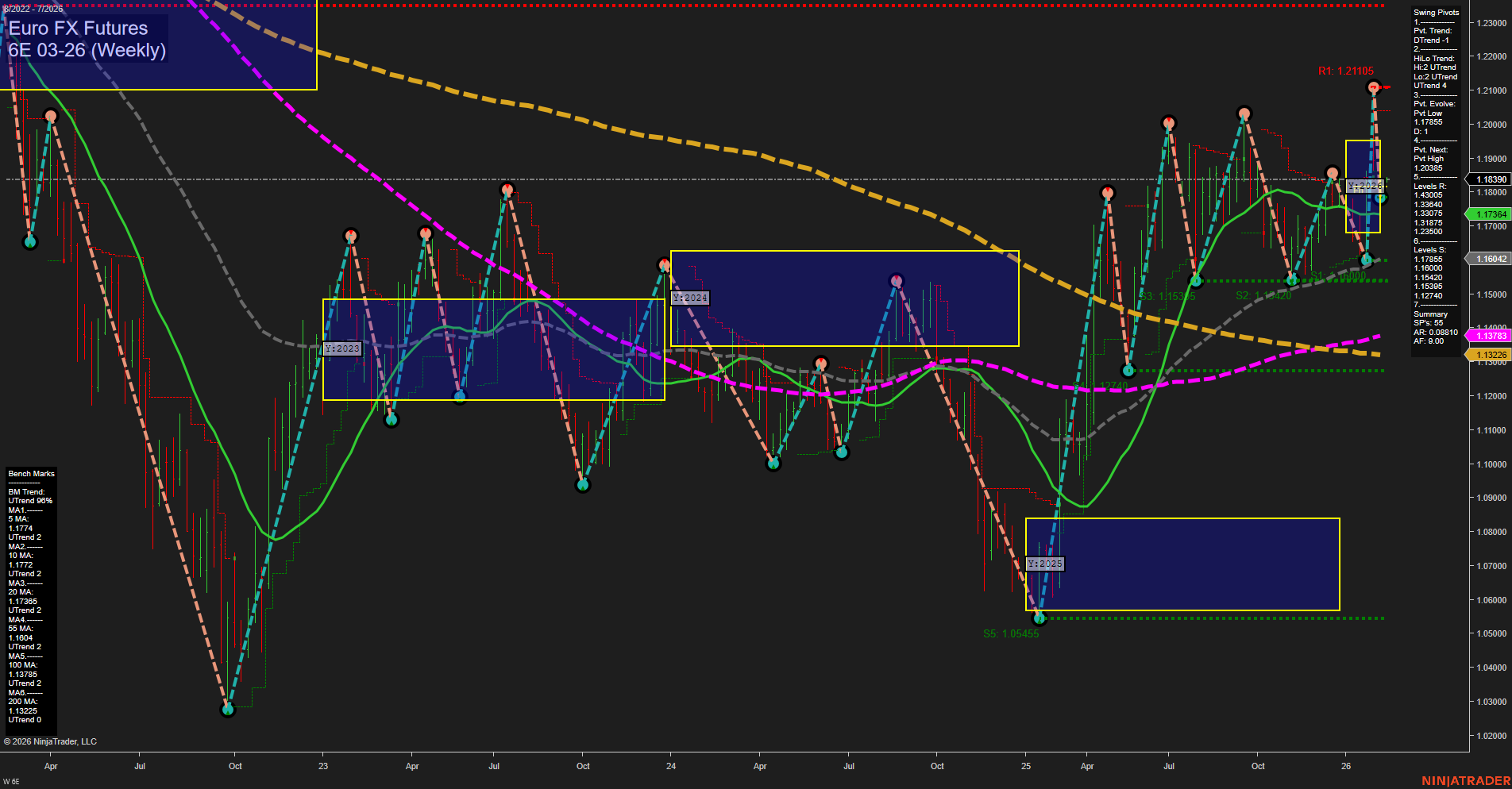

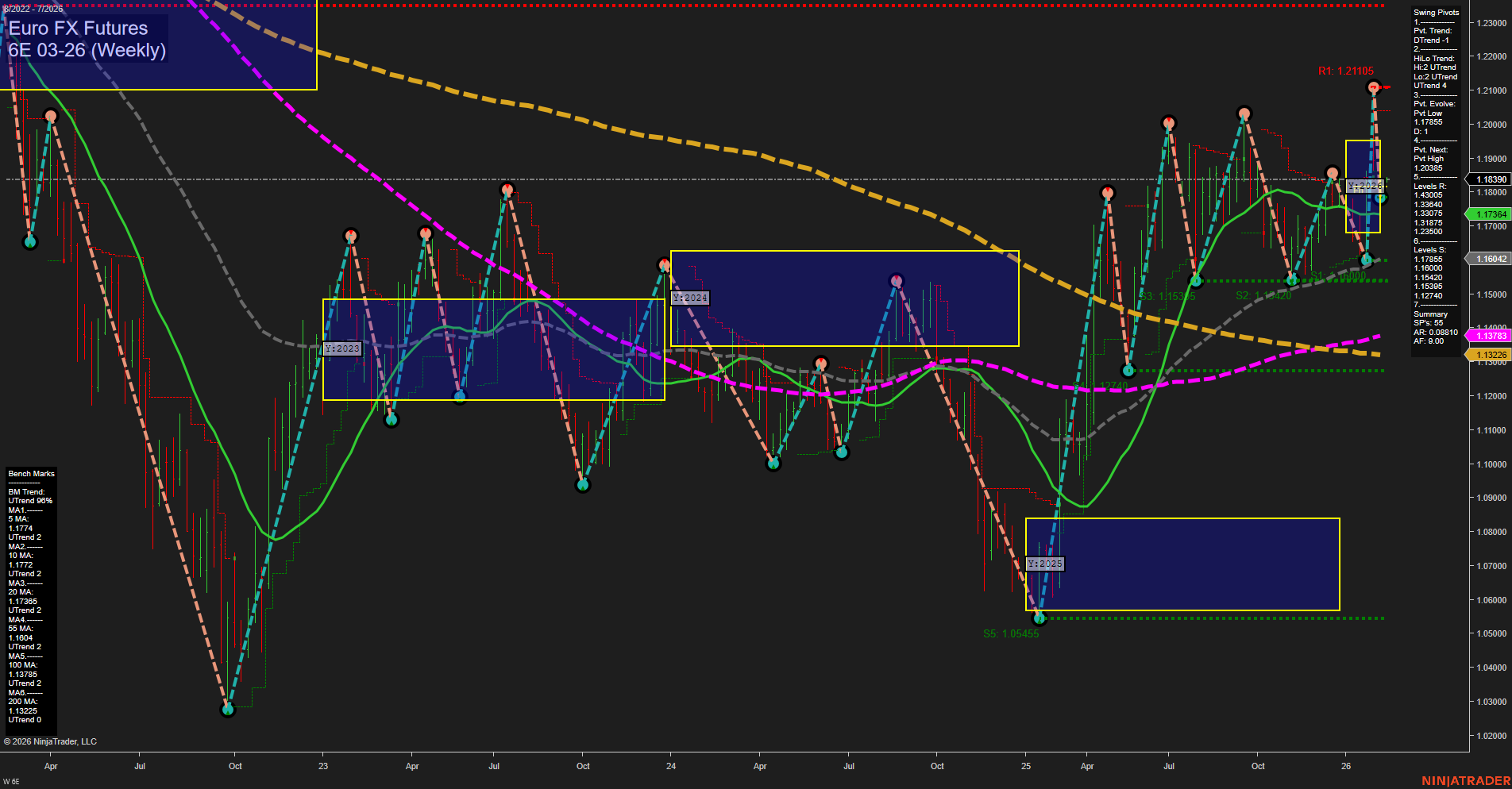

6E Euro FX Futures Weekly Chart Analysis: 2026-Feb-08 18:02 CT

Price Action

- Last: 1.17364,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -21%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -11%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.17364,

- 4. Pvt. Next: Pvt high 1.21105,

- 5. Levels R: 1.21105, 1.20385, 1.18390,

- 6. Levels S: 1.17364, 1.16402, 1.13225.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.1774 Down Trend,

- (Intermediate-Term) 10 Week: 1.1772 Down Trend,

- (Long-Term) 20 Week: 1.1736 Down Trend,

- (Long-Term) 55 Week: 1.1845 Down Trend,

- (Long-Term) 100 Week: 1.1878 Down Trend,

- (Long-Term) 200 Week: 1.1322 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Short 6E 03-26 @ 1.18125 Signals.USAR-MSFG

- 03 Feb 2026: Short 6E 03-26 @ 1.18385 Signals.USAR-WSFG

- 02 Feb 2026: Short 6E 03-26 @ 1.18295 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a clear short-term and intermediate-term bearish structure, with price action below both the weekly and monthly session fib grid centers and all key moving averages trending down except the 200-week, which remains up. Recent swing pivots confirm a downward trend, with the most recent pivot low aligning with current price and resistance levels overhead. Multiple recent short trade signals reinforce the prevailing downside momentum. However, the yearly session fib grid trend remains up, and the 200-week moving average is still in an uptrend, suggesting that while the long-term structure is not decisively bearish, the market is currently in a corrective or pullback phase within a broader uptrend. The environment is characterized by slow momentum and medium-sized bars, indicating a controlled but persistent sell-off rather than a panic-driven move. Traders are likely watching for a test of support near 1.16402 and 1.13225, with resistance at 1.18390 and 1.20385. The overall setup suggests a market in retracement mode, with the potential for further downside in the short to intermediate term, while the long-term trend remains in flux.

Chart Analysis ATS AI Generated: 2026-02-08 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.