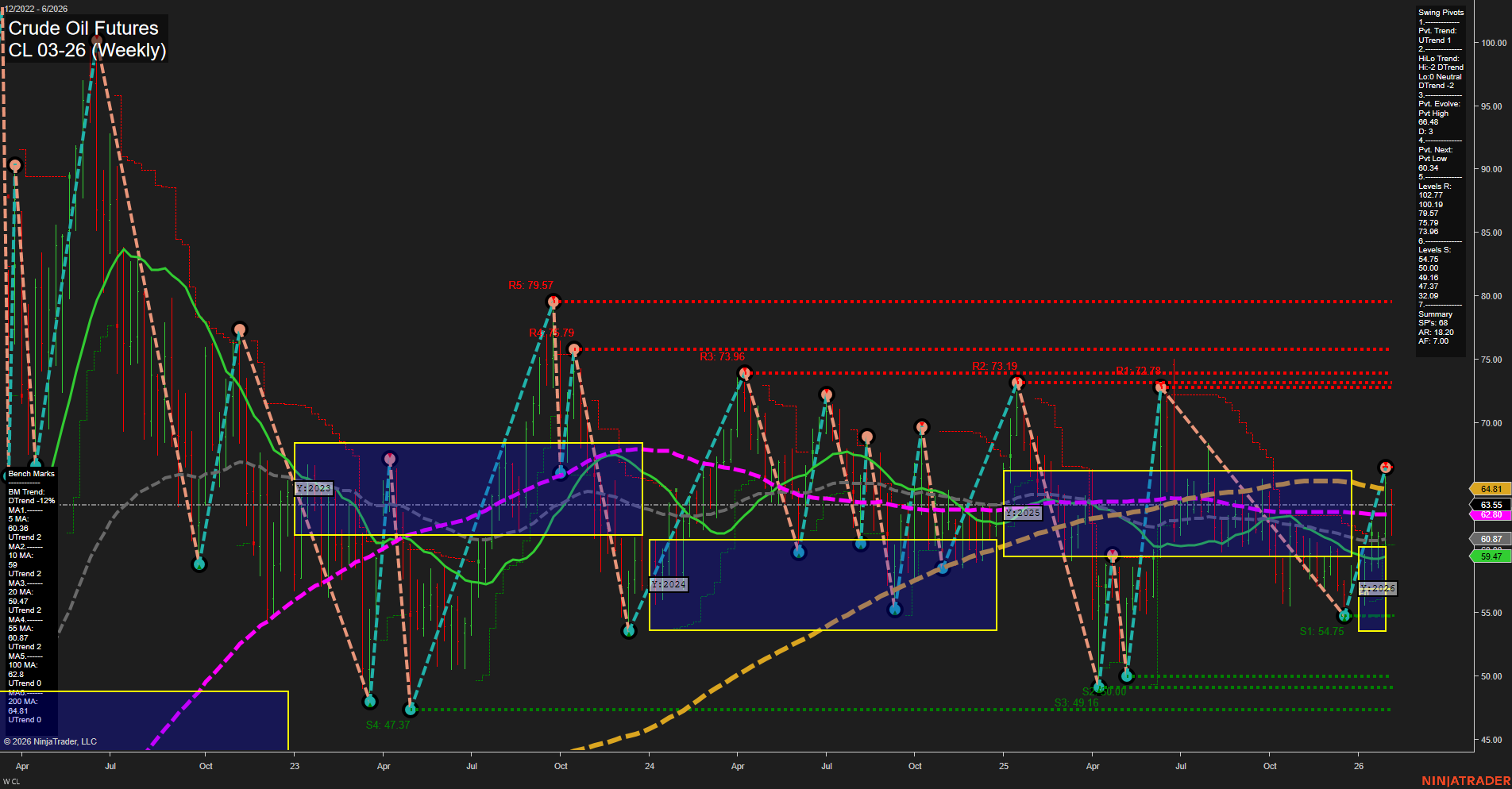

The weekly chart for CL Crude Oil Futures as of early February 2026 shows a market in transition. Price action is currently medium in range with average momentum, reflecting a recent bounce from support but not yet a decisive breakout. Short-term and intermediate-term Fib grid trends (WSFG, MSFG) remain down, with price below their respective NTZ/F0% levels, indicating ongoing downward pressure in these timeframes. However, the long-term yearly grid (YSFG) is up, with price above the NTZ center, suggesting a broader bullish bias. Swing pivots highlight a short-term uptrend but an intermediate-term downtrend, with the most recent pivot high at 64.8 and next key support at 59.47. Resistance levels cluster well above current price, while support is layered below, indicating a potential range-bound or consolidative environment unless a breakout occurs. Weekly benchmarks are mixed: the 5-week and 55/100-week MAs are in downtrends, but the 10-week, 20-week, and 200-week MAs are trending up, reflecting a tug-of-war between timeframes. Recent trade signals show both long and short entries, underscoring the choppy, indecisive nature of the current market. Overall, the short-term outlook is neutral as the market tests resistance after a bounce, the intermediate-term remains bearish due to prevailing downtrends, while the long-term structure is bullish, supported by the yearly grid and some longer MAs. This environment is typical of a market in transition, with potential for further consolidation or a larger directional move as new pivots and levels are tested.