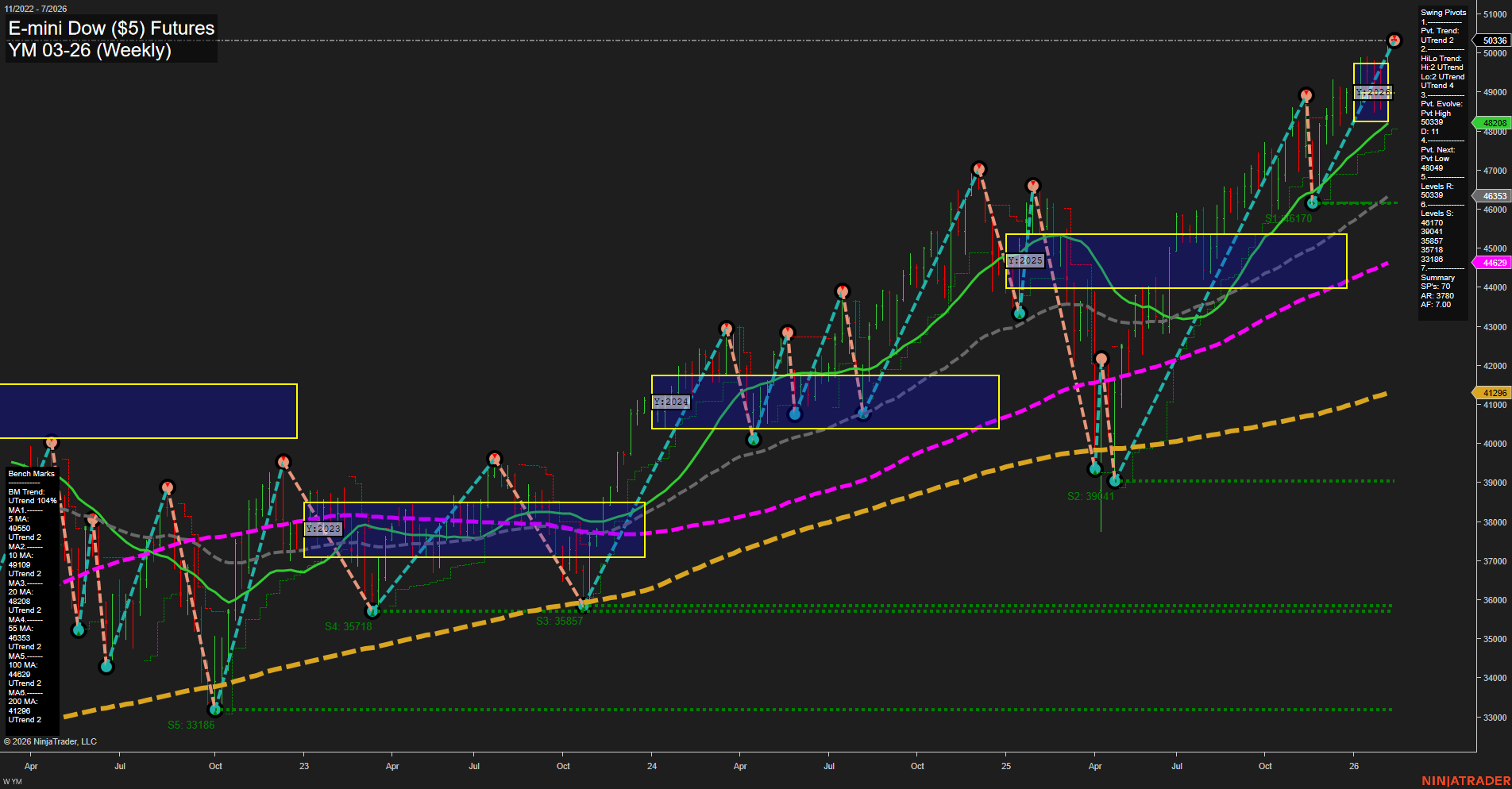

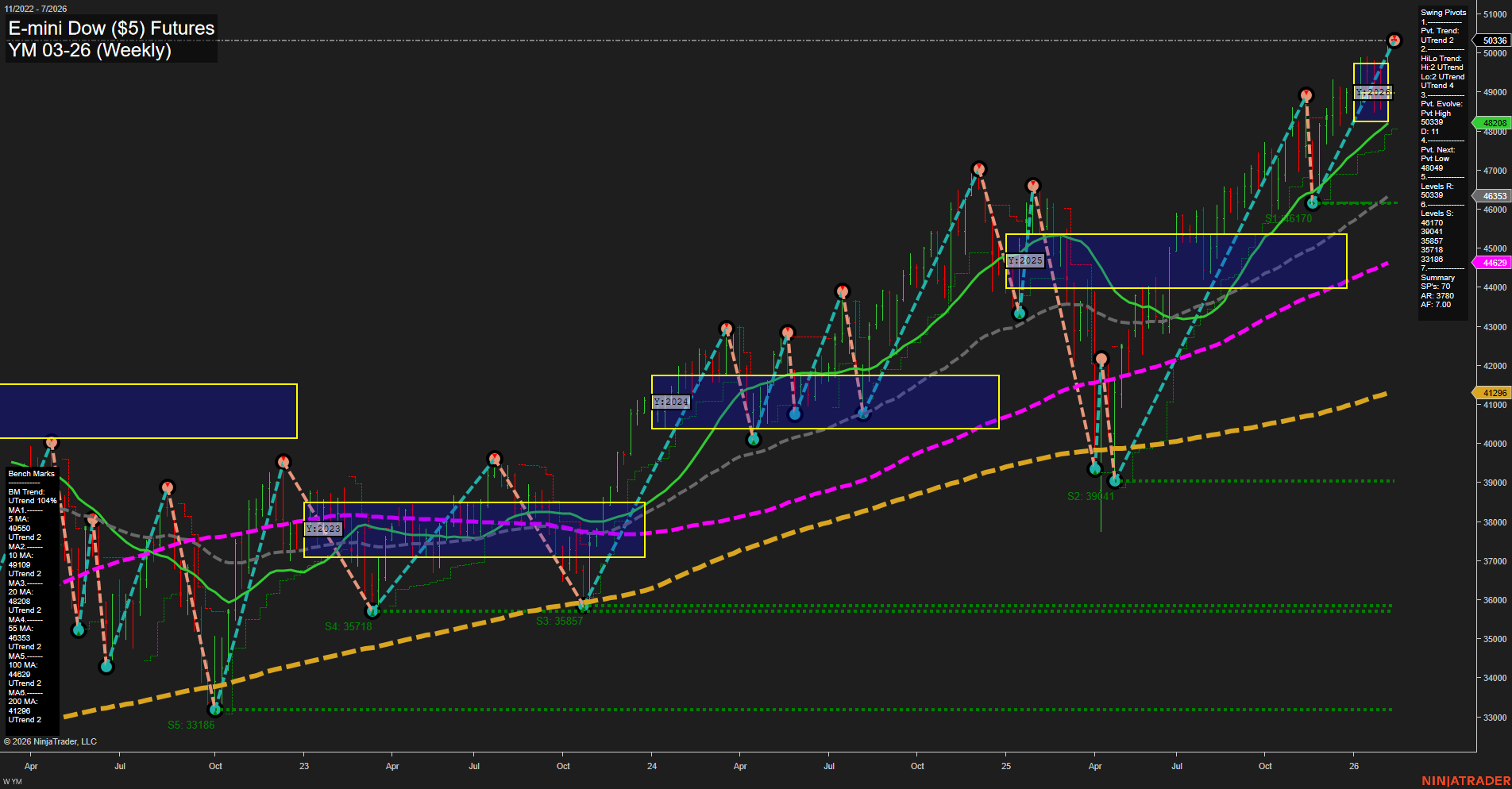

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2026-Feb-08 18:21 CT

Price Action

- Last: 50336,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 66%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 50349,

- 4. Pvt. Next: Pvt low 46353,

- 5. Levels R: 50349,

- 6. Levels S: 46353, 39841, 35857, 33186.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 48208 Up Trend,

- (Intermediate-Term) 10 Week: 46353 Up Trend,

- (Long-Term) 20 Week: 45060 Up Trend,

- (Long-Term) 55 Week: 44529 Up Trend,

- (Long-Term) 100 Week: 41208 Up Trend,

- (Long-Term) 200 Week: 41296 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Long YM 03-26 @ 49949 Signals.USAR.TR120

- 03 Feb 2026: Long YM 03-26 @ 49342 Signals.USAR-MSFG

- 02 Feb 2026: Short YM 03-26 @ 48642 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow ($5) Futures weekly chart displays a robust uptrend across all timeframes. Price action is strong, with large bars and fast momentum, indicating aggressive buying and a clear directional move. The price is trading well above all key session Fib grid levels (weekly, monthly, yearly), and the NTZ (neutral zone) bias is decisively to the upside. Swing pivot analysis confirms an upward trend in both short- and intermediate-term, with the most recent pivot high at 50349 acting as immediate resistance and multiple support levels below, the nearest at 46353. All benchmark moving averages from 5-week to 200-week are trending upward, reinforcing the strength and breadth of the current rally. Recent trade signals are predominantly long, aligning with the prevailing bullish structure. The market is in a strong trending phase, with higher highs and higher lows, and no immediate signs of reversal or exhaustion. This environment is characterized by trend continuation, with any pullbacks likely to be viewed as opportunities within the broader bullish context.

Chart Analysis ATS AI Generated: 2026-02-08 18:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.