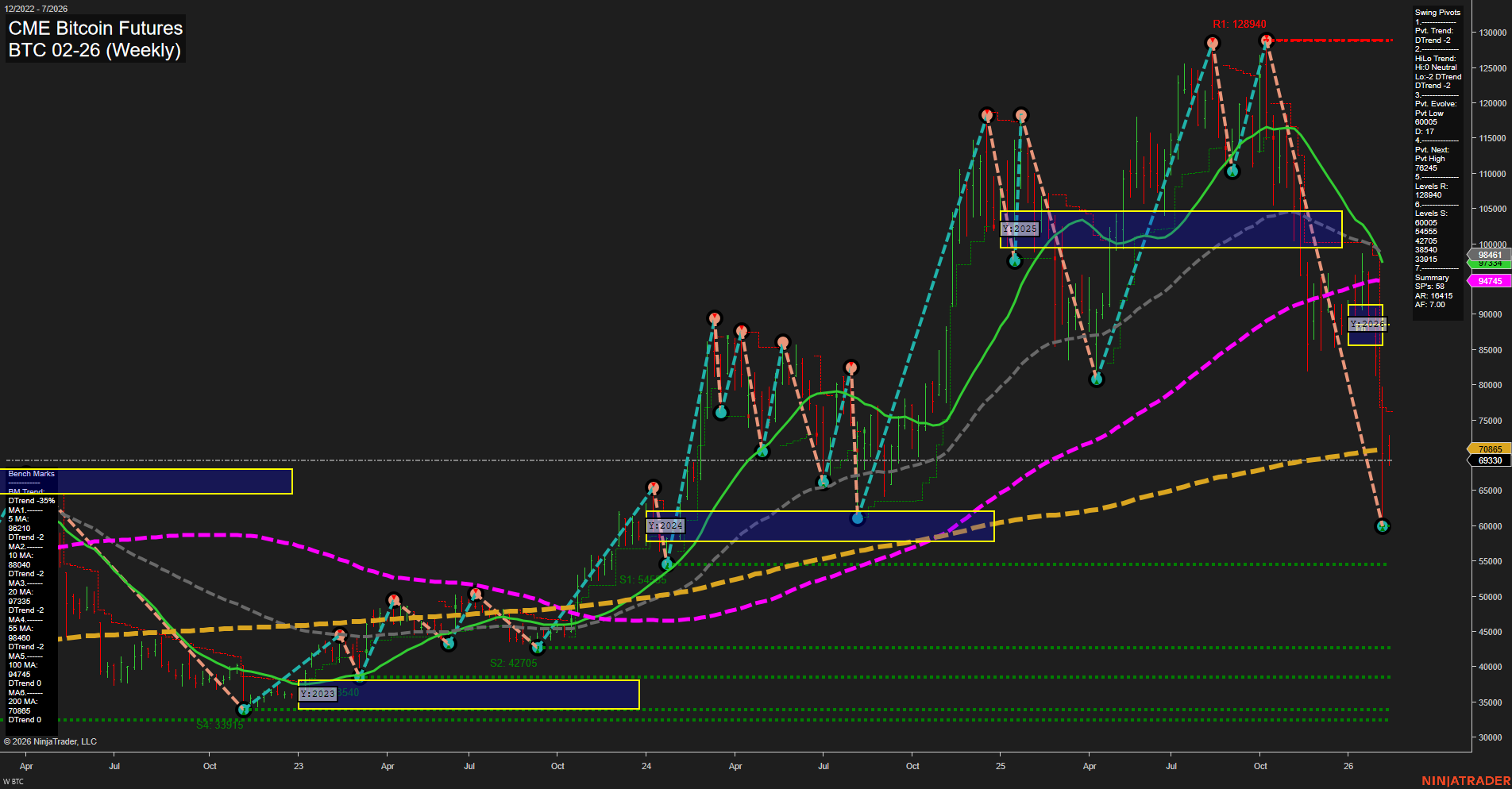

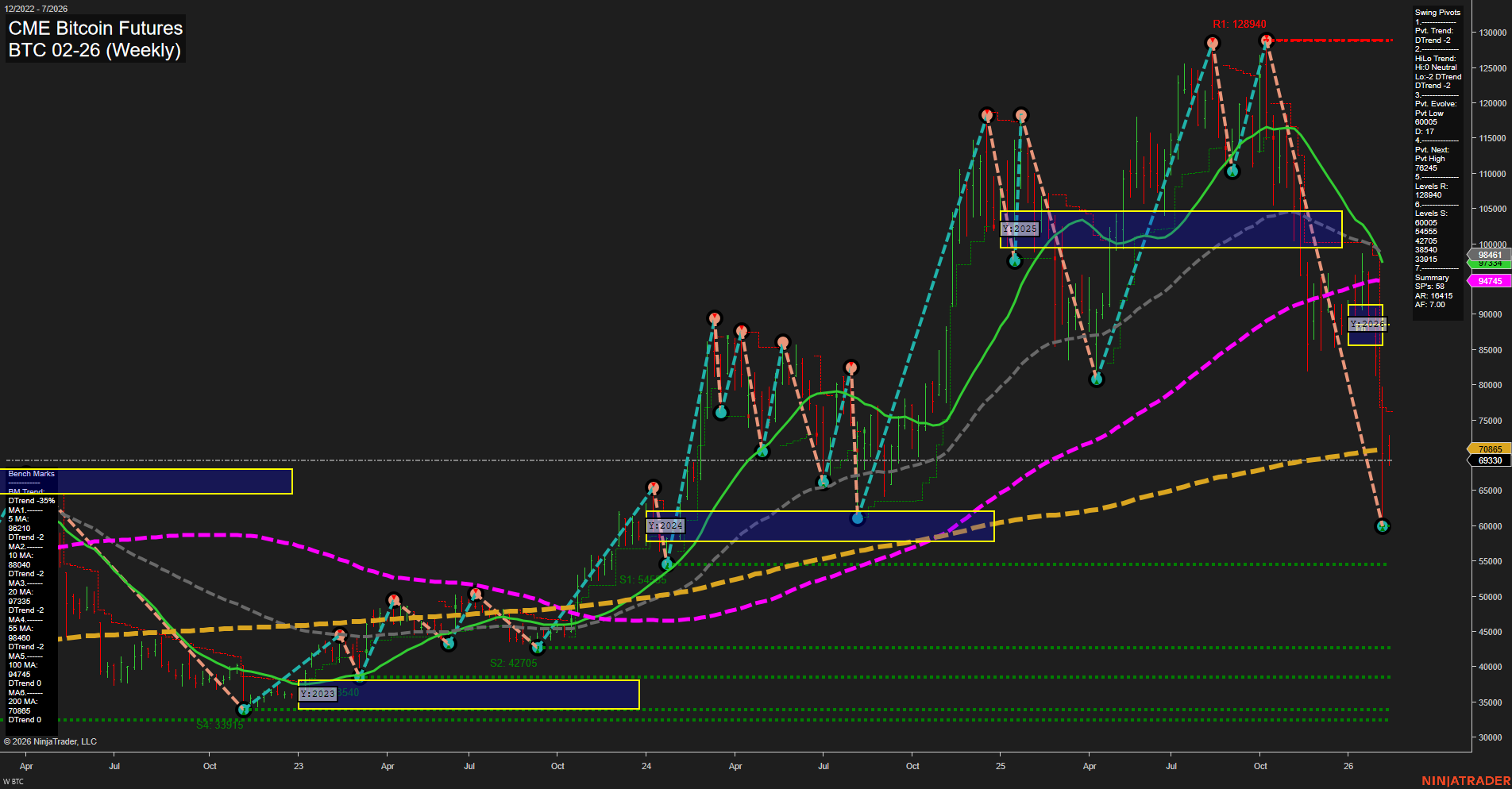

BTC CME Bitcoin Futures Weekly Chart Analysis: 2026-Feb-09 07:05 CT

Price Action

- Last: 69330,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -18%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -40%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -67%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 69330,

- 4. Pvt. Next: Pvt high 82648,

- 5. Levels R: 128940, 120225, 82648, 74450, 70090,

- 6. Levels S: 69330, 55440, 42705, 3540, 13915.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 88210 Down Trend,

- (Intermediate-Term) 10 Week: 94745 Down Trend,

- (Long-Term) 20 Week: 98040 Down Trend,

- (Long-Term) 55 Week: 94710 Down Trend,

- (Long-Term) 100 Week: 104760 Up Trend,

- (Long-Term) 200 Week: 70685 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Long BTC 02-26 @ 70090 Signals.USAR.TR120

- 04 Feb 2026: Short BTC 02-26 @ 74450 Signals.USAR-MSFG

- 03 Feb 2026: Short BTC 02-26 @ 76665 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

BTC CME Bitcoin Futures are exhibiting pronounced downside momentum across all timeframes, with large weekly bars and fast momentum confirming a strong sell-off. Price is trading well below all key Fibonacci grid levels (weekly, monthly, yearly), and the NTZ zones are acting as resistance overhead. Both short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 69330 and the next significant resistance at 82648. Multiple resistance levels cluster above, while support levels are spaced much lower, indicating a lack of immediate structural support. All key weekly moving averages (5, 10, 20, 55) are trending down, reinforcing the bearish structure, though the 100 and 200 week MAs remain in uptrend but are now well above current price. Recent trade signals have shifted from short to a tentative long, but the overall context remains bearish. The market is in a clear corrective phase, with potential for further volatility and possible oversold bounces, but the dominant trend remains to the downside. This environment is characterized by trend continuation, lower highs, and lower lows, with no clear signs of reversal yet.

Chart Analysis ATS AI Generated: 2026-02-09 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.