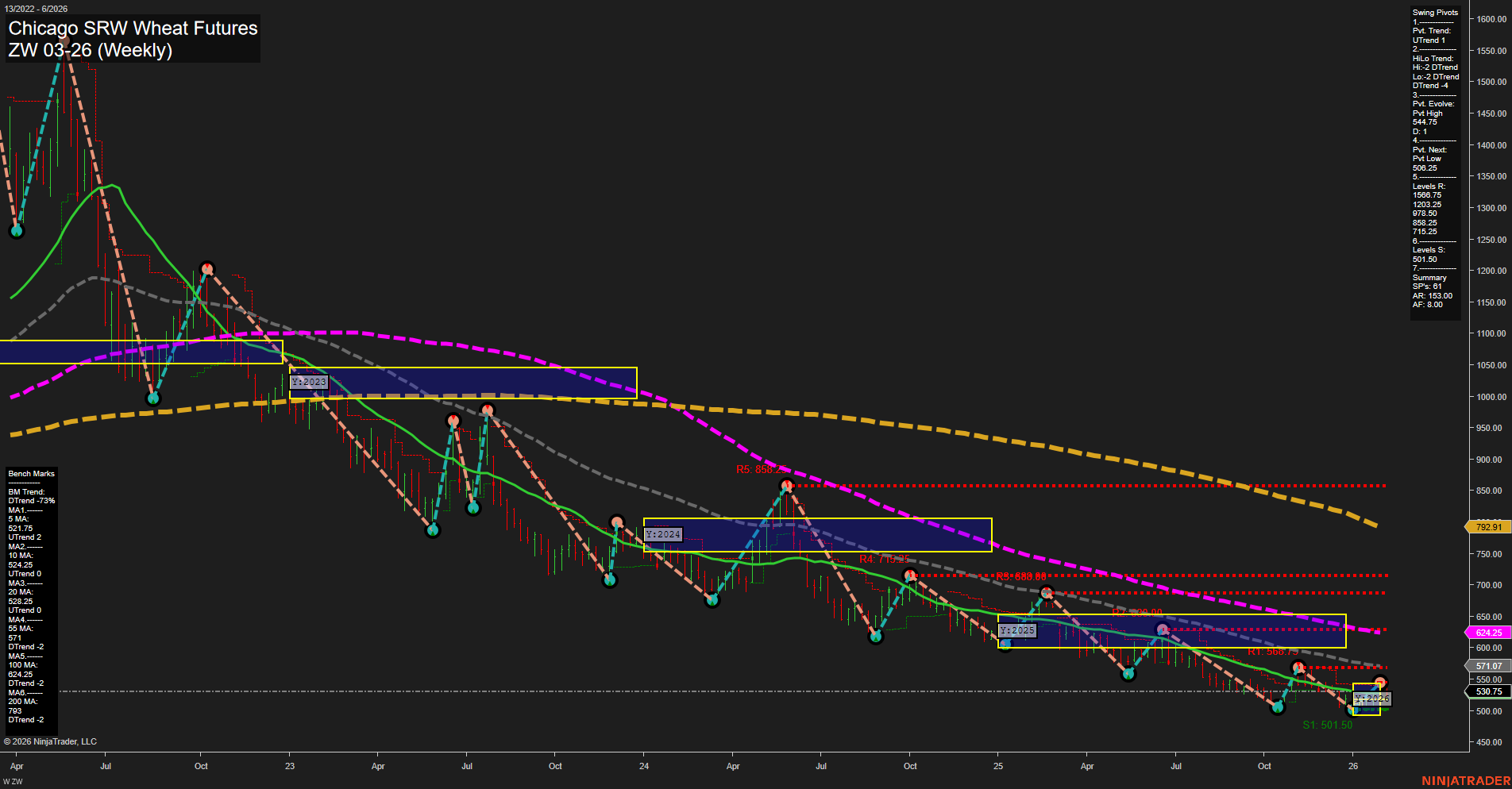

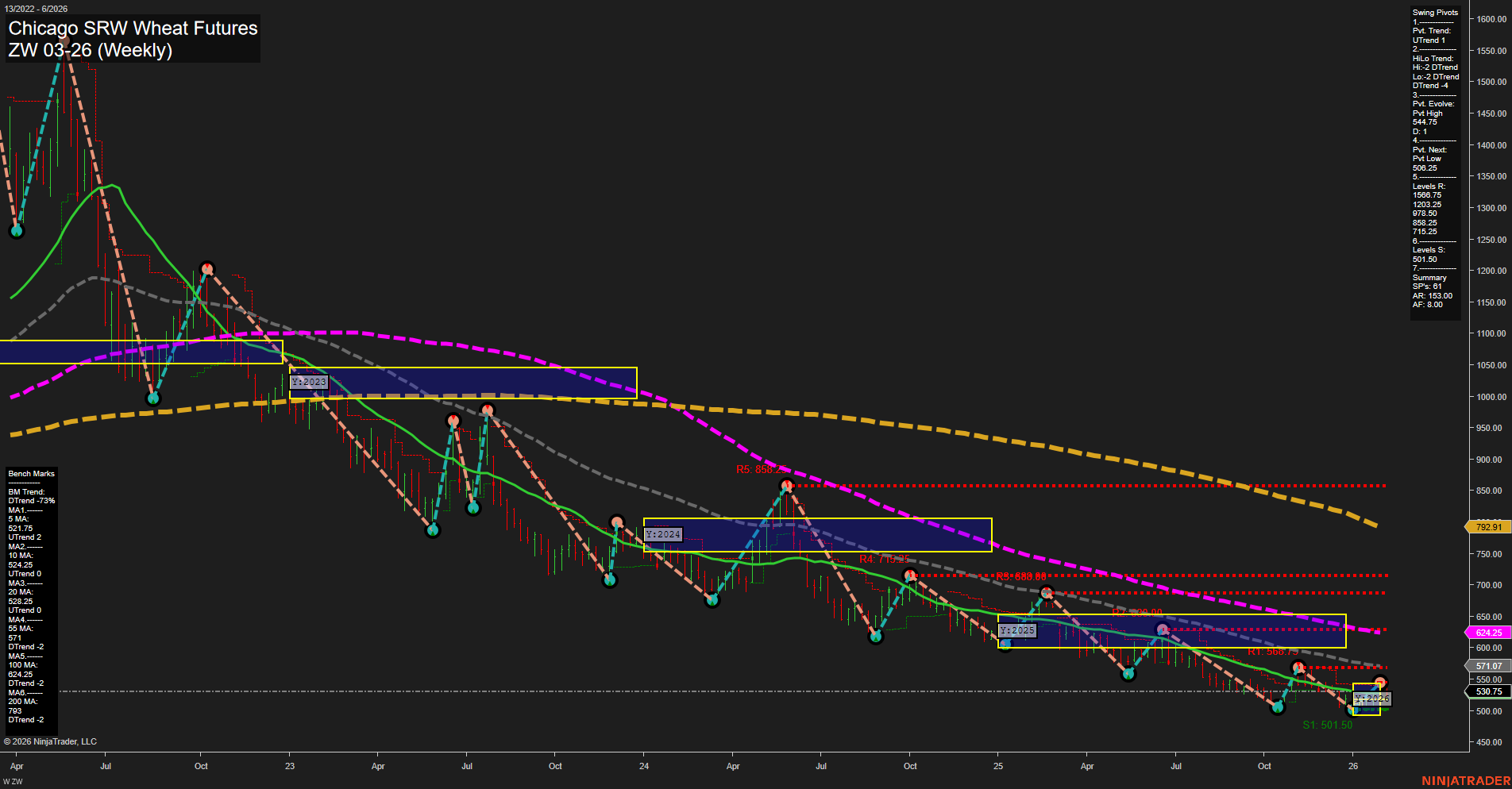

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2026-Feb-08 18:24 CT

Price Action

- Last: 535,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -43%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -18%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 541.75,

- 4. Pvt. Next: Pvt Low 505.25,

- 5. Levels R: 689.00, 624.25, 577.00, 541.75,

- 6. Levels S: 501.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 532.25 Down Trend,

- (Intermediate-Term) 10 Week: 536.25 Down Trend,

- (Long-Term) 20 Week: 553.25 Down Trend,

- (Long-Term) 55 Week: 617.00 Down Trend,

- (Long-Term) 100 Week: 703.00 Down Trend,

- (Long-Term) 200 Week: 792.91 Down Trend.

Recent Trade Signals

- 05 Feb 2026: Long ZW 03-26 @ 535 Signals.USAR.TR120

- 02 Feb 2026: Short ZW 03-26 @ 530.75 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The ZW Chicago SRW Wheat Futures weekly chart shows a persistent downtrend across both short-term and intermediate-term timeframes, as indicated by the WSFG and MSFG trends, swing pivot direction, and all benchmark moving averages trending lower. Price action is subdued, with small bars and slow momentum, suggesting a lack of strong buying interest or volatility. The most recent swing pivot is a high at 541.75, with the next key support at 501.50, highlighting a market that continues to make lower highs and lower lows. Despite a minor long signal on February 5th, the overall structure remains bearish, with resistance levels stacked above and little evidence of a reversal. The long-term YSFG trend has turned slightly positive, but this is not yet confirmed by price or moving averages, keeping the long-term outlook neutral. The market appears to be in a prolonged consolidation or base-building phase after a significant selloff, with any rallies likely to encounter strong resistance until a clear change in trend emerges.

Chart Analysis ATS AI Generated: 2026-02-08 18:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.