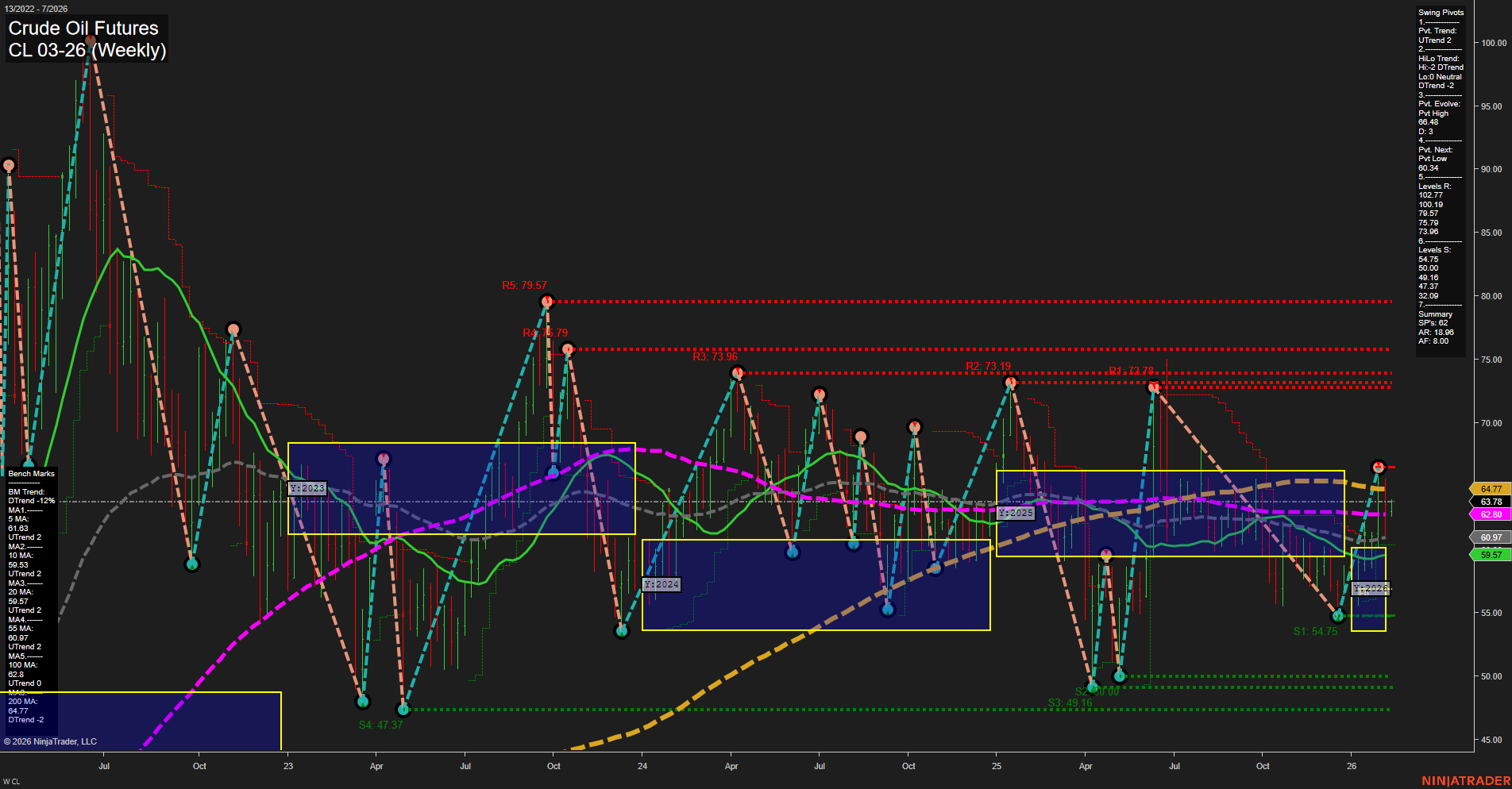

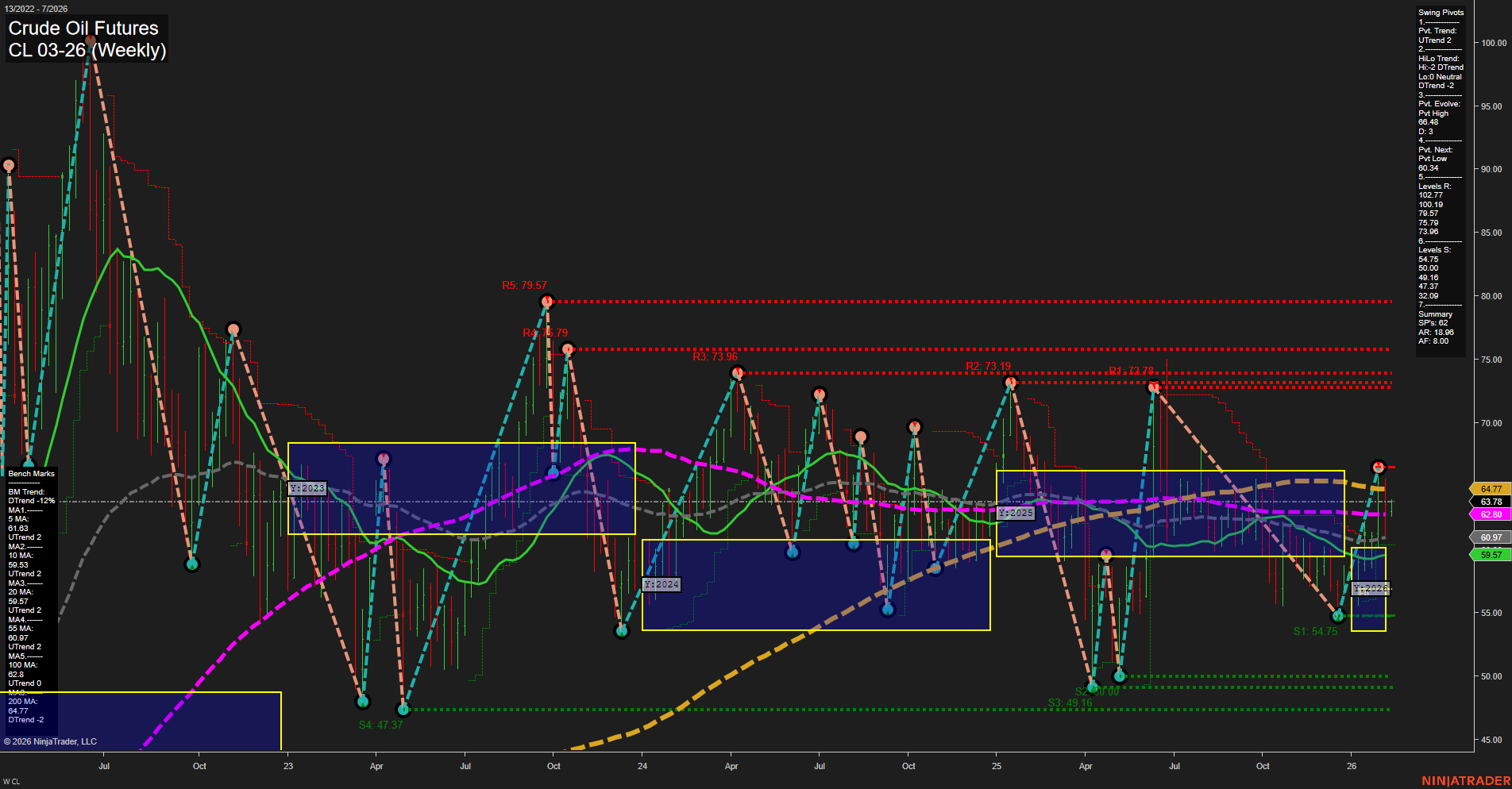

CL Crude Oil Futures Weekly Chart Analysis: 2026-Feb-09 07:06 CT

Price Action

- Last: 64.77,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -13%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 64.8,

- 4. Pvt. Next: Pvt low 54.75,

- 5. Levels R: 100.17, 79.57, 76.79, 73.96, 73.19, 72.78,

- 6. Levels S: 54.75, 50.10, 49.16, 47.37, 37.02.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 61.83 Up Trend,

- (Intermediate-Term) 10 Week: 61.03 Up Trend,

- (Long-Term) 20 Week: 59.97 Up Trend,

- (Long-Term) 55 Week: 60.97 Up Trend,

- (Long-Term) 100 Week: 62.60 Down Trend,

- (Long-Term) 200 Week: 64.77 Down Trend.

Recent Trade Signals

- 06 Feb 2026: Short CL 03-26 @ 64.08 Signals.USAR-WSFG

- 03 Feb 2026: Long CL 03-26 @ 63.8 Signals.USAR.TR120

- 02 Feb 2026: Short CL 03-26 @ 63.71 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Crude oil futures are currently exhibiting a mixed structure across timeframes. The short-term trend is bullish, supported by price action above the weekly session fib grid (WSFG) NTZ and a recent upswing in swing pivots, with momentum at an average pace and medium-sized bars. However, the intermediate-term (monthly) trend remains bearish, as indicated by the MSFG and a downward HiLo swing trend, suggesting that the recent rally may be a countertrend move within a broader pullback. Long-term (yearly) structure is neutral, with price above the yearly NTZ and most long-term moving averages trending up, but the 100 and 200 week MAs still in a downtrend, reflecting a market in transition. Resistance is layered above at 72.78–100.17, while support is clustered at 54.75–47.37, highlighting a wide trading range. Recent trade signals show both long and short entries, underscoring the choppy, two-way nature of the current market. Overall, the market is in a consolidation phase with short-term bullish momentum, but faces significant overhead resistance and unresolved longer-term directionality.

Chart Analysis ATS AI Generated: 2026-02-09 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.