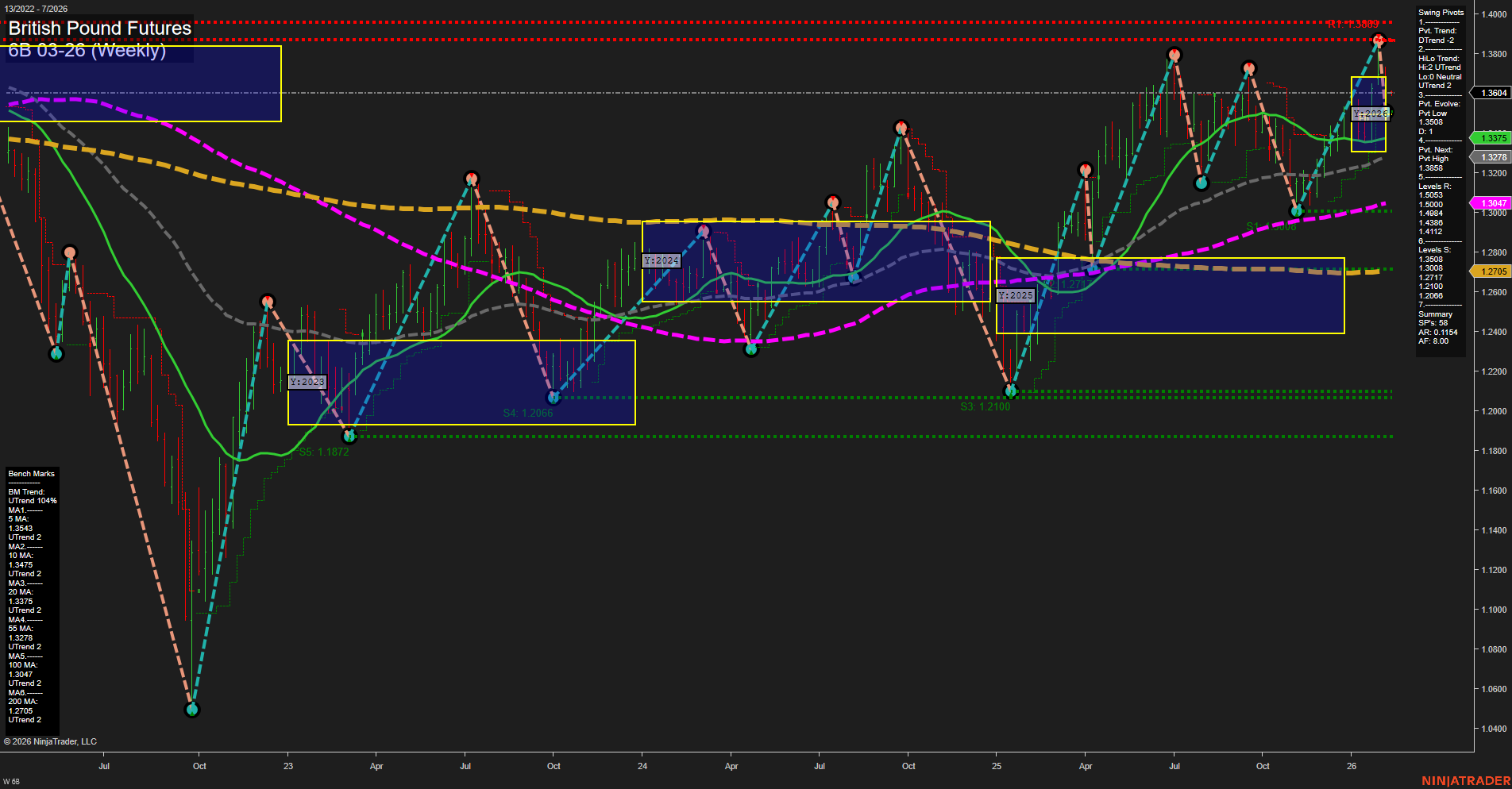

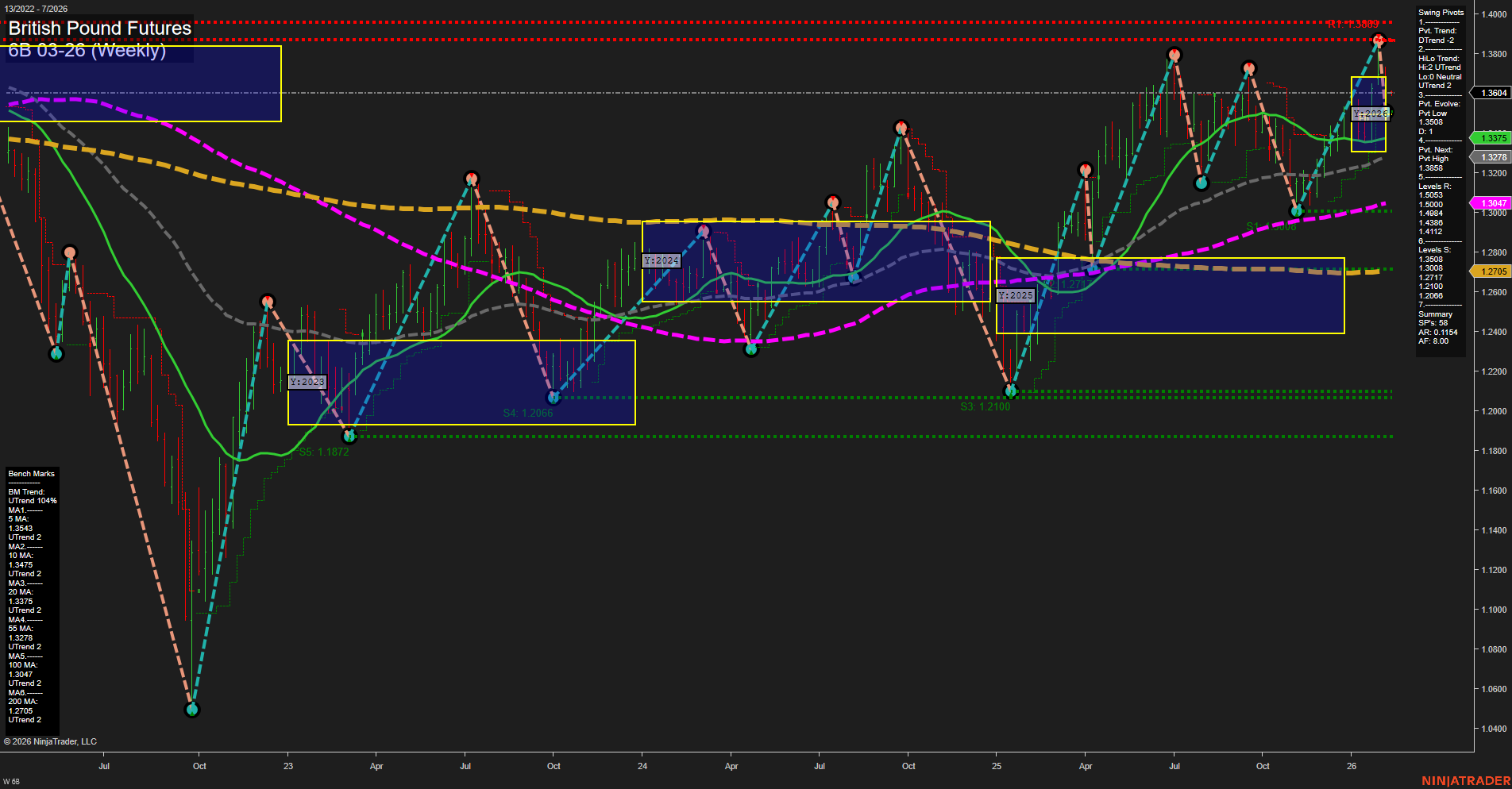

6B British Pound Futures Weekly Chart Analysis: 2026-Feb-08 18:01 CT

Price Action

- Last: 1.3644,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -39%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -17%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.3644,

- 4. Pvt. Next: Pvt high 1.3589,

- 5. Levels R: 1.3589, 1.3549, 1.3538, 1.3278,

- 6. Levels S: 1.1872, 1.2066, 1.2100.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3435 Up Trend,

- (Intermediate-Term) 10 Week: 1.3278 Up Trend,

- (Long-Term) 20 Week: 1.3047 Up Trend,

- (Long-Term) 55 Week: 1.2705 Up Trend,

- (Long-Term) 100 Week: 1.3071 Up Trend,

- (Long-Term) 200 Week: 1.2705 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Long 6B 03-26 @ 1.3614 Signals.USAR.TR120

- 05 Feb 2026: Short 6B 03-26 @ 1.3549 Signals.USAR.TR720

- 05 Feb 2026: Short 6B 03-26 @ 1.3617 Signals.USAR-MSFG

- 04 Feb 2026: Short 6B 03-26 @ 1.3657 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) weekly chart shows a market in transition. Short-term momentum has shifted bearish, as indicated by the WSFG trend and recent swing pivot direction, with price currently below the NTZ and F0% levels. Intermediate-term signals are mixed: while the MSFG trend is down and price is below the monthly NTZ, the HiLo trend remains up, suggesting underlying support from previous higher lows. Long-term structure remains bullish, with the YSFG trend up and price above the yearly NTZ, supported by all major moving averages trending higher. Recent trade signals reflect this mixed environment, with both long and short entries triggered in close succession, highlighting choppy and potentially volatile conditions. Key resistance levels are clustered just above current price, while major support remains well below, indicating a wide trading range. The market appears to be consolidating after a strong rally, with potential for either a deeper pullback or a resumption of the long-term uptrend depending on how price reacts to nearby resistance and support zones.

Chart Analysis ATS AI Generated: 2026-02-08 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.