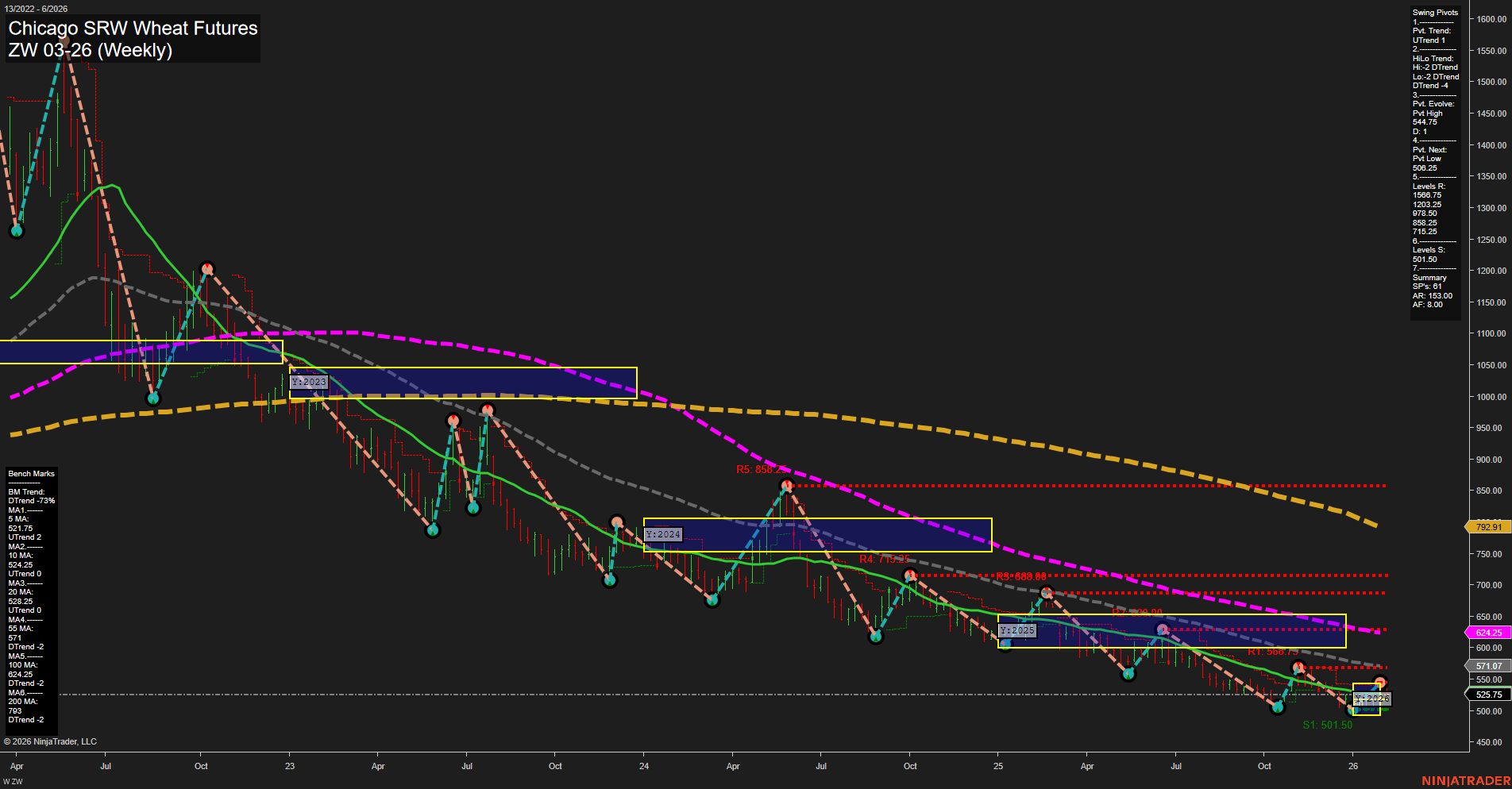

The ZW Chicago SRW Wheat Futures market remains under pronounced pressure, with price action characterized by small bars and slow momentum, indicating a lack of strong buying interest and a persistent grind lower. Both the short-term and intermediate-term trends are decisively bearish, as confirmed by the WSFG and MSFG readings, which show price well below their respective NTZ/F0% levels and ongoing downtrends. Swing pivot analysis further reinforces this, with both short-term and intermediate-term trends pointing down, and the next key support levels clustered just below current prices (505.25, 501.50). All major weekly moving averages (from 5 to 200 weeks) are trending lower, underscoring the entrenched nature of the decline. However, the yearly session fib grid (YSFG) shows a slight positive reading and price just above the annual NTZ, suggesting some stabilization or potential for a longer-term base, but not yet a confirmed reversal. The most recent trade signal is a short entry, aligning with the prevailing trend. Overall, the market is in a well-established downtrend on both short and intermediate timeframes, with only tentative signs of long-term stabilization. The technical landscape suggests continued pressure, with any rallies likely to encounter significant resistance at prior swing highs and major moving averages.