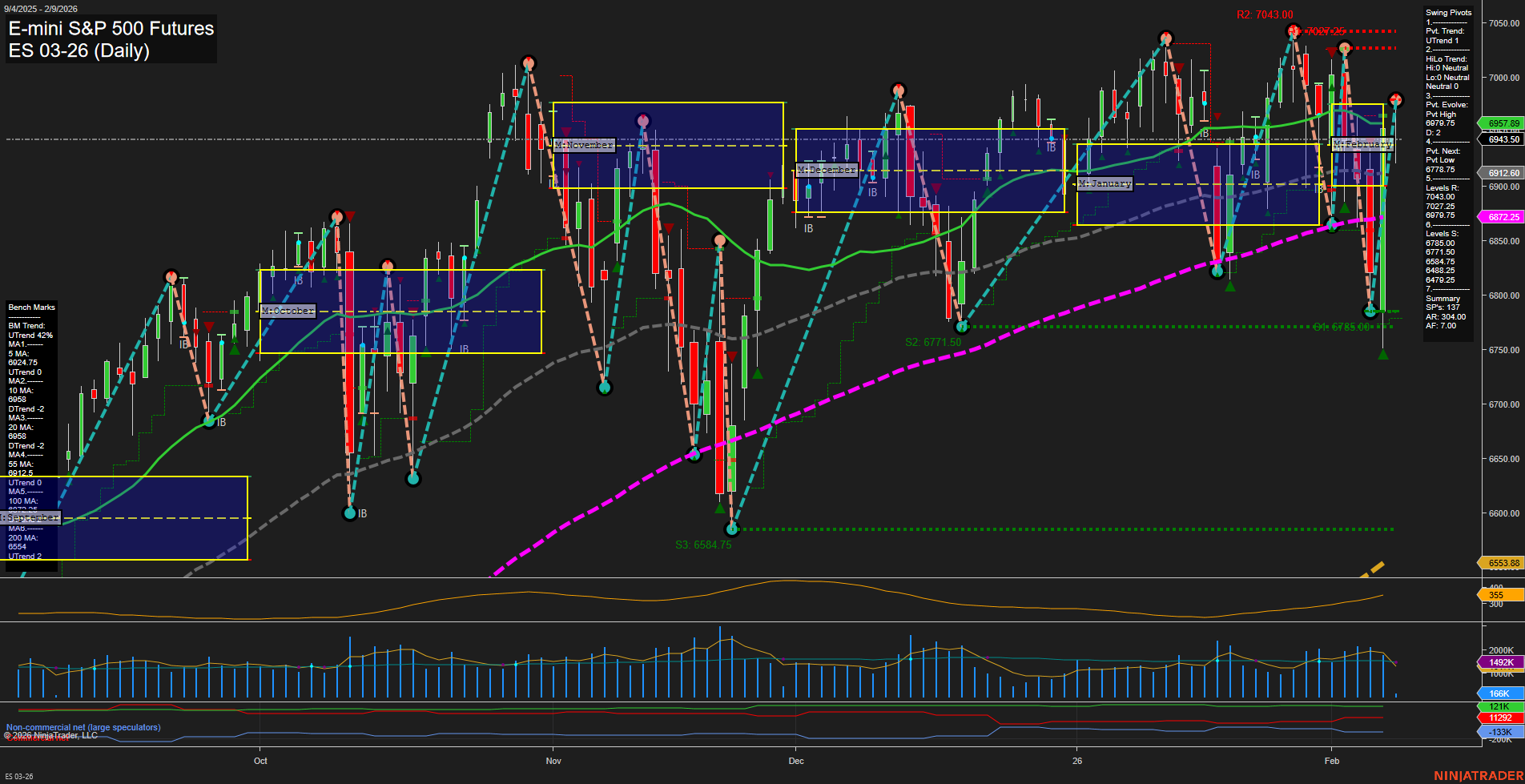

The ES E-mini S&P 500 Futures daily chart currently reflects a market in transition, with strong short- and intermediate-term bullish signals emerging after a period of volatility and sharp price swings. The most recent price action shows large bars and fast momentum, indicating heightened volatility and active participation. The short-term swing pivot trend has shifted to an uptrend, supported by all benchmark moving averages (5, 10, 20, 55, 100, and 200 day) trending upward, which reinforces the bullish bias in the near to intermediate term. However, the weekly and yearly session fib grids (WSFG and YSFG) remain in a downtrend, with price below their respective NTZ/F0% levels, suggesting that the longer-term structure is still under pressure. The intermediate-term monthly fib grid (MSFG) is up, with price above the NTZ, indicating a possible recovery or bounce phase. Key resistance levels are clustered near recent highs (7043.00, 7027.25, 7007.25), while support is well-defined below (6775.75, 6740.25, 6685.25), providing clear reference points for swing traders. Recent trade signals have flipped from short to long, aligning with the shift in short-term momentum and the uptrend in moving averages. The elevated ATR and strong volume moving average (VOLMA) confirm the presence of volatility and liquidity, which are favorable for swing trading setups. Overall, the market is showing signs of a bullish reversal in the short to intermediate term, but the longer-term trend remains bearish, warranting close monitoring for potential trend continuation or reversal patterns.