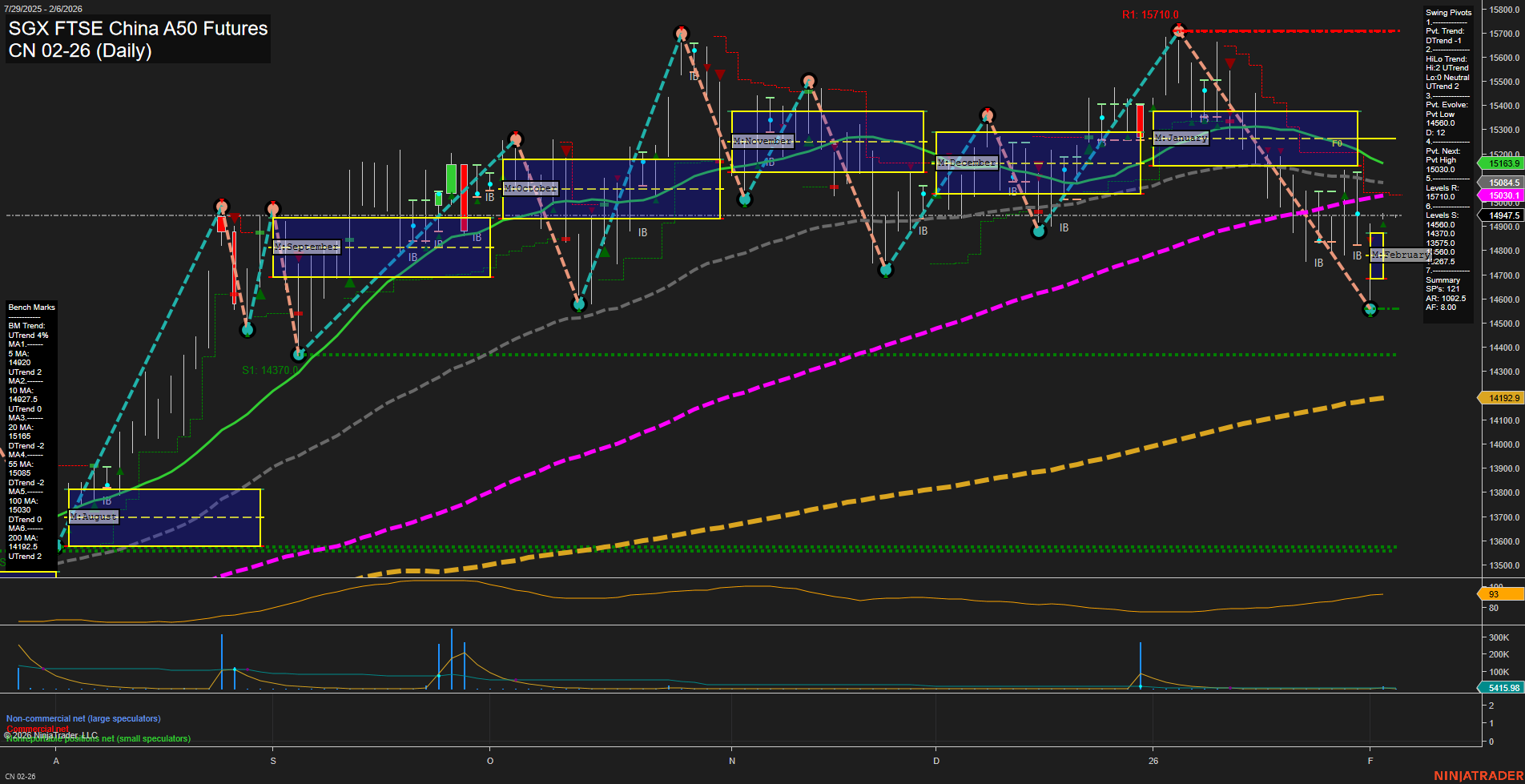

The CN SGX FTSE China A50 Futures daily chart shows a recent shift to short-term downside momentum, with the last price at 14,993 and a series of medium-sized bars reflecting a slow momentum environment. The short-term swing pivot trend is down (DTrend), with the most recent pivot low at 14,800 and resistance at 15,163 and 15,710. All short- and intermediate-term moving averages (5, 10, 20, 55-day) are trending down, reinforcing the short-term bearish tone, while the 100 and 200-day moving averages remain in uptrends, suggesting longer-term structural support is still intact. The intermediate-term HiLo trend remains up, indicating that the broader swing structure has not fully reversed. Both the weekly and monthly session fib grids are neutral, with price currently within the NTZ, and no clear directional bias from these frameworks. Volatility, as measured by ATR, is moderate, and volume metrics are stable. Overall, the market is in a corrective or pullback phase within a larger uptrend, with short-term pressure to the downside but no decisive breakdown of long-term support levels. The environment is characterized by consolidation and potential for further testing of support, with no clear breakout or breakdown signal at this stage.