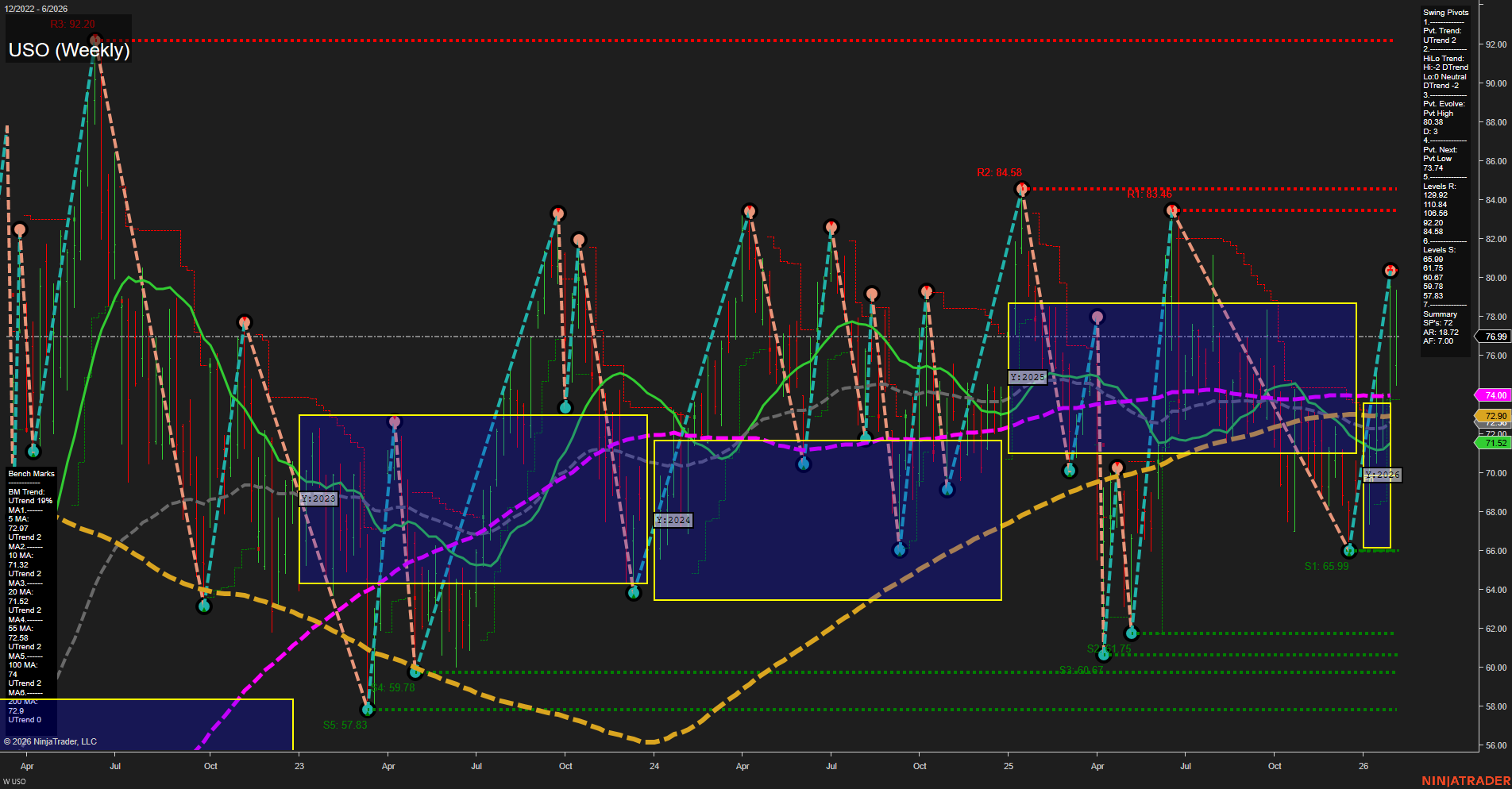

USO is currently trading at 76.99, with medium-sized weekly bars and average momentum, reflecting a market in transition. The short-term swing pivot trend has shifted to an uptrend, supported by rising 5, 10, and 20-week moving averages, indicating renewed bullish sentiment in the near term. However, the intermediate-term HiLo trend remains in a downtrend, and the 55, 100, and 200-week moving averages are still trending lower, highlighting persistent long-term bearish pressure. The price is consolidating within a neutral zone on the session fib grids across all timeframes, suggesting indecision and a lack of clear directional conviction. Key resistance levels are clustered above at 78.85, 80.84, and 83.25, while support is layered below at 72.90, 71.52, and 65.99. The next significant pivot to watch is the recent swing low at 65.99, which, if tested, could signal a deeper retracement. Overall, the chart reflects a market caught between short-term bullish momentum and longer-term bearish structure, with price action oscillating within a broad range. This environment is typical of a choppy, mean-reverting phase, where swing traders may see both counter-trend rallies and sharp pullbacks. The lack of a clear breakout or breakdown from the NTZ (neutral zone) suggests that directional conviction will likely depend on a catalyst or a decisive move through key resistance or support levels.