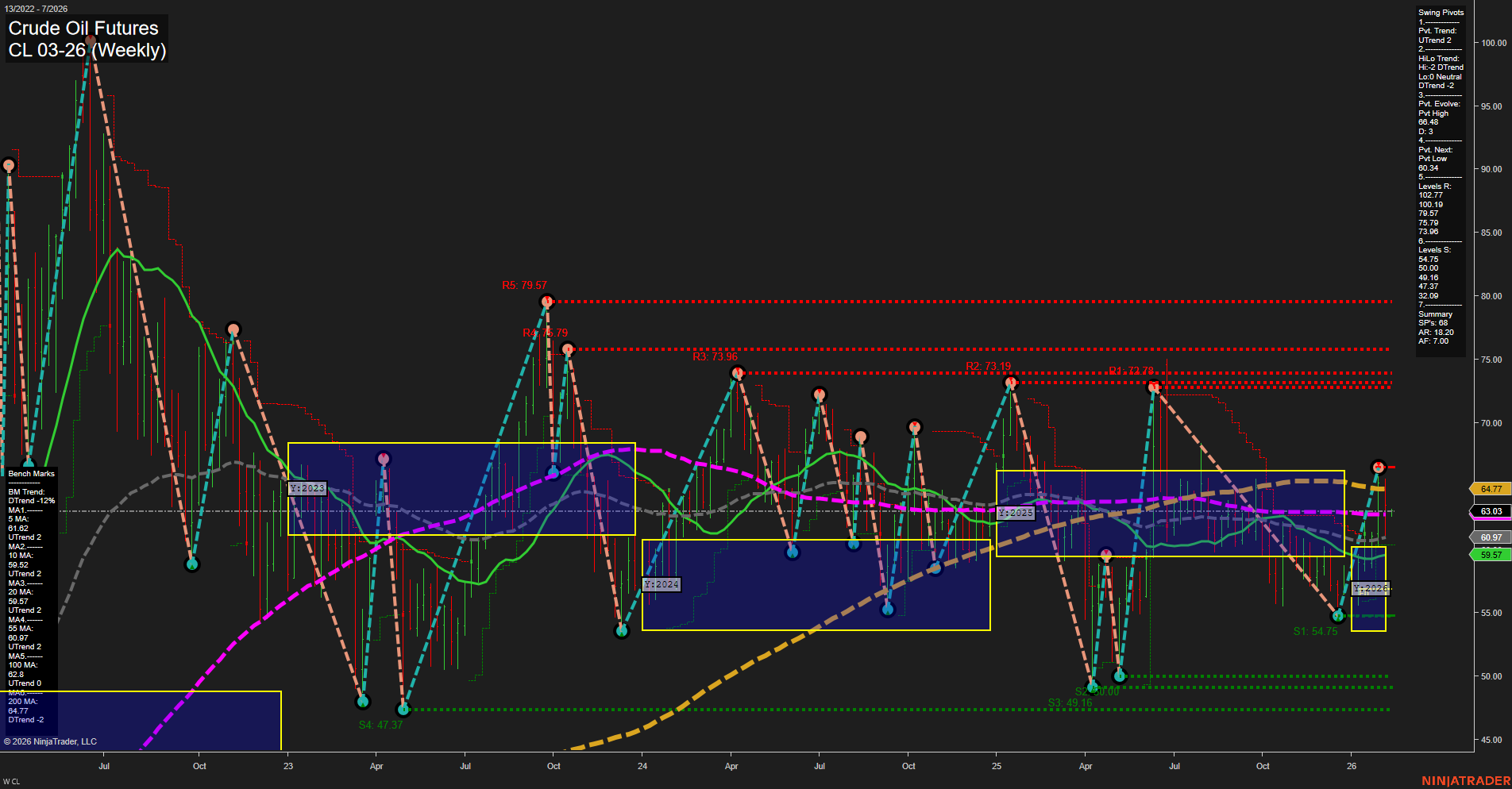

Crude oil futures are currently navigating a complex technical landscape. Price action shows a medium-sized bar with average momentum, indicating neither strong acceleration nor a sharp reversal. The short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both down, with price below their respective NTZ (neutral trading zones), suggesting prevailing downward pressure in the near to intermediate term. However, the yearly (YSFG) trend remains up, with price above the annual NTZ, hinting at underlying long-term support. Swing pivots reveal a short-term uptrend but an intermediate-term downtrend, with the most recent pivot high at 64.83 and the next key support at 54.75. Resistance levels are clustered much higher, indicating significant overhead supply should price attempt a rally. The moving averages show mixed signals: short and intermediate-term averages are trending up, but the longer-term 55 and 200-week benchmarks are still in downtrends, reflecting a market in transition. Recent trade signals have been mixed, with both long and short entries triggered in early February, highlighting choppy, range-bound conditions. Overall, the market is consolidating after a prior sell-off, with volatility and indecision evident. The technical setup suggests a market at a crossroads, with neither bulls nor bears in clear control across all timeframes. Swing traders should note the potential for further consolidation or a breakout as the market tests key support and resistance levels.