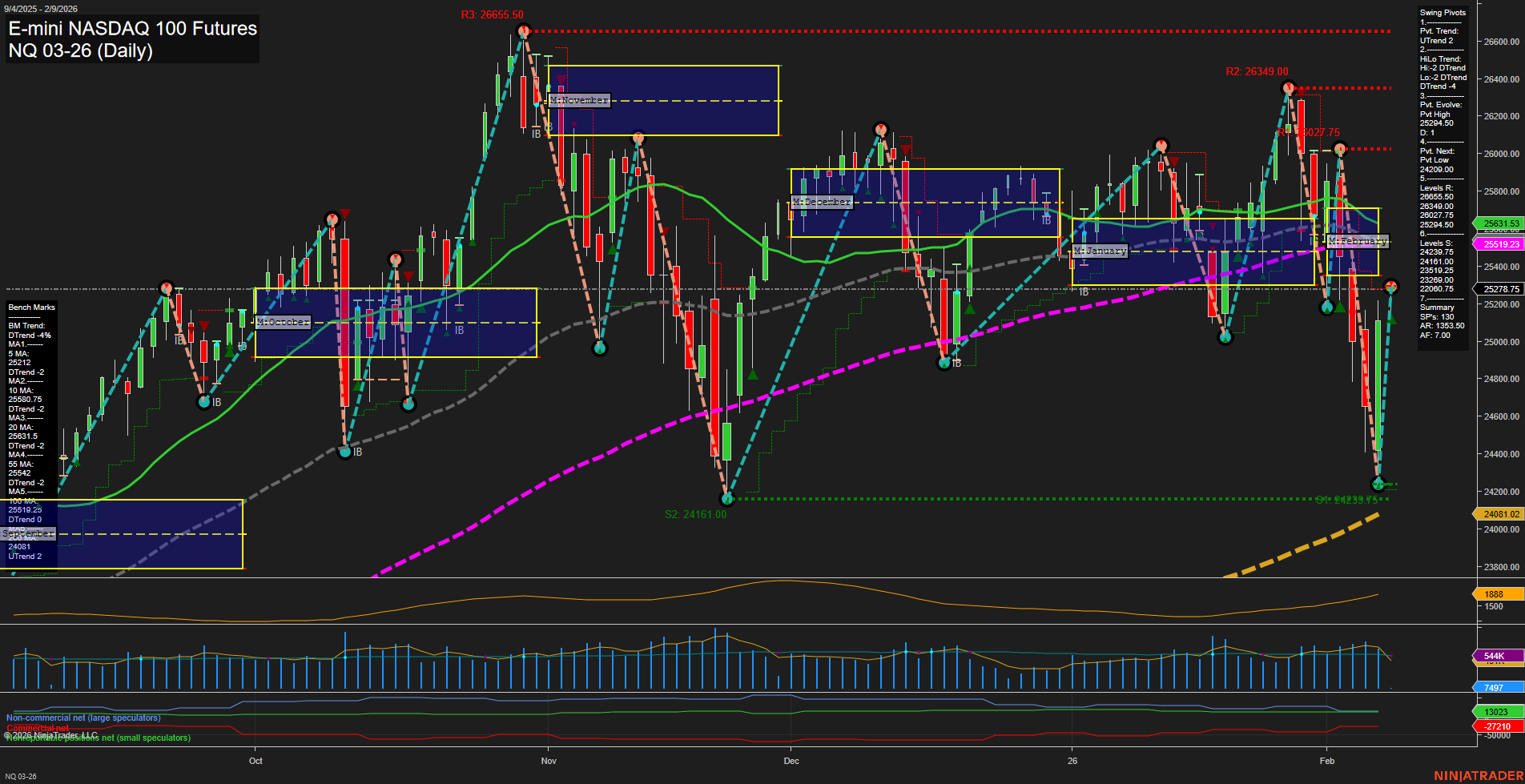

NQ E-mini NASDAQ 100 Futures Daily Chart Analysis: 2026-Feb-08 18:14 CT

Price Action

- Last: 25275.75,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -15%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -13%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 24249.75,

- 4. Pvt. Next: Pvt high 26349.00,

- 5. Levels R: 26655.50, 26349.00, 26027.75, 25834.00, 25619.25,

- 6. Levels S: 24249.75, 24161.00, 24081.00.

Daily Benchmarks

- (Short-Term) 5 Day: 25212.4 Down Trend,

- (Short-Term) 10 Day: 25580.75 Down Trend,

- (Intermediate-Term) 20 Day: 25631.5 Down Trend,

- (Intermediate-Term) 55 Day: 25519.23 Down Trend,

- (Long-Term) 100 Day: 25019.20 Up Trend,

- (Long-Term) 200 Day: 24081.02 Up Trend.

Additional Metrics

Recent Trade Signals

- 09 Feb 2026: Long NQ 03-26 @ 25275 Signals.USAR-WSFG

- 06 Feb 2026: Long NQ 03-26 @ 25084.25 Signals.USAR.TR120

- 04 Feb 2026: Short NQ 03-26 @ 25194.25 Signals.USAR-MSFG

- 02 Feb 2026: Short NQ 03-26 @ 25341.5 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures daily chart shows a market in transition. Price action has been volatile with large bars and fast momentum, reflecting heightened activity and possible news-driven moves. The short-term WSFG trend is up, with price currently above the weekly NTZ, but the intermediate and long-term MSFG and YSFG trends remain down, with price below their respective NTZs. Swing pivots indicate a dominant downtrend in both short and intermediate terms, with the most recent pivot low at 24,249.75 and resistance levels stacked above. All key short and intermediate-term moving averages are trending down, while the 100 and 200-day long-term averages are still up, suggesting a possible inflection point if selling persists. ATR and volume metrics confirm elevated volatility and participation. Recent trade signals show mixed direction, with both long and short entries triggered in the past week, highlighting the choppy and reactive nature of the current environment. Overall, the market is consolidating after a sharp sell-off, with short-term stabilization but persistent downside pressure in the broader trend structure.

Chart Analysis ATS AI Generated: 2026-02-08 18:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.