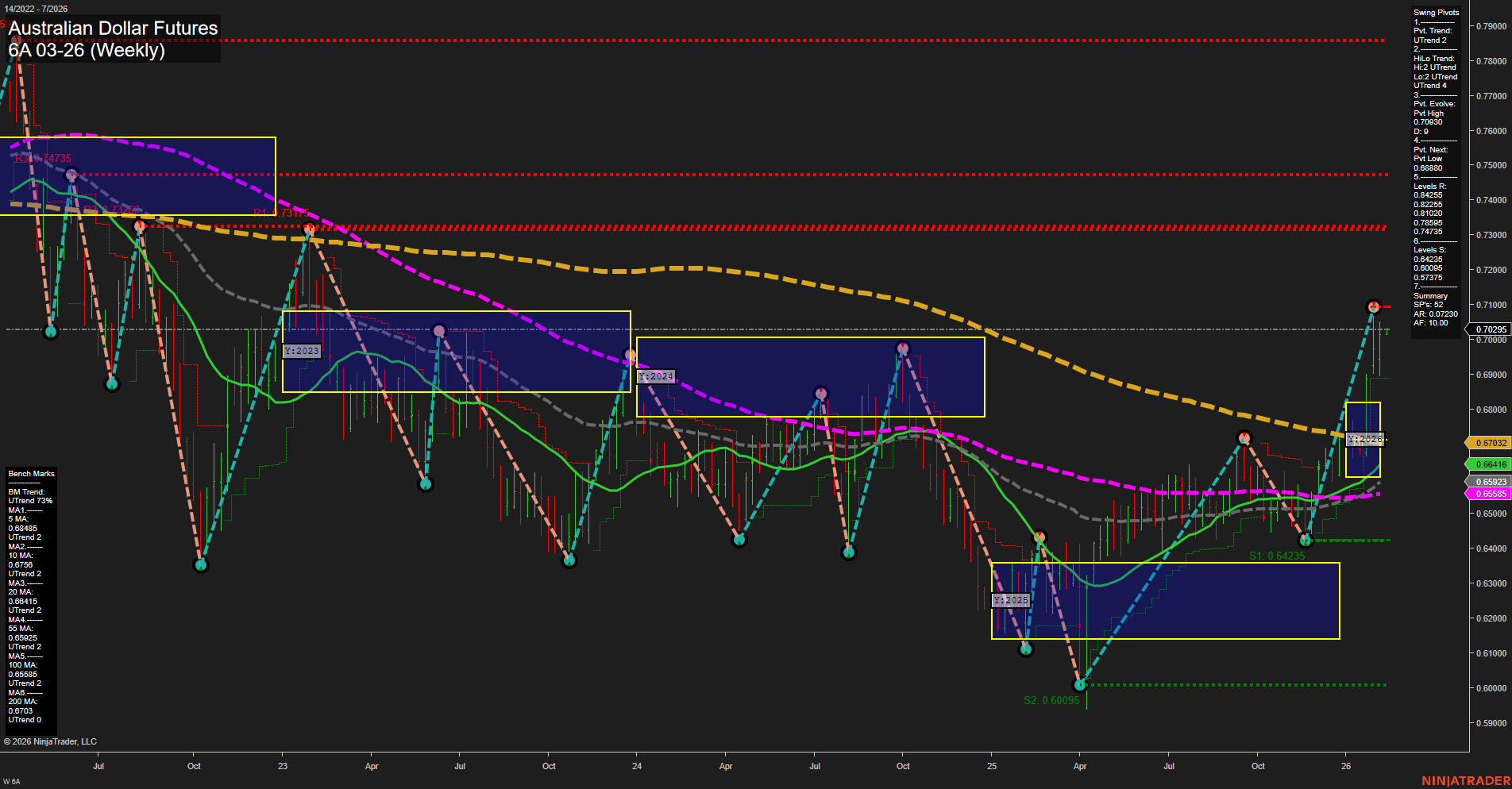

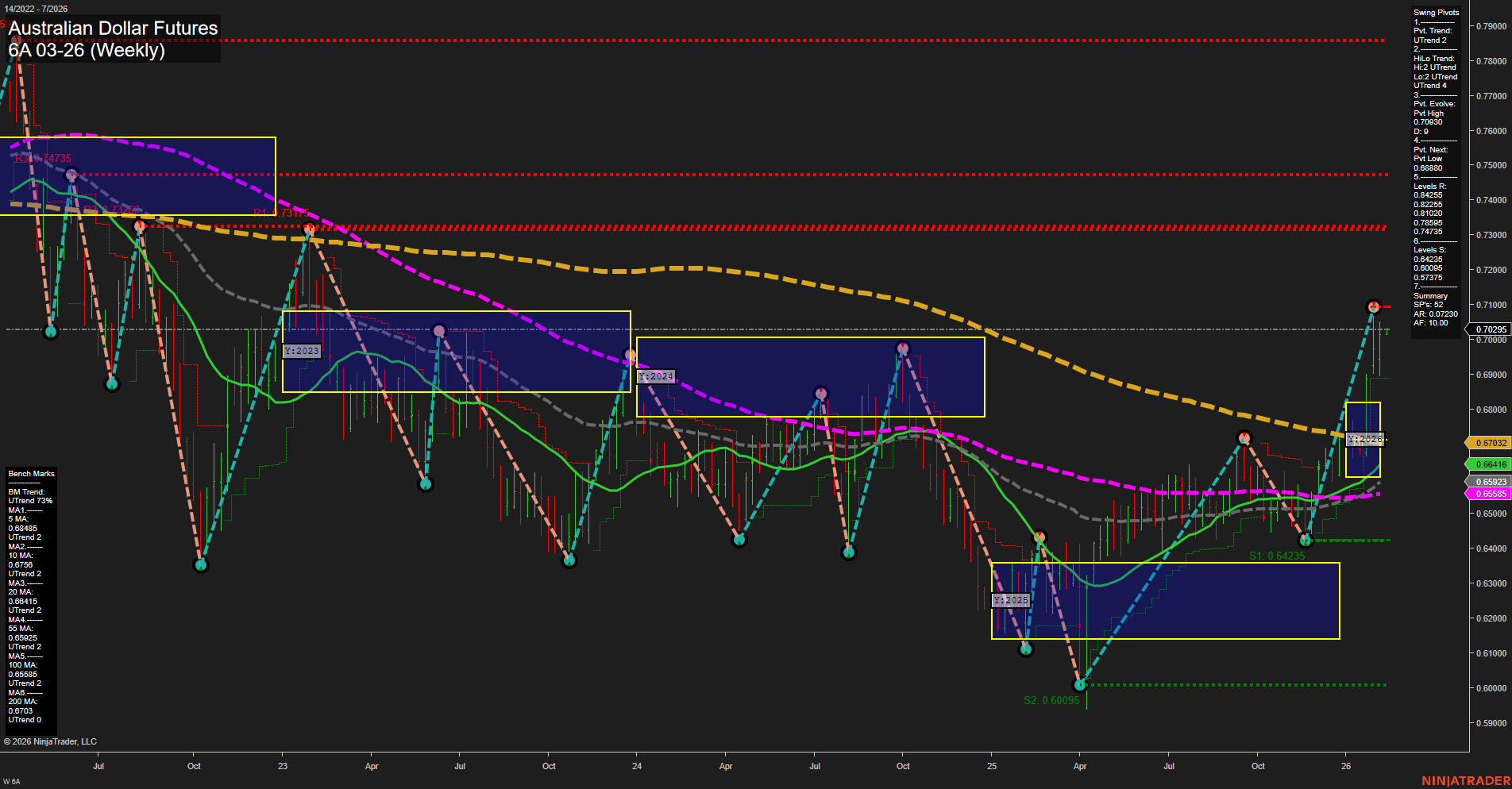

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Feb-08 18:00 CT

Price Action

- Last: 0.70395,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.7039,

- 4. Pvt. Next: Pvt low 0.64235,

- 5. Levels R: 0.77385, 0.74735, 0.82255, 0.8888,

- 6. Levels S: 0.64235, 0.60095, 0.57375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.68415 Up Trend,

- (Intermediate-Term) 10 Week: 0.66123 Up Trend,

- (Long-Term) 20 Week: 0.66416 Up Trend,

- (Long-Term) 55 Week: 0.65595 Up Trend,

- (Long-Term) 100 Week: 0.67032 Down Trend,

- (Long-Term) 200 Week: 0.70603 Down Trend.

Recent Trade Signals

- 09 Feb 2026: Long 6A 03-26 @ 0.7035 Signals.USAR-WSFG

- 06 Feb 2026: Long 6A 03-26 @ 0.7012 Signals.USAR.TR120

- 04 Feb 2026: Long 6A 03-26 @ 0.69955 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a strong bullish move in the short and intermediate term, with price surging above key moving averages and printing large, fast-momentum bars. The swing pivot structure confirms an uptrend, with the most recent pivot high at 0.7039 and the next significant support at 0.64235. All short and intermediate-term moving averages are trending up, while the longer-term 100 and 200 week MAs remain in a downtrend, indicating that the recent rally is challenging the broader bearish structure but has not yet fully reversed it. Multiple recent long trade signals reinforce the current bullish momentum. Resistance levels above are spaced widely, suggesting room for further upside if momentum persists, while support is well-defined below. The overall environment reflects a transition phase, with strong upward momentum in the short and intermediate term, but the long-term trend remains neutral as price tests major resistance and longer-term averages.

Chart Analysis ATS AI Generated: 2026-02-08 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.