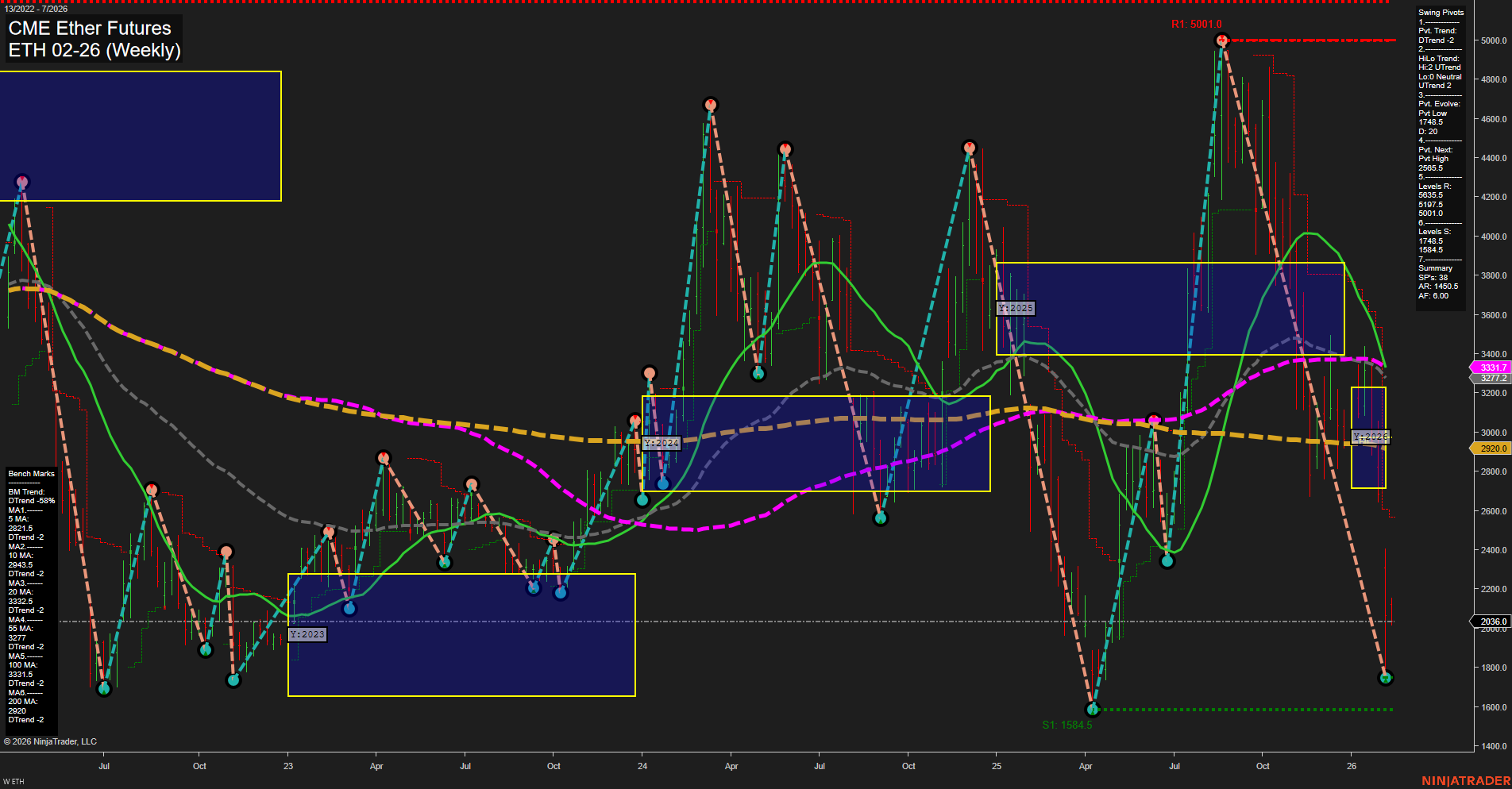

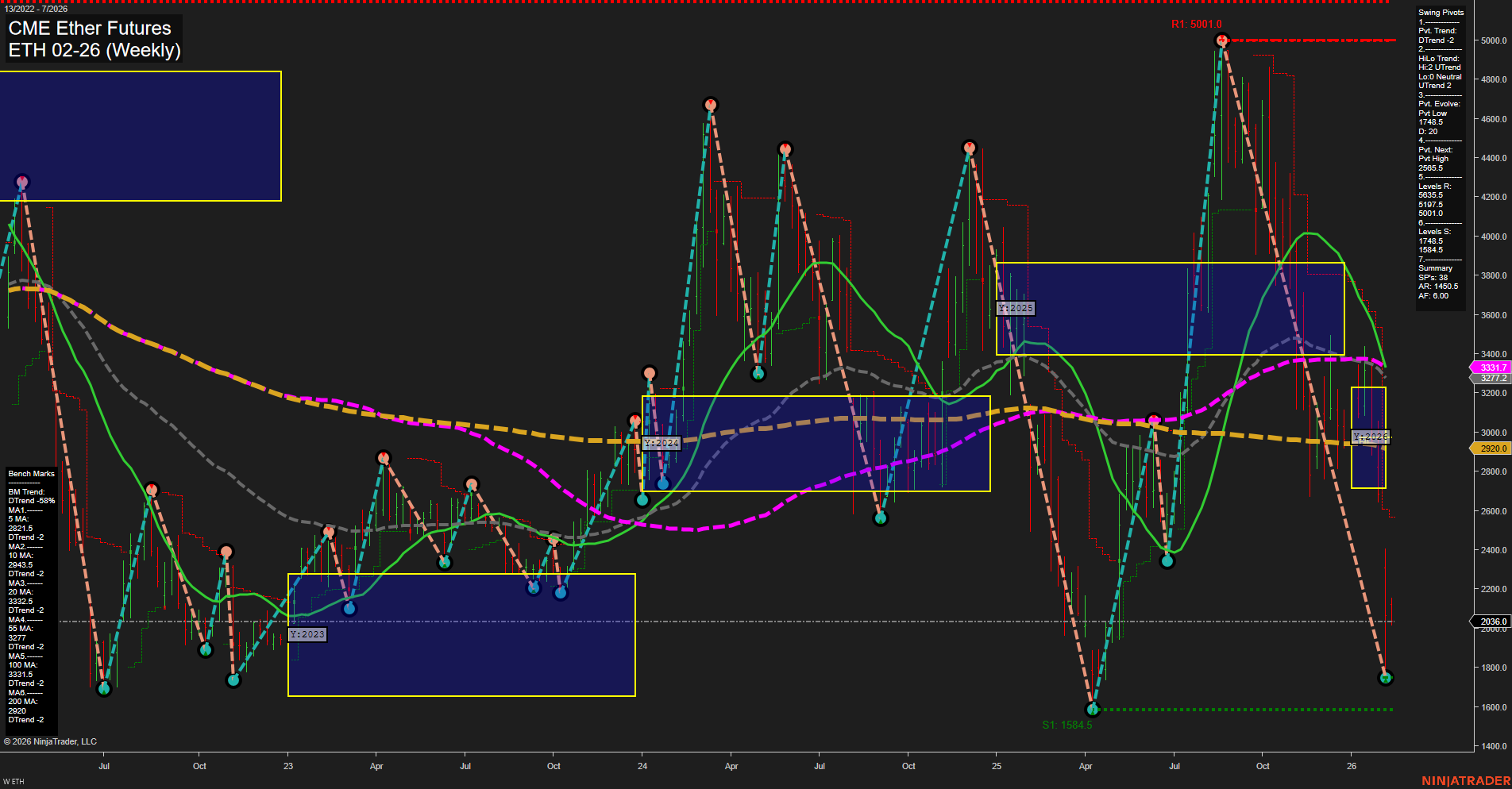

ETH CME Ether Futures Weekly Chart Analysis: 2026-Feb-09 07:10 CT

Price Action

- Last: 2036.0,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -17%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1744.5,

- 4. Pvt. Next: Pvt low 1584.5,

- 5. Levels R: 5001.0, 4265.5, 3265.5, 2565.5,

- 6. Levels S: 1744.5, 1584.5.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2521.6 Down Trend,

- (Intermediate-Term) 10 Week: 2824.1 Down Trend,

- (Long-Term) 20 Week: 3227.7 Down Trend,

- (Long-Term) 55 Week: 3331.7 Down Trend,

- (Long-Term) 100 Week: 3361.1 Down Trend,

- (Long-Term) 200 Week: 2920.0 Down Trend.

Recent Trade Signals

- 09 Feb 2026: Long ETH 02-26 @ 2087 Signals.USAR.TR120

- 05 Feb 2026: Short ETH 02-26 @ 2090 Signals.USAR-MSFG

- 04 Feb 2026: Short ETH 02-26 @ 2264.5 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The ETH CME Ether Futures weekly chart is showing pronounced bearish momentum across all timeframes. Price has broken decisively below all major moving averages, with the last price at 2036.0 well under the 20, 55, 100, and 200 week benchmarks, all of which are trending down. The WSFG, MSFG, and YSFG session fib grids confirm a persistent downtrend, with price trading below their respective NTZ/F0% levels and negative percentage readings. Swing pivot analysis highlights a dominant downtrend, with the most recent pivots evolving lower and next support levels at 1744.5 and 1584.5, while resistance is stacked far above at 2565.5 and higher. Recent trade signals reflect a choppy, high-volatility environment with both short and long signals, but the prevailing direction remains to the downside. The overall structure suggests a strong sell-off phase, with little evidence of a reversal or sustained bounce, and the market is currently testing lower support zones after a sharp decline from previous highs.

Chart Analysis ATS AI Generated: 2026-02-09 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.