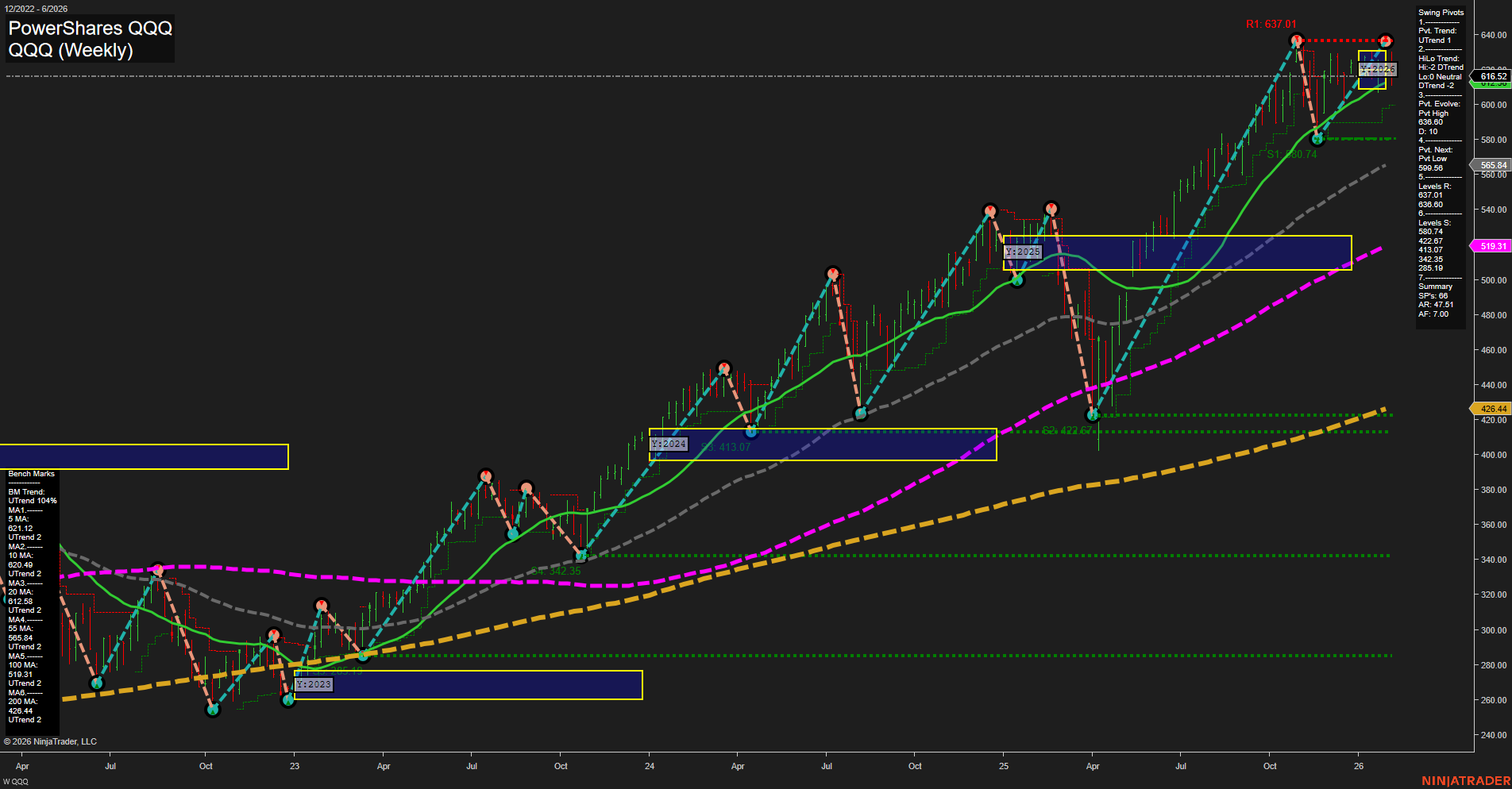

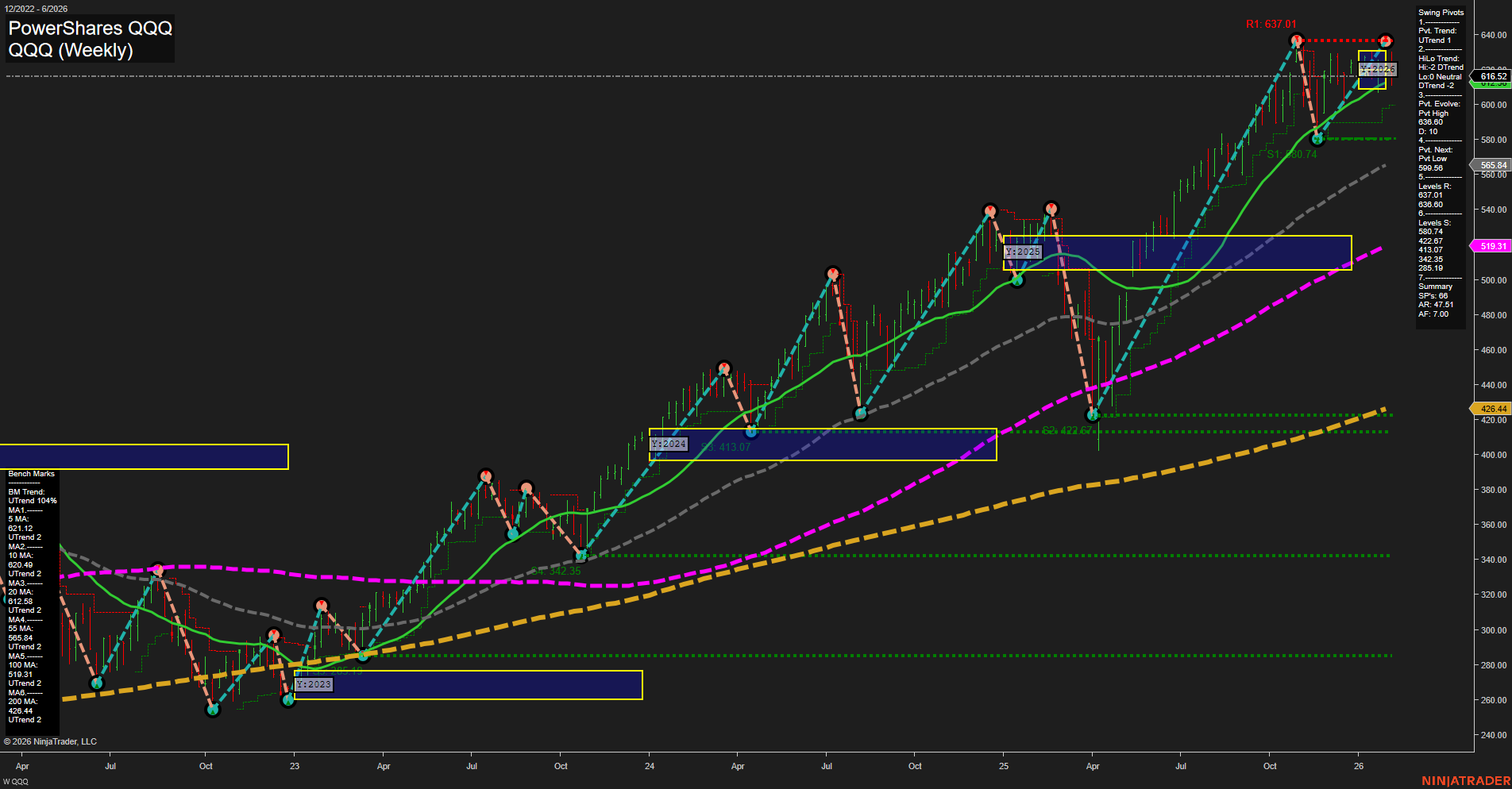

QQQ PowerShares QQQ Weekly Chart Analysis: 2026-Feb-04 07:14 CT

Price Action

- Last: 616.52,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 637.01,

- 4. Pvt. Next: Pvt low 560.74,

- 5. Levels R: 637.01,

- 6. Levels S: 560.74, 472.67, 413.07, 342.35.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 621.12 Up Trend,

- (Intermediate-Term) 10 Week: 603.40 Up Trend,

- (Long-Term) 20 Week: 579.84 Up Trend,

- (Long-Term) 55 Week: 519.31 Up Trend,

- (Long-Term) 100 Week: 513.09 Up Trend,

- (Long-Term) 200 Week: 426.44 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The QQQ weekly chart continues to show a strong uptrend across all major timeframes, with price holding above all key moving averages, each of which is trending upward. The most recent swing pivot is a high at 637.01, with the next significant support at 560.74, followed by deeper supports at 472.67, 413.07, and 342.35. The current price action is consolidating just below the recent highs, with medium-sized bars and average momentum, suggesting a pause or digestion phase after a strong rally. The neutral bias from the session fib grids (WSFG, MSFG, YSFG) indicates a lack of immediate directional conviction, but the underlying trend structure remains bullish. No major reversal signals are present, and the chart structure favors trend continuation, with higher lows and higher highs dominating the pattern. Volatility appears contained, and the market is not exhibiting frothy or choppy behavior. For a futures swing trader, the environment remains constructive for trend-following strategies, with clear levels to monitor for potential pullbacks or breakout continuation.

Chart Analysis ATS AI Generated: 2026-02-04 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.