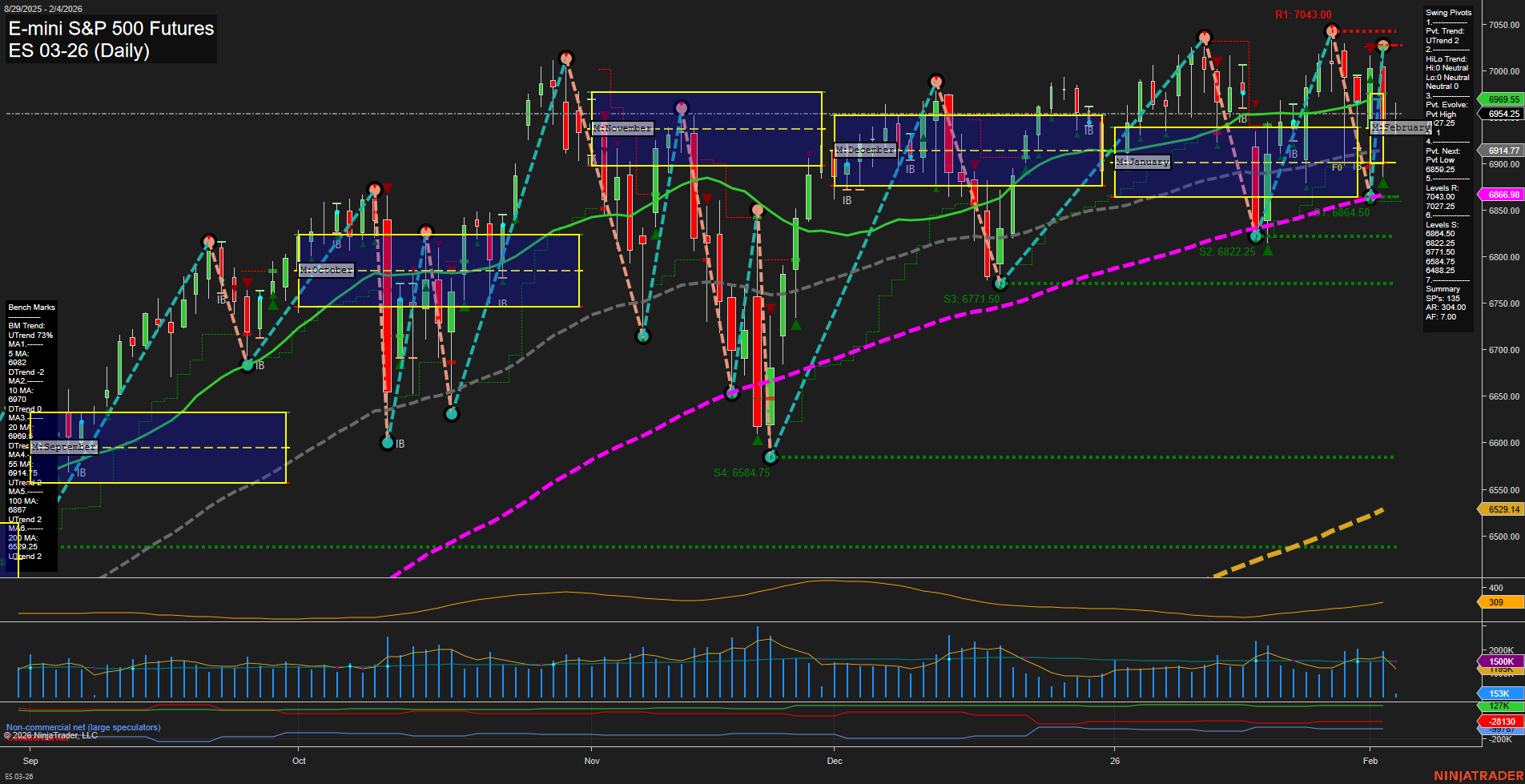

The ES E-mini S&P 500 Futures are currently trading in a medium-range bar environment with average momentum, reflecting a market that is neither strongly trending nor consolidating tightly. Short-term price action is mixed: while the 5-day moving average is trending up, the 10-day is down, and the most recent swing pivot trend is up, but with a neutral intermediate HiLo trend. The price is above both the weekly and monthly session fib grid NTZ centers, supporting an upward bias in the short and intermediate term. However, the yearly fib grid trend remains down, and price is below the annual NTZ, indicating longer-term caution. Swing pivots show the most recent evolution as a pivot high at 7043, with the next key support at 6895.25. Resistance levels are layered above, with 7043 as the most significant. Most intermediate and long-term moving averages are in uptrends, suggesting underlying strength, but the recent cluster of short signals and a neutral short-term rating point to a market at a potential inflection point. Volatility (ATR) is moderate, and volume remains robust. Overall, the market is in a transition phase: short-term signals are mixed, intermediate-term structure is bullish, and long-term remains neutral. This environment often precedes a decisive move, with traders watching for either a breakout continuation or a deeper retracement. The recent short signals highlight the need to monitor for potential reversals or failed breakouts near resistance.