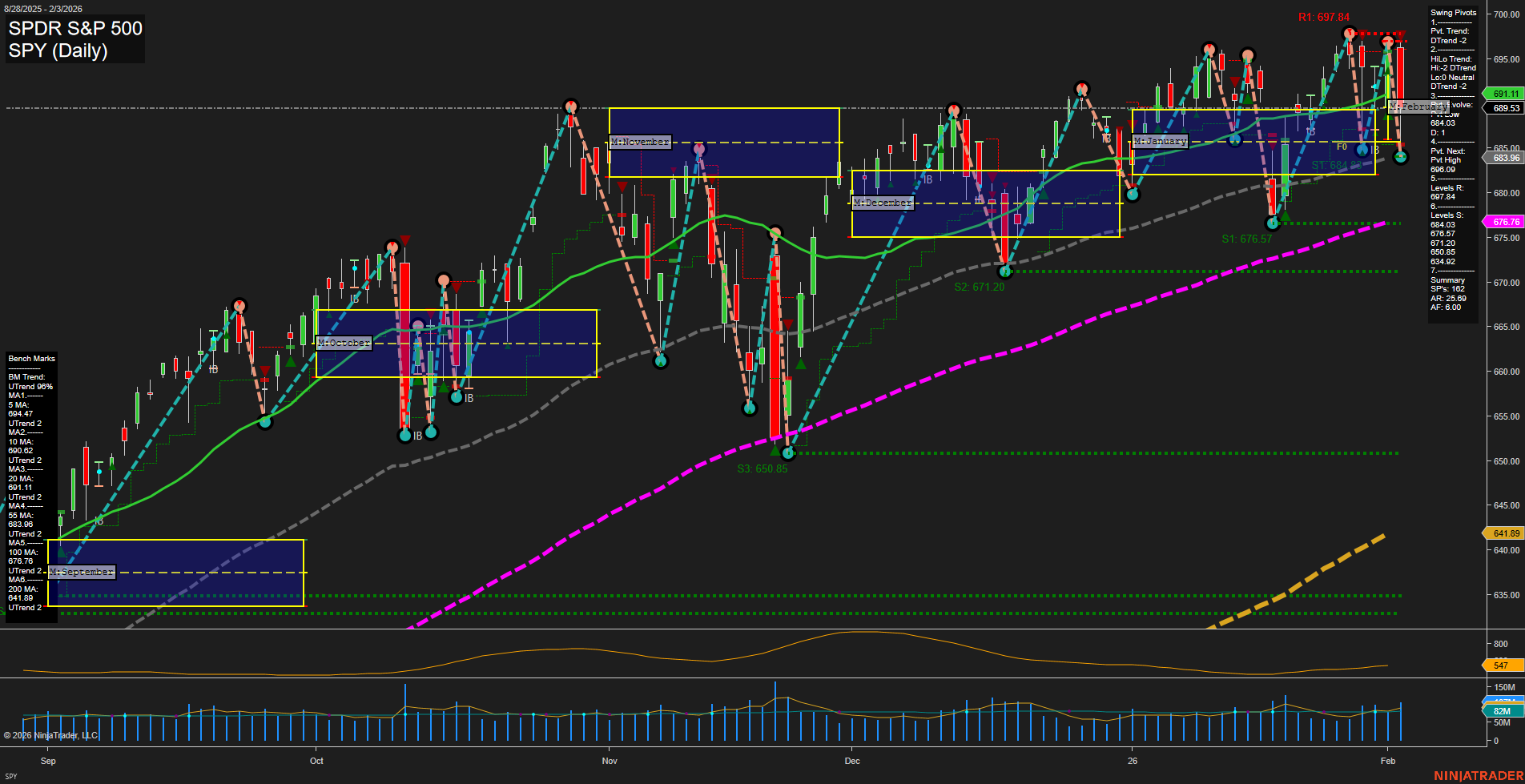

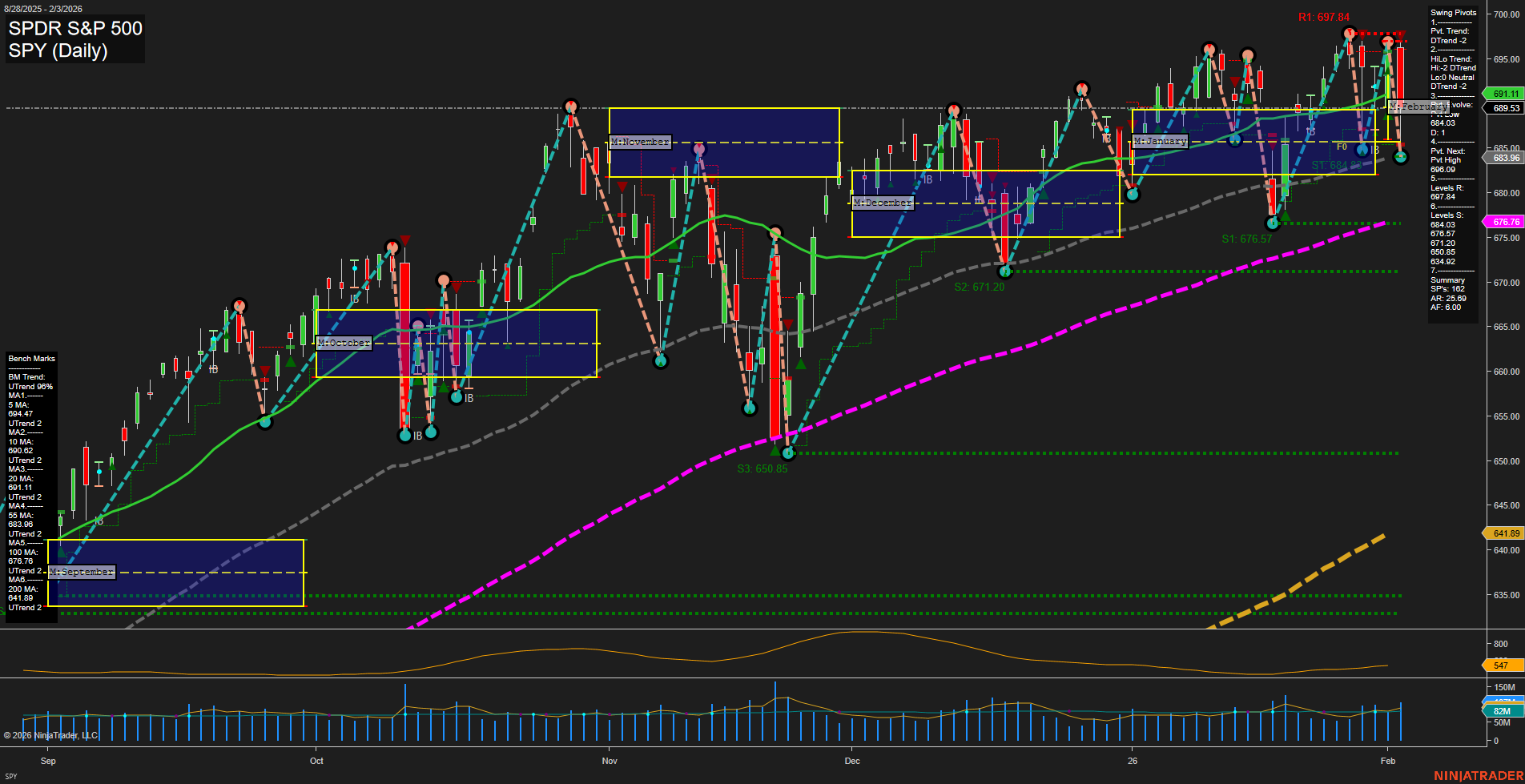

SPY SPDR S&P 500 Daily Chart Analysis: 2026-Feb-04 07:18 CT

Price Action

- Last: 689.11,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 697.84,

- 4. Pvt. Next: Pvt low 683.95,

- 5. Levels R: 697.84, 698.08,

- 6. Levels S: 684.00, 676.57, 671.20, 650.85.

Daily Benchmarks

- (Short-Term) 5 Day: 684.47 Up Trend,

- (Short-Term) 10 Day: 681.11 Up Trend,

- (Intermediate-Term) 20 Day: 683.94 Up Trend,

- (Intermediate-Term) 55 Day: 676.96 Up Trend,

- (Long-Term) 100 Day: 670.72 Up Trend,

- (Long-Term) 200 Day: 641.89 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The SPY daily chart shows a market in a consolidation phase near all-time highs, with price action exhibiting medium-sized bars and average momentum. The short-term and intermediate-term trends, as indicated by both the swing pivots and session fib grids, are neutral to slightly downward, reflecting recent pullbacks from resistance near 697.84. However, all benchmark moving averages from short to long-term remain in solid uptrends, supporting a bullish long-term structure. Volatility is moderate, and volume remains robust, suggesting active participation but no clear directional conviction in the short run. Key support levels are clustered in the 684–671 range, while resistance is just below 700. The market appears to be digesting gains, with no immediate breakout or breakdown signal, and is likely awaiting a catalyst for the next directional move. Swing traders should note the potential for further consolidation or a retest of support before any sustained trend continuation.

Chart Analysis ATS AI Generated: 2026-02-04 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.