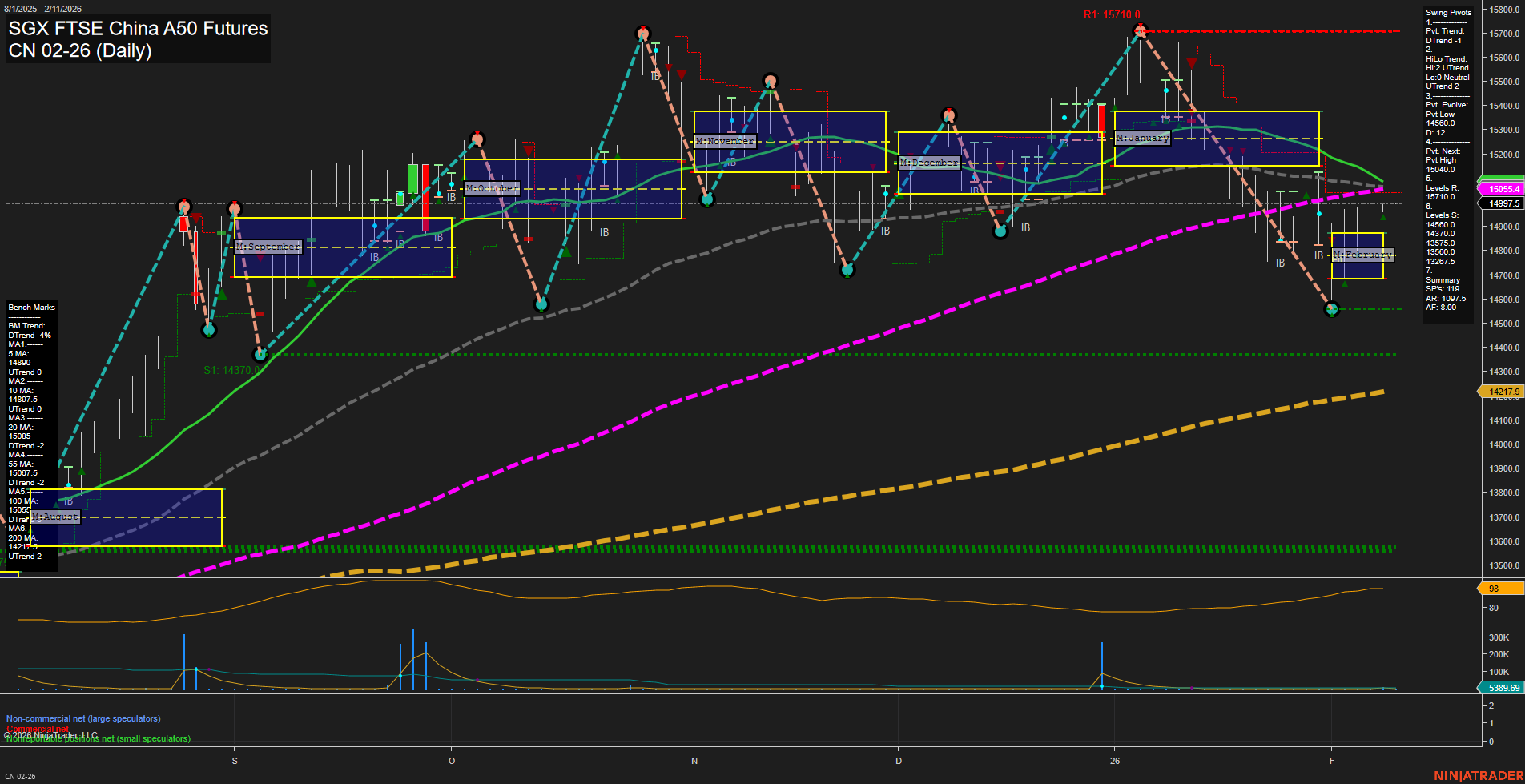

The CN SGX FTSE China A50 Futures daily chart currently reflects a market in transition. Price action is characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend has shifted to a downtrend, with the most recent pivot low at 14,900 and the next potential reversal at the 15,040 pivot high. Resistance is clearly defined at 15,710 and 15,040, while support levels are set at 14,370, 13,575, and 13,085, suggesting a broad range for potential price movement. All short-term and intermediate-term moving averages (5, 10, 20, 55-day) are trending down, reinforcing the short-term bearish bias. However, the 100-day and 200-day long-term moving averages remain in an uptrend, which tempers the overall bearishness and points to a neutral long-term outlook. Both the weekly and monthly session fib grids are neutral, with no clear bias, and volatility as measured by ATR is moderate. Volume remains robust, but without a clear directional surge, and the market appears to be consolidating after a recent swing down. The intermediate-term HiLo trend remains up, suggesting that while the short-term is under pressure, the broader structure has not yet broken down. This environment is typical of a market in a corrective phase within a larger uptrend, with potential for further consolidation or a test of lower support levels before any significant reversal or continuation emerges.