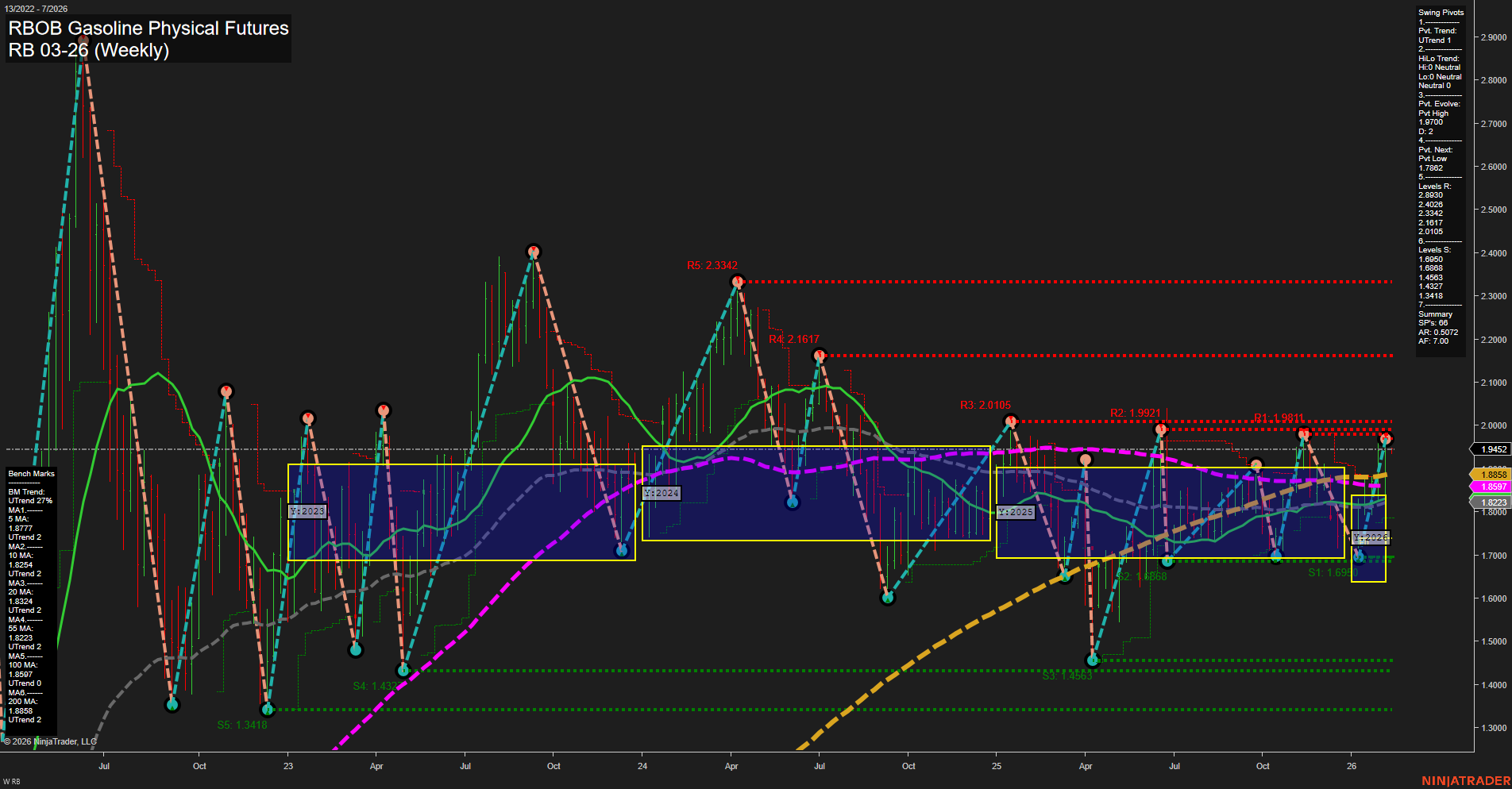

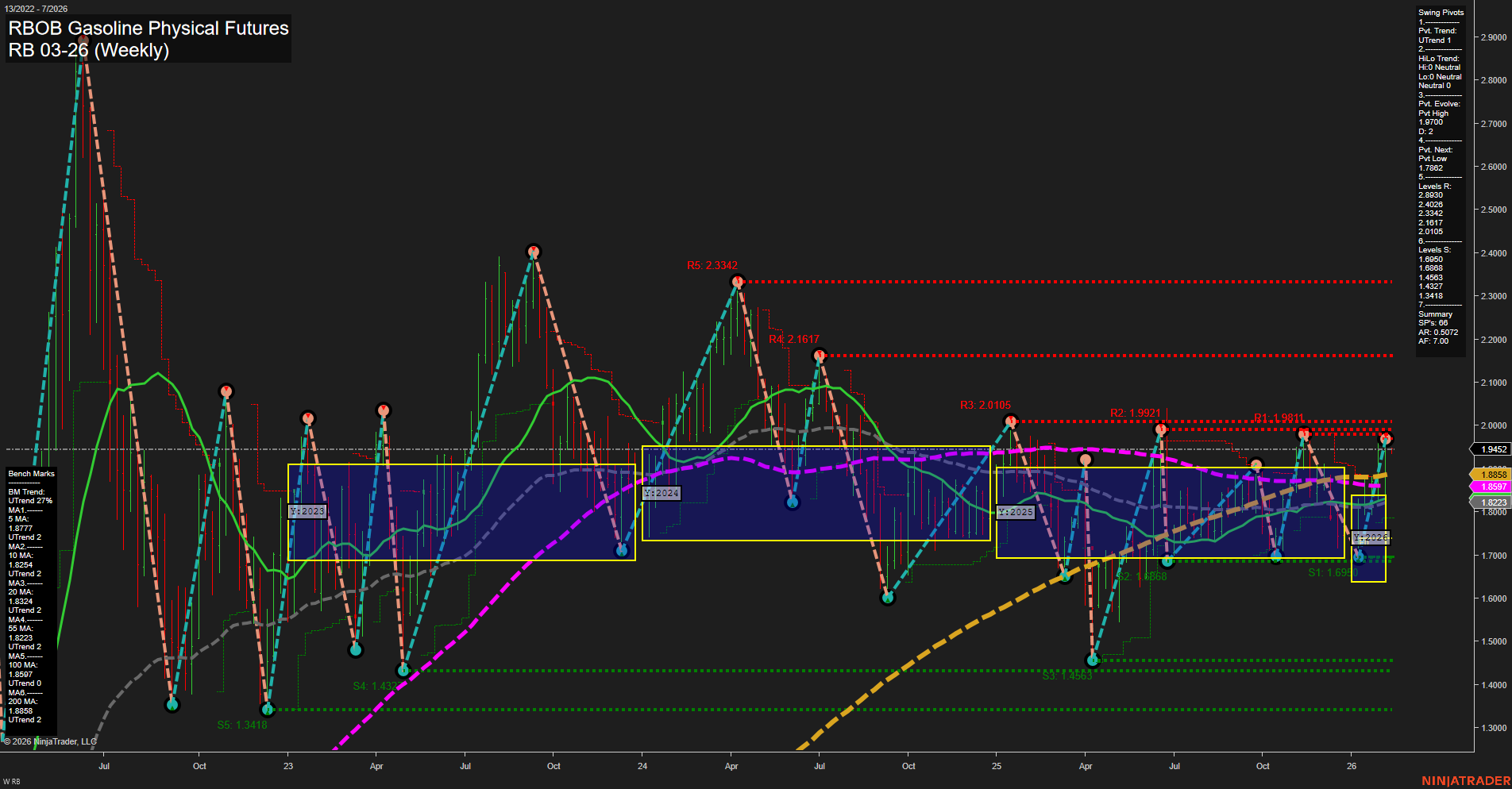

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2026-Feb-08 18:16 CT

Price Action

- Last: 1.9452,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt high 1.9704,

- 4. Pvt. Next: Pvt low 1.7682,

- 5. Levels R: 2.3342, 2.1617, 2.0105, 1.9921, 1.9811,

- 6. Levels S: 1.6980, 1.4683, 1.4327, 1.3418.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8777 Up Trend,

- (Intermediate-Term) 10 Week: 1.8223 Up Trend,

- (Long-Term) 20 Week: 1.8597 Up Trend,

- (Long-Term) 55 Week: 1.8608 Up Trend,

- (Long-Term) 100 Week: 1.8707 Up Trend,

- (Long-Term) 200 Week: 1.8658 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Short RB 03-26 @ 1.915 Signals.USAR-WSFG

- 03 Feb 2026: Long RB 03-26 @ 1.9162 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The weekly chart for RBOB Gasoline Physical Futures shows a market that is currently in a bullish phase on both the short- and long-term horizons, with price action above all major moving averages and the yearly, monthly, and weekly session fib grids all trending upward. The short-term swing pivot trend is up, and the most recent pivots show a higher high evolving, while the next key level to watch is a potential pivot low at 1.7682. Resistance levels are clustered above 1.98, with major resistance at 2.33, while support is well below at 1.6980 and lower. The intermediate-term trend is neutral, suggesting some consolidation or indecision, which is also reflected in the recent trade signals showing both long and short entries within a tight range. Overall, the market is showing signs of a potential trend continuation, but with some choppiness and possible retracements as it tests resistance levels. The technical structure favors higher lows and a constructive long-term outlook, but the intermediate-term may see sideways action or pullbacks before a decisive breakout.

Chart Analysis ATS AI Generated: 2026-02-08 18:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.