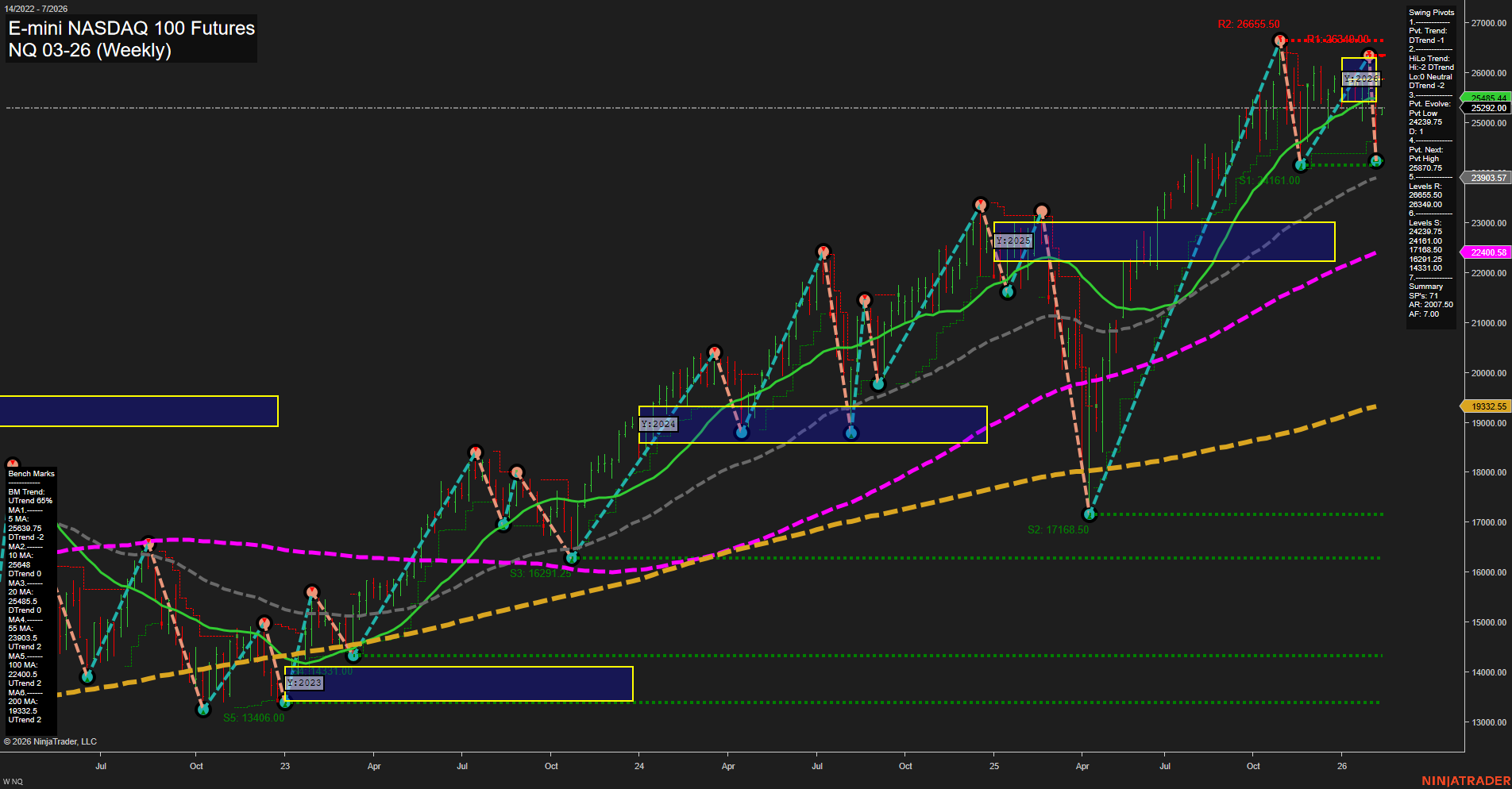

The NQ E-mini NASDAQ 100 Futures weekly chart shows a market in transition. Short-term price action is mixed, with the last price near 25,290 and average momentum, while the weekly session fib grid (WSFG) trend is up and price is above the NTZ center, suggesting some upward bias. However, swing pivots indicate a short-term and intermediate-term downtrend, with the most recent pivot low at 23,930.57 and the next resistance at 26,340.00. Intermediate-term (monthly) and long-term (yearly) fib grid trends are both down, with price below their respective NTZ centers, reflecting a broader corrective or consolidative phase after a strong rally. Weekly benchmarks show a split: the 5-week and 20-week moving averages are in uptrends, but the 10-week is in a downtrend, highlighting recent choppiness and possible range-bound action. Longer-term moving averages (55, 100, 200 week) remain in solid uptrends, supporting a bullish long-term structure. Recent trade signals reflect this mixed environment, with both long and short signals triggered in the past week, indicating indecision and volatility. Overall, the short-term outlook is neutral as the market tests support and resistance within a broader consolidation. The intermediate-term is bearish, with downward pressure from the monthly trend and swing pivots. The long-term remains bullish, underpinned by rising long-term moving averages and higher structural lows. The market appears to be in a corrective phase within a larger uptrend, with potential for further consolidation or a retest of recent lows before any sustained breakout or trend continuation.