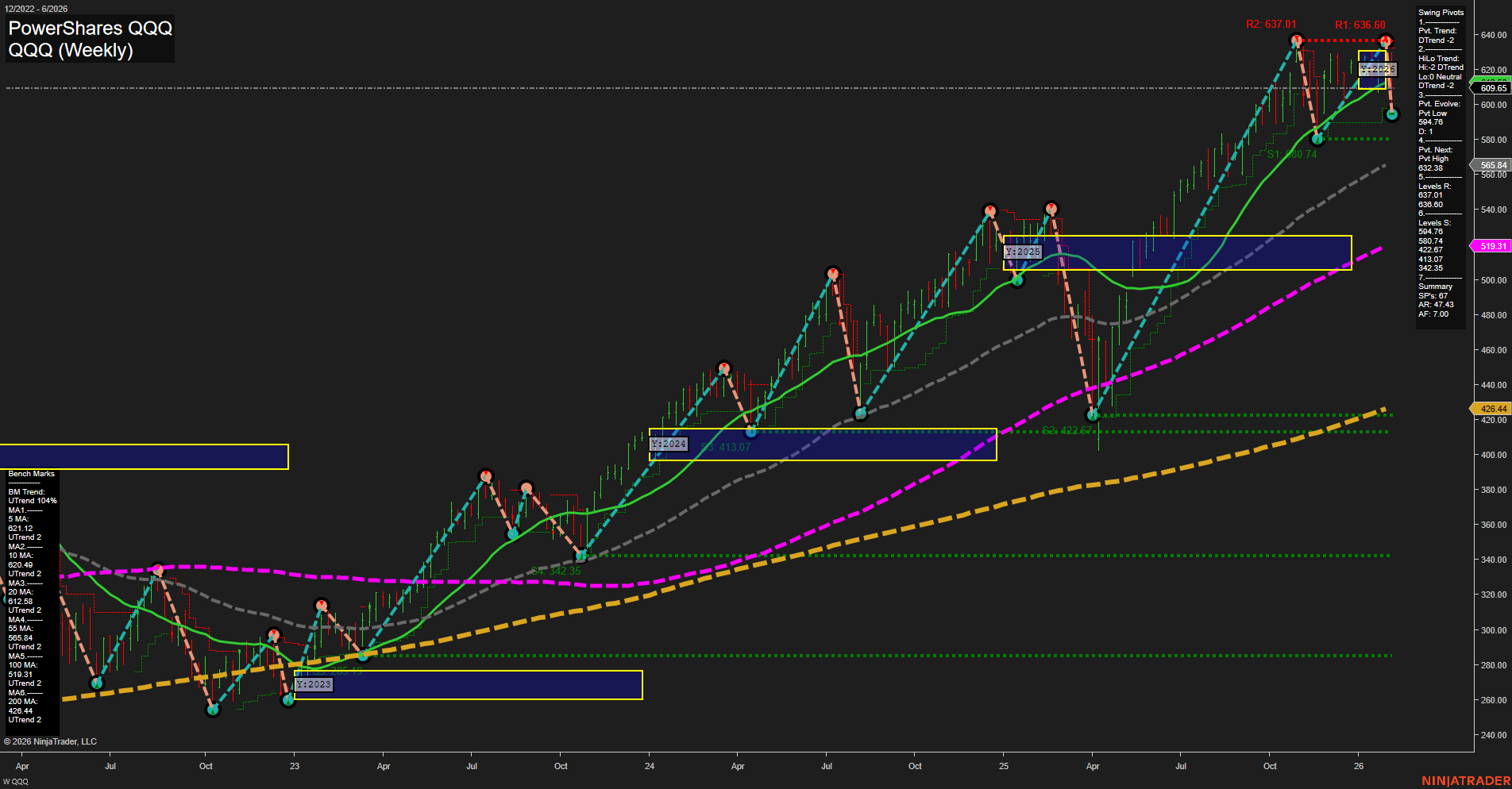

The QQQ weekly chart shows a market in transition. After a strong multi-month uptrend, recent price action has shifted to a corrective phase, with the last swing pivot forming a high at 636.60 and the current price pulling back to 609.65. Both short-term and intermediate-term swing pivot trends have turned down, confirmed by the 5- and 10-week moving averages rolling over into a downtrend. However, the long-term structure remains robustly bullish, with the 20-, 55-, 100-, and 200-week moving averages all trending higher and well below current price, providing a strong underlying support base. Resistance is clustered near the recent highs (636.60–637.01), while support levels are layered below, with the next key swing low at 565.84 and further support at 523.83 and 472.67. The price is currently consolidating within the yearly session fib grid’s neutral zone, suggesting indecision and a pause after the prior rally. This environment is typical of a market digesting gains, with potential for either a deeper retracement or a resumption of the primary uptrend once consolidation resolves. For a futures swing trader, the current setup signals caution in the short and intermediate term, as momentum has slowed and corrective action dominates. However, the long-term bullish structure remains intact, and any significant pullbacks toward major support could be watched for signs of trend continuation. The market is in a consolidation phase, with volatility likely to persist until a clear directional breakout occurs.