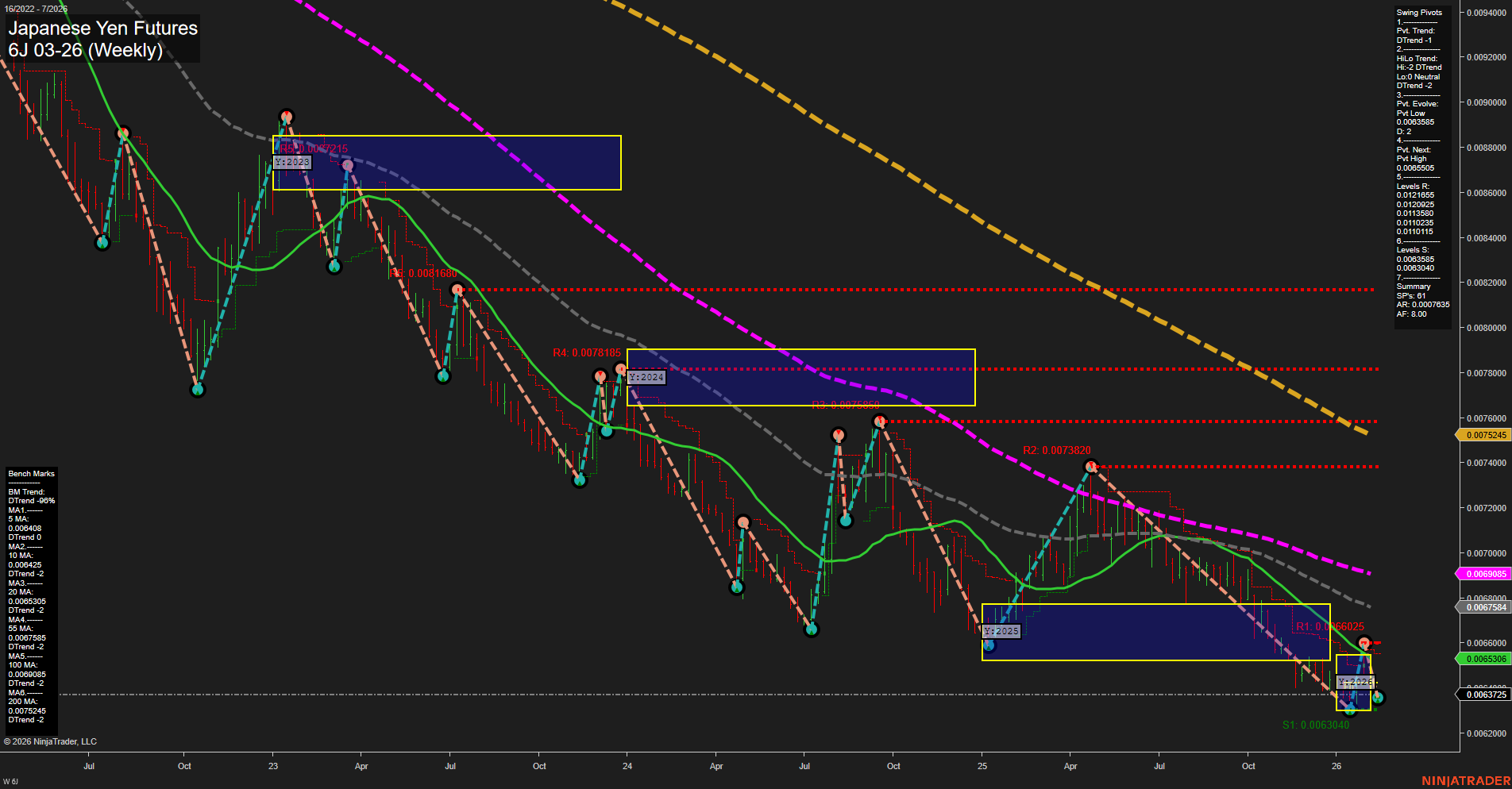

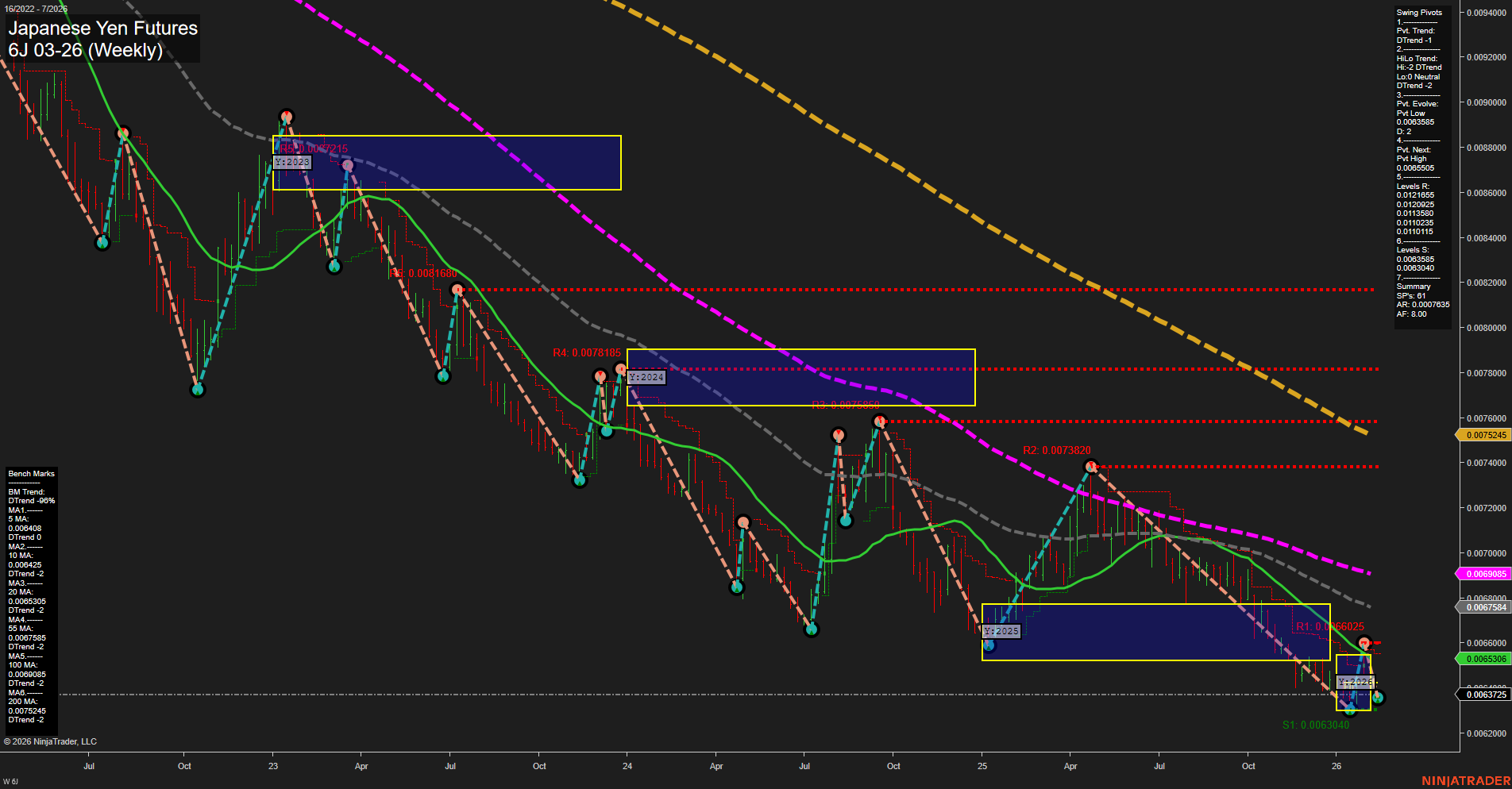

6J Japanese Yen Futures Weekly Chart Analysis: 2026-Feb-08 18:03 CT

Price Action

- Last: 0.0063725,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -32%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0063985,

- 4. Pvt. Next: Pvt High 0.0065805,

- 5. Levels R: 0.0075245, 0.0073820, 0.0071855, 0.0070355, 0.0069695, 0.0069255, 0.0069025, 0.0068935, 0.0068715, 0.0068115,

- 6. Levels S: 0.0063985, 0.0063040, 0.0053725.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0064083 Down Trend,

- (Intermediate-Term) 10 Week: 0.006425 Down Trend,

- (Long-Term) 20 Week: 0.0065305 Down Trend,

- (Long-Term) 55 Week: 0.0067584 Down Trend,

- (Long-Term) 100 Week: 0.0069695 Down Trend,

- (Long-Term) 200 Week: 0.0075245 Down Trend.

Recent Trade Signals

- 04 Feb 2026: Short 6J 03-26 @ 0.006417 Signals.USAR-MSFG

- 03 Feb 2026: Short 6J 03-26 @ 0.006444 Signals.USAR-WSFG

- 03 Feb 2026: Short 6J 03-26 @ 0.006445 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart shows a market in a persistent downtrend across intermediate and long-term timeframes, with all major moving averages trending lower and price trading below key resistance levels. The short-term WSFG trend has turned up, with price currently above the weekly NTZ center, suggesting a possible short-term bounce or consolidation phase. However, swing pivots and recent trade signals remain aligned to the downside, and the intermediate and long-term Fib grid trends are still negative. Support is clustered near recent lows, while resistance levels remain well above current price, indicating that any rallies may face significant overhead supply. The overall structure suggests the market is in a corrective phase within a broader bearish cycle, with short-term stabilization but no clear evidence yet of a sustained reversal. Volatility appears contained, and the market may be in a basing or pause phase before the next directional move.

Chart Analysis ATS AI Generated: 2026-02-08 18:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.