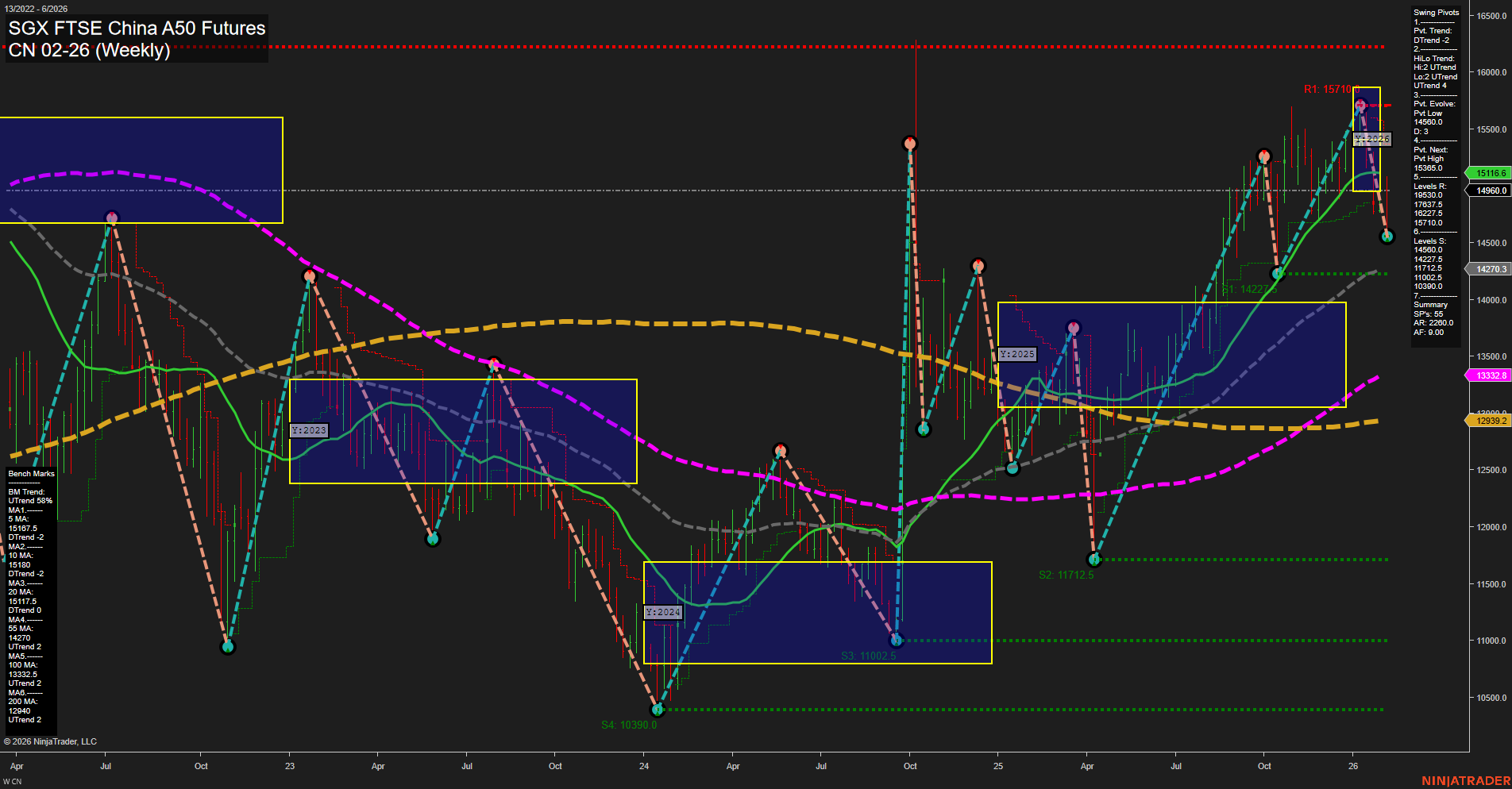

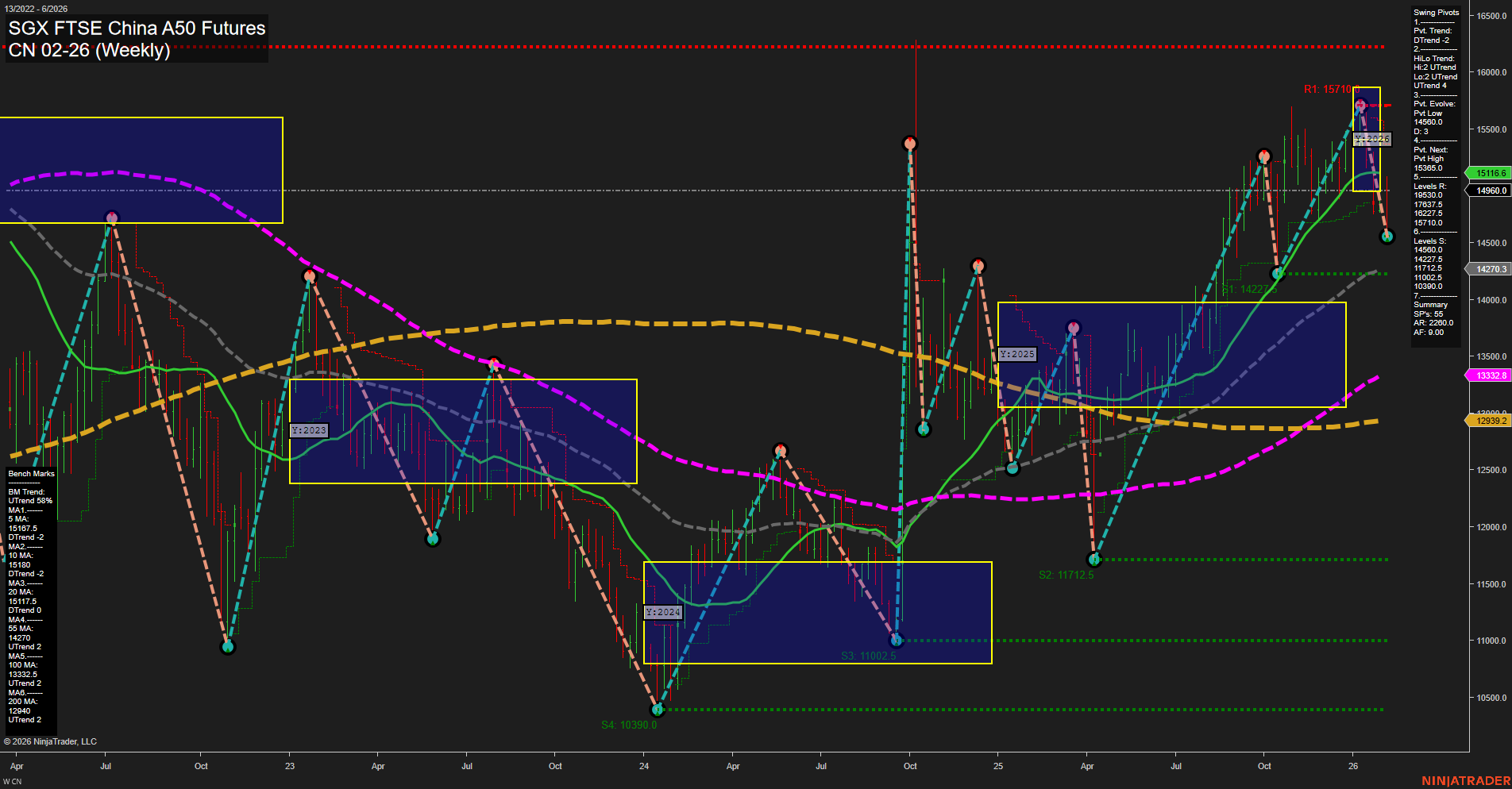

CN SGX FTSE China A50 Futures Weekly Chart Analysis: 2026-Feb-08 18:06 CT

Price Action

- Last: 15116.6,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 14500.0,

- 4. Pvt. Next: Pvt high 15385.0,

- 5. Levels R: 15710.0, 15385.0, 15040.0,

- 6. Levels S: 14270.3, 11712.5, 11002.5, 10390.0.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 15167.6 Down Trend,

- (Intermediate-Term) 10 Week: 15010.4 Down Trend,

- (Long-Term) 20 Week: 14271.7 Up Trend,

- (Long-Term) 55 Week: 13332.8 Up Trend,

- (Long-Term) 100 Week: 12393.2 Up Trend,

- (Long-Term) 200 Week: 12400.0 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The CN SGX FTSE China A50 Futures weekly chart shows a recent pullback from a swing high, with price currently sitting just above a key support pivot at 14500.0 after failing to break through resistance at 15385.0. Short-term momentum has shifted to the downside, as indicated by the downtrend in both the 5- and 10-week moving averages and the most recent swing pivot trend. However, the intermediate- and long-term trends remain bullish, supported by higher lows and rising 20-, 55-, 100-, and 200-week moving averages. The market has transitioned from a strong rally phase into a corrective or consolidation phase, with volatility increasing near resistance. Key support levels to watch are 14500.0 and 14270.3, while resistance remains at 15385.0 and 15710.0. The overall structure suggests a healthy pullback within a broader uptrend, with the potential for further consolidation before the next directional move. The neutral bias across the session fib grids reflects this indecision, as the market digests recent gains and tests key levels.

Chart Analysis ATS AI Generated: 2026-02-08 18:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.