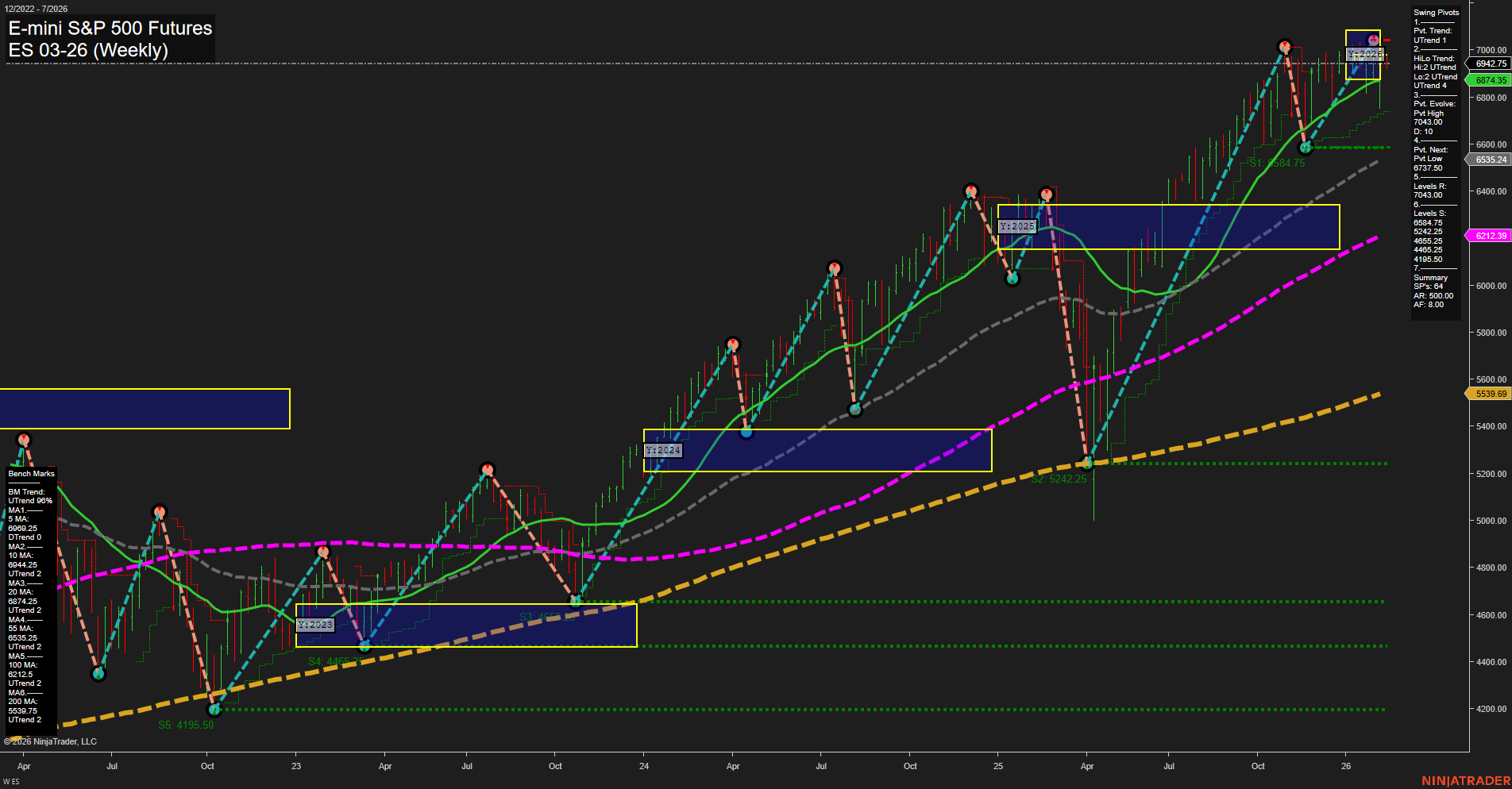

ES E-mini S&P 500 Futures Weekly Chart Analysis: 2026-Feb-09 07:09 CT

Price Action

- Last: 6942.75,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 7040.00,

- 4. Pvt. Next: Pvt low 6737.00,

- 5. Levels R: 7040.00, 6908.25, 6856.25,

- 6. Levels S: 6737.00, 6465.25, 6062.25, 5533.25, 5242.25, 4915.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 6874.25 Up Trend,

- (Intermediate-Term) 10 Week: 6673.25 Up Trend,

- (Long-Term) 20 Week: 6535.25 Up Trend,

- (Long-Term) 55 Week: 6212.39 Up Trend,

- (Long-Term) 100 Week: 6062.25 Up Trend,

- (Long-Term) 200 Week: 5539.69 Up Trend.

Recent Trade Signals

- 09 Feb 2026: Long ES 03-26 @ 6969.75 Signals.USAR-MSFG

- 06 Feb 2026: Long ES 03-26 @ 6916.5 Signals.USAR.TR120

- 05 Feb 2026: Short ES 03-26 @ 6856 Signals.USAR.TR720

- 05 Feb 2026: Short ES 03-26 @ 6908 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The ES E-mini S&P 500 Futures weekly chart shows a market in a broad uptrend, with all major moving averages (5, 10, 20, 55, 100, 200 week) trending higher, confirming strong underlying momentum on intermediate and long-term timeframes. The most recent price action is consolidating just below a recent swing high (7040.00), with medium-sized bars and average momentum, suggesting a pause or digestion phase after a strong rally.

Short-term signals are mixed: the Weekly Session Fib Grid (WSFG) trend is down and price is below the NTZ, indicating some short-term weakness or pullback, while the swing pivot trend remains up. Intermediate-term (MSFG) and long-term (YSFG) Fib Grid trends are diverging, with the monthly grid up and the yearly grid down, but the overall structure favors the bulls as price remains above key support levels and above all major moving averages.

Recent trade signals reflect this mixed environment, with both long and short entries triggered in the last week, highlighting a choppy, rotational environment near highs. Key support levels to watch are 6737.00 and 6465.25, while resistance is defined by the recent high at 7040.00. The market appears to be in a consolidation or potential topping phase, but the dominant trend remains upward unless key support levels are broken.

Chart Analysis ATS AI Generated: 2026-02-09 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.