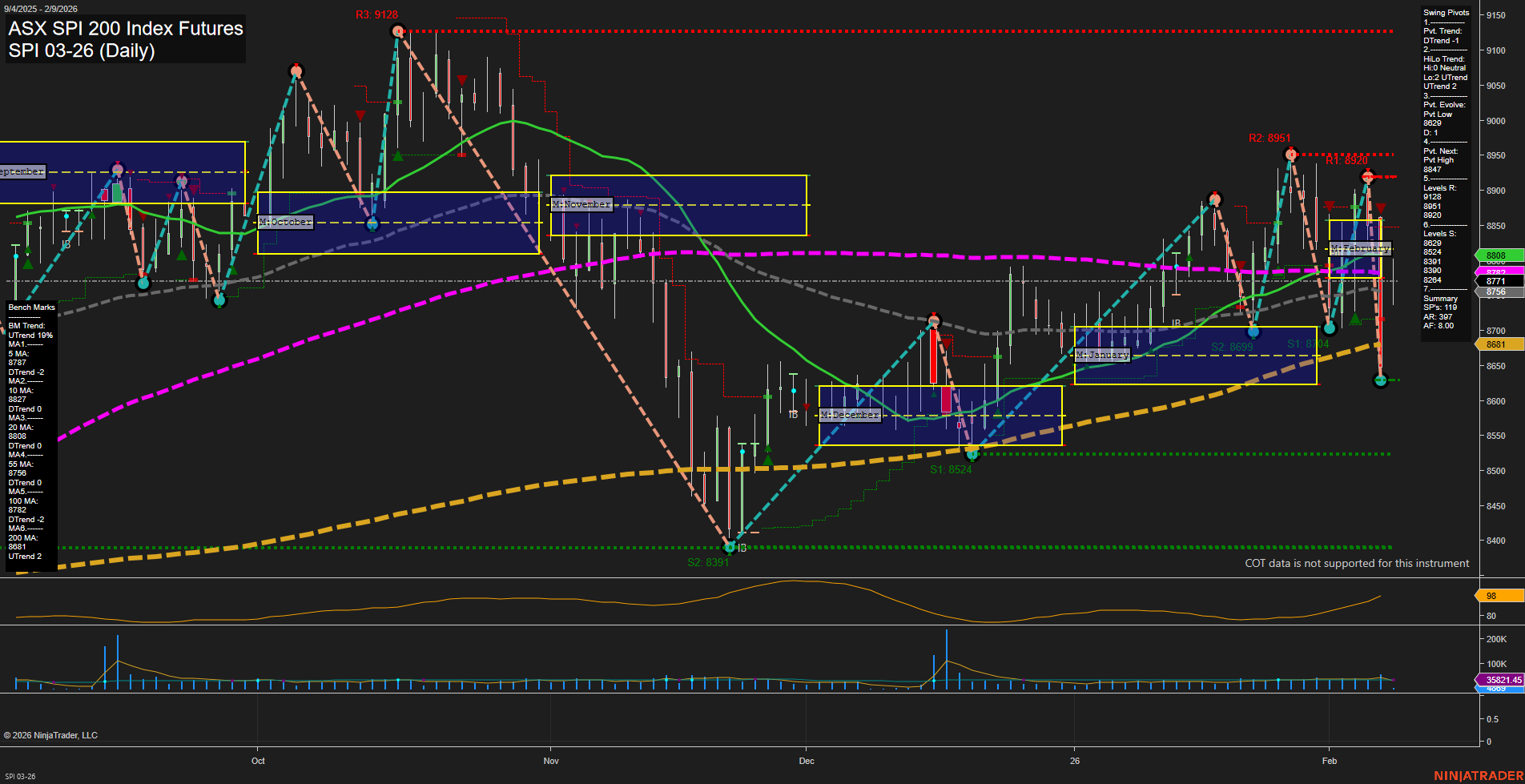

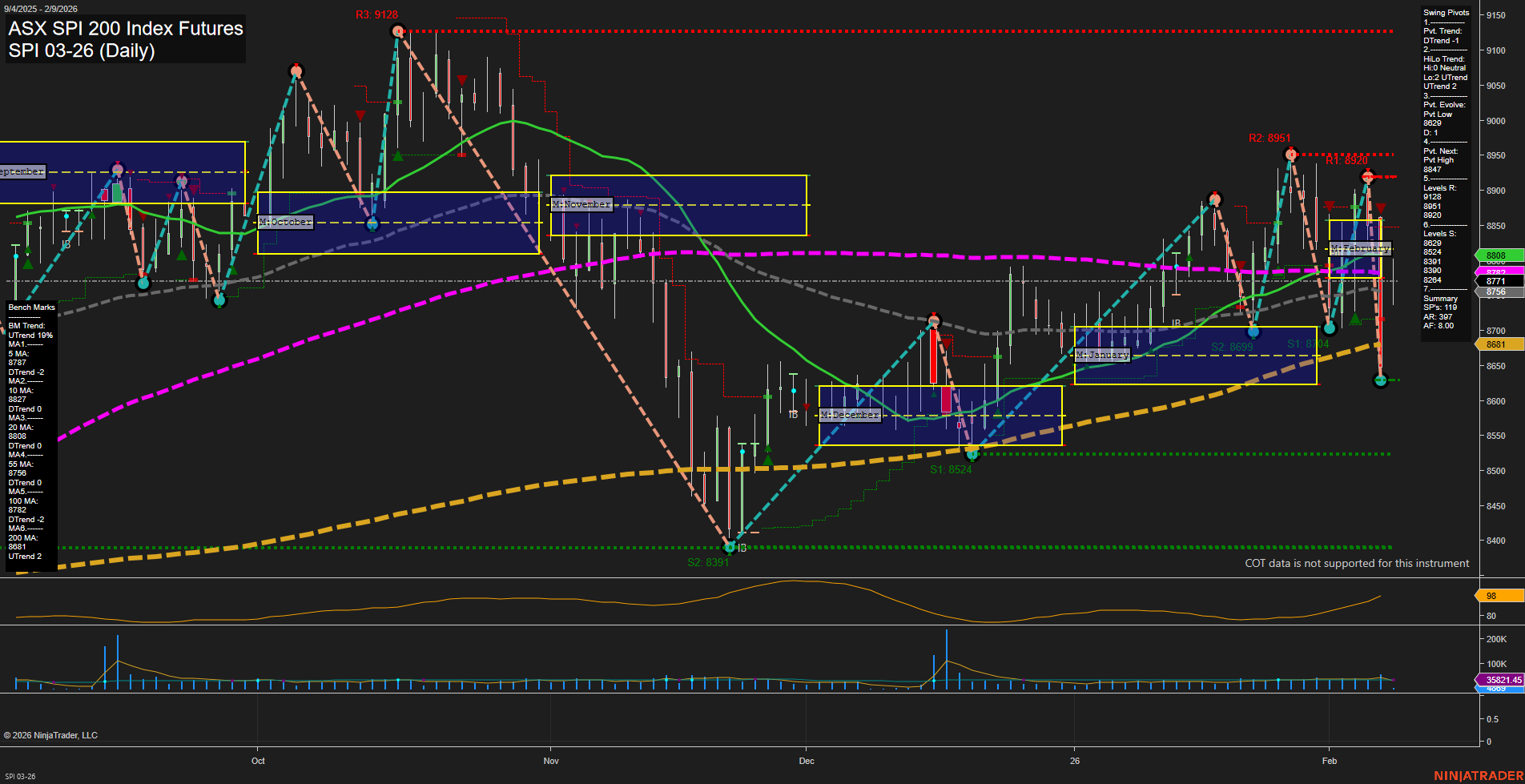

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2026-Feb-08 18:18 CT

Price Action

- Last: 8808,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 8680,

- 4. Pvt. Next: Pvt High 8877,

- 5. Levels R: 8951, 8877, 8820,

- 6. Levels S: 8680, 8524, 8391.

Daily Benchmarks

- (Short-Term) 5 Day: 8777 Down Trend,

- (Short-Term) 10 Day: 8808 Down Trend,

- (Intermediate-Term) 20 Day: 8883 Down Trend,

- (Intermediate-Term) 55 Day: 8802 Up Trend,

- (Long-Term) 100 Day: 8722 Up Trend,

- (Long-Term) 200 Day: 8681 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The SPI 200 futures are currently experiencing heightened volatility, as indicated by large bars and fast momentum. The short-term trend has shifted to bearish, with price breaking below recent swing supports and both the 5-day and 10-day moving averages trending down. However, intermediate and long-term moving averages remain in uptrends, suggesting underlying strength in the broader trend. The most recent swing pivot is a low at 8680, with the next potential reversal at the 8877 level. Resistance is layered above at 8820, 8877, and 8951, while support is found at 8680, 8524, and 8391. The market is currently in a consolidation phase on the higher timeframes, with neutral bias on both the weekly and monthly session fib grids. The overall structure suggests a short-term pullback within a longer-term uptrend, with volatility elevated and volume steady. Swing traders should note the potential for further downside in the short term, but the presence of strong support and uptrending long-term benchmarks may limit the extent of any correction.

Chart Analysis ATS AI Generated: 2026-02-08 18:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.