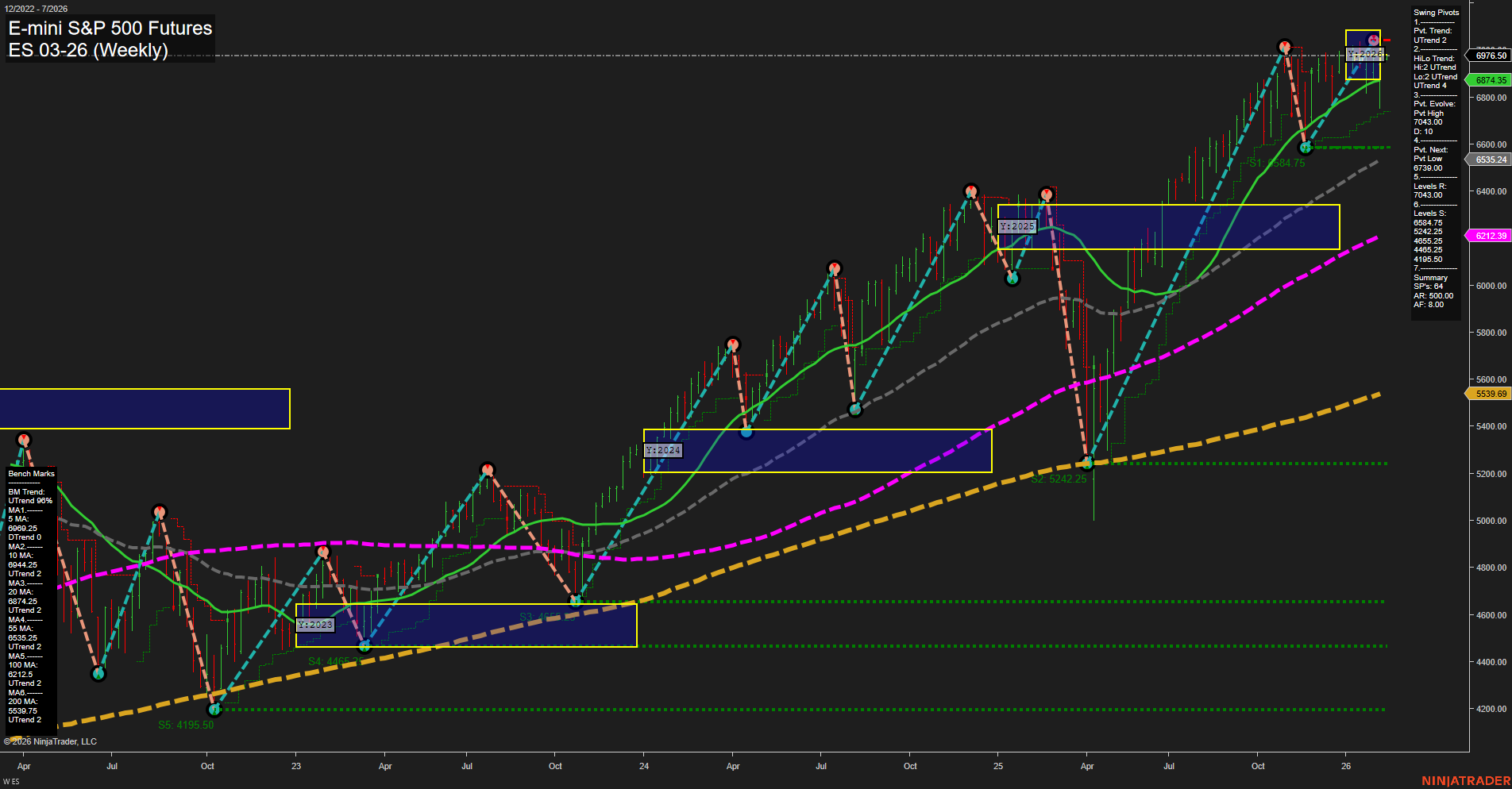

ES E-mini S&P 500 Futures Weekly Chart Analysis: 2026-Feb-08 18:08 CT

Price Action

- Last: 6976.50,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 12%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 7043.00,

- 4. Pvt. Next: Pvt low 6790.00,

- 5. Levels R: 7043.00, 7025.25,

- 6. Levels S: 6790.00, 6465.25, 6065.25, 5533.25, 5242.25, 4915.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 6962.25 Up Trend,

- (Intermediate-Term) 10 Week: 6874.25 Up Trend,

- (Long-Term) 20 Week: 6535.25 Up Trend,

- (Long-Term) 55 Week: 6212.39 Up Trend,

- (Long-Term) 100 Week: 6060.25 Up Trend,

- (Long-Term) 200 Week: 5539.69 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Long ES 03-26 @ 6916.5 Signals.USAR.TR120

- 05 Feb 2026: Short ES 03-26 @ 6856 Signals.USAR.TR720

- 05 Feb 2026: Short ES 03-26 @ 6901.25 Signals.USAR-MSFG

- 05 Feb 2026: Short ES 03-26 @ 6908 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ES E-mini S&P 500 Futures weekly chart shows a market in a strong uptrend across both short- and intermediate-term timeframes, as indicated by the upward momentum in the WSFG and MSFG grids, as well as the consistent uptrend in all benchmark moving averages. The most recent price action is above the NTZ center line for both weekly and monthly grids, reinforcing the bullish bias. Swing pivots confirm this with both short- and intermediate-term trends in an uptrend, and resistance is being tested near recent highs (7043.00). However, the yearly grid trend is slightly negative, with price just below the yearly NTZ, suggesting some long-term caution or potential for consolidation. Recent trade signals show a mix of short and long entries, reflecting some short-term volatility or profit-taking near highs. Overall, the market is in a bullish phase with strong support levels below, but the long-term trend is flattening, which could lead to a period of consolidation or range-bound action if resistance holds. The technical structure favors trend continuation, but traders should be aware of the potential for pullbacks or sideways movement as the market digests recent gains.

Chart Analysis ATS AI Generated: 2026-02-08 18:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.