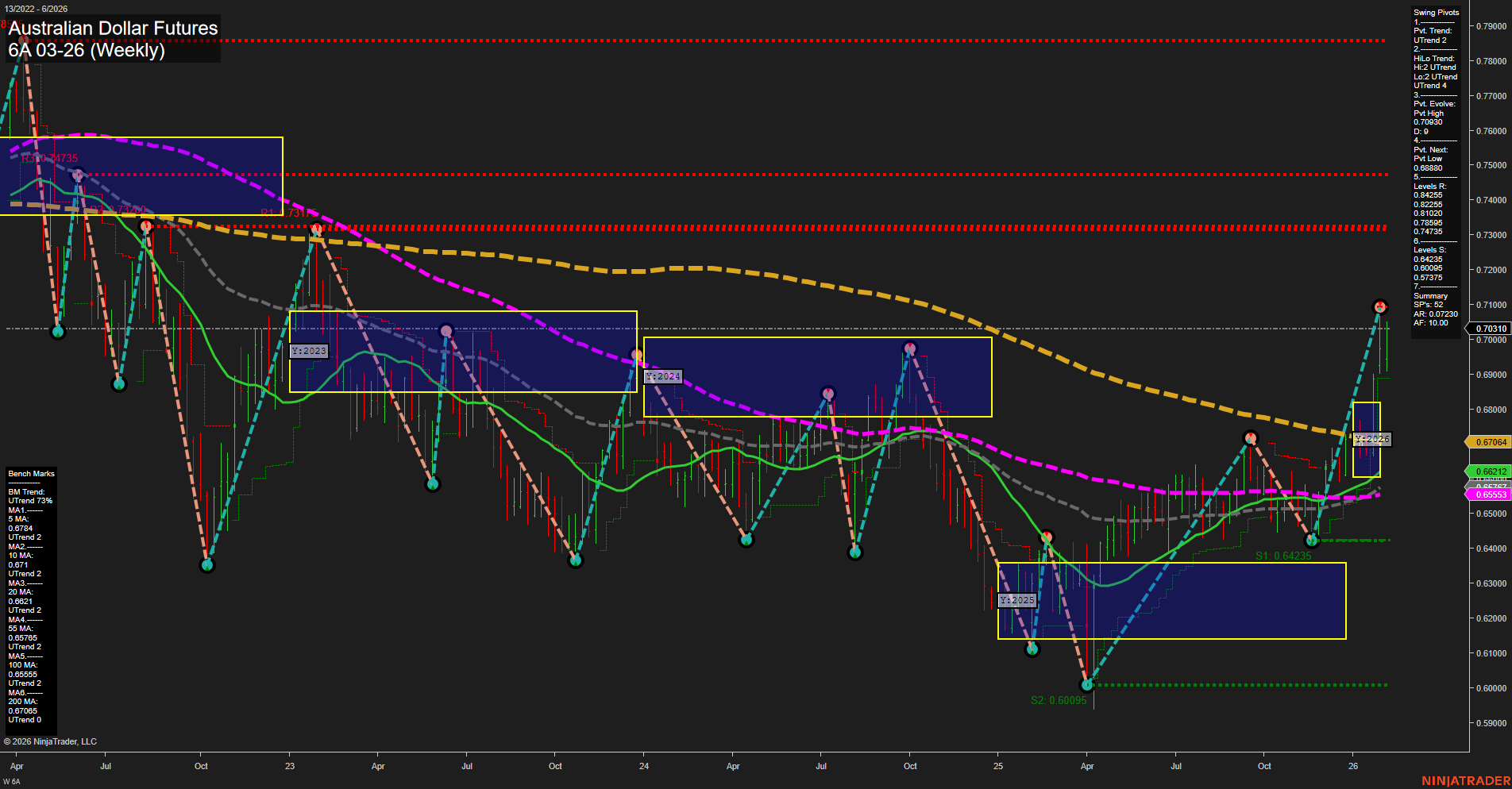

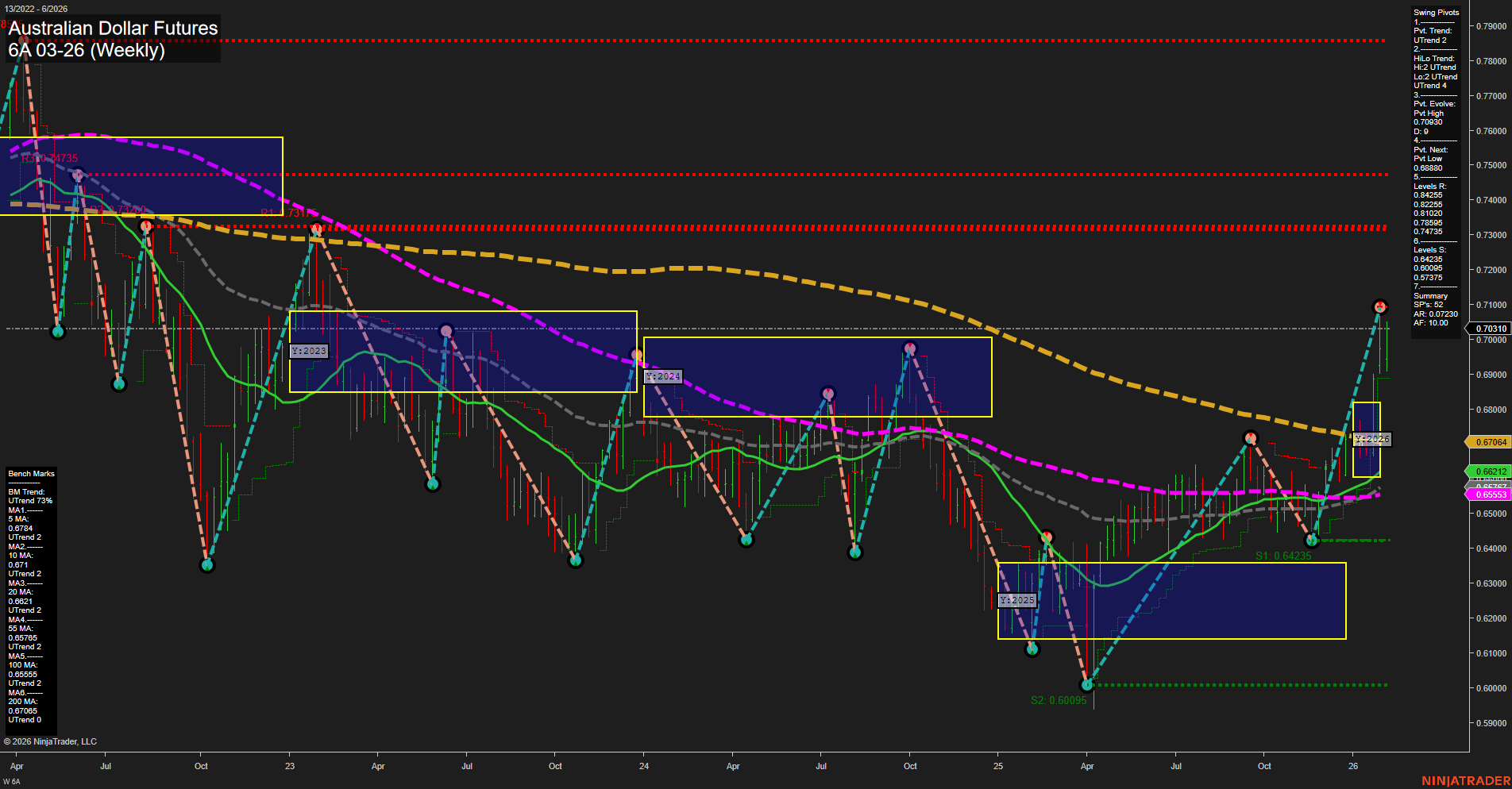

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Feb-04 07:00 CT

Price Action

- Last: 0.70310,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.70310,

- 4. Pvt. Next: Pvt low 0.64235,

- 5. Levels R: 0.70310, 0.68880, 0.68255, 0.67475,

- 6. Levels S: 0.64235, 0.60095, 0.57375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.67844 Up Trend,

- (Intermediate-Term) 10 Week: 0.67171 Up Trend,

- (Long-Term) 20 Week: 0.66212 Up Trend,

- (Long-Term) 55 Week: 0.65555 Up Trend,

- (Long-Term) 100 Week: 0.67064 Up Trend,

- (Long-Term) 200 Week: 0.67805 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures have shown a strong upward move, with the latest weekly bar being large and momentum fast, indicating a surge in buying interest. Both short-term and intermediate-term swing pivot trends are in an uptrend, with the most recent pivot high at 0.70310, which now acts as immediate resistance. Support is well below at 0.64235, highlighting the extent of the recent rally. All key moving averages up to the 100-week are trending higher, confirming broad-based bullish momentum, though the 200-week MA remains in a downtrend, suggesting the long-term structure is still neutral and not fully reversed. The price is currently neutral relative to the session fib grids, indicating a potential pause or consolidation after the sharp move. Overall, the market is in a bullish phase in the short and intermediate term, with the potential for further upside if resistance levels are cleared, but the long-term trend has yet to fully confirm a sustained reversal. The recent price action suggests a possible breakout from a prolonged consolidation, with volatility elevated and the potential for trend continuation if momentum persists.

Chart Analysis ATS AI Generated: 2026-02-04 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.