: Long FDAX 03-26 @ 24,895 Signals.USAR-MSFG

- 06 Feb 2026: Long FDAX 03-26 @ 24,801 Signals.USAR.TR120

- 06 Feb 2026: Long FDAX 03-26 @ 24,710 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures daily chart is showing a strong bullish structure across all timeframes. Price is currently above all key moving averages, with each benchmark (5, 10, 20, 55, 100, and 200 day) trending upward, confirming broad-based strength. The most recent swing pivot trend is up, with the next key resistance at 25,190 and 25,641, while support is layered below at 24,895, 24,244, and further down. The ATR and VOLMA indicate healthy but not extreme volatility, supporting the sustainability of the current move. Recent trade signals have all been to the long side, aligning with the prevailing uptrend. The market has recently bounced from support, forming higher lows, and is now testing the upper end of the February MSFG range, suggesting potential for further upside if resistance levels are cleared. The overall environment is characterized by trend continuation, with no immediate signs of exhaustion or reversal, and the technical backdrop remains supportive for swing traders favoring the long side.

Chart Analysis ATS AI Generated: 2026-02-09 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.