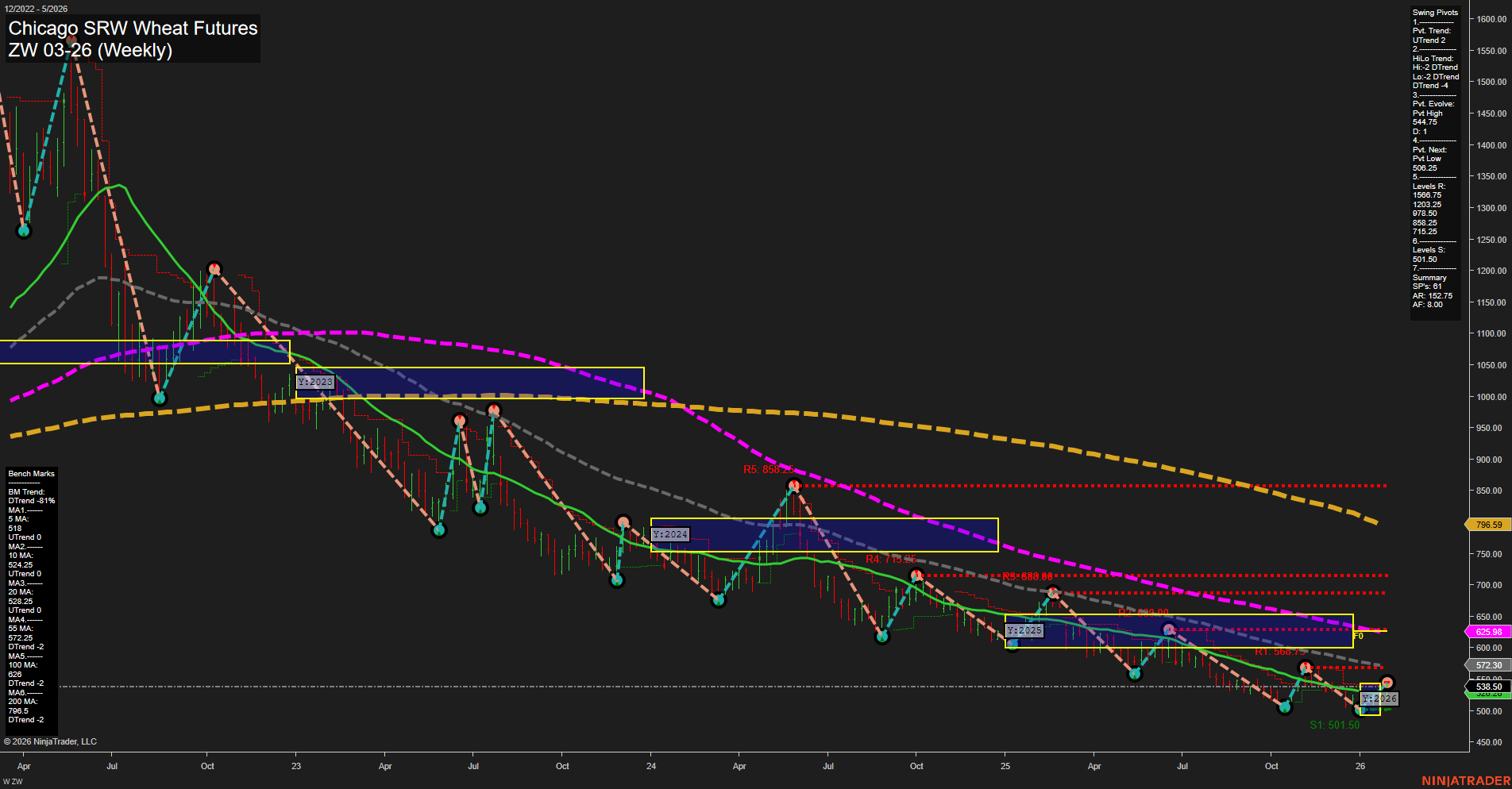

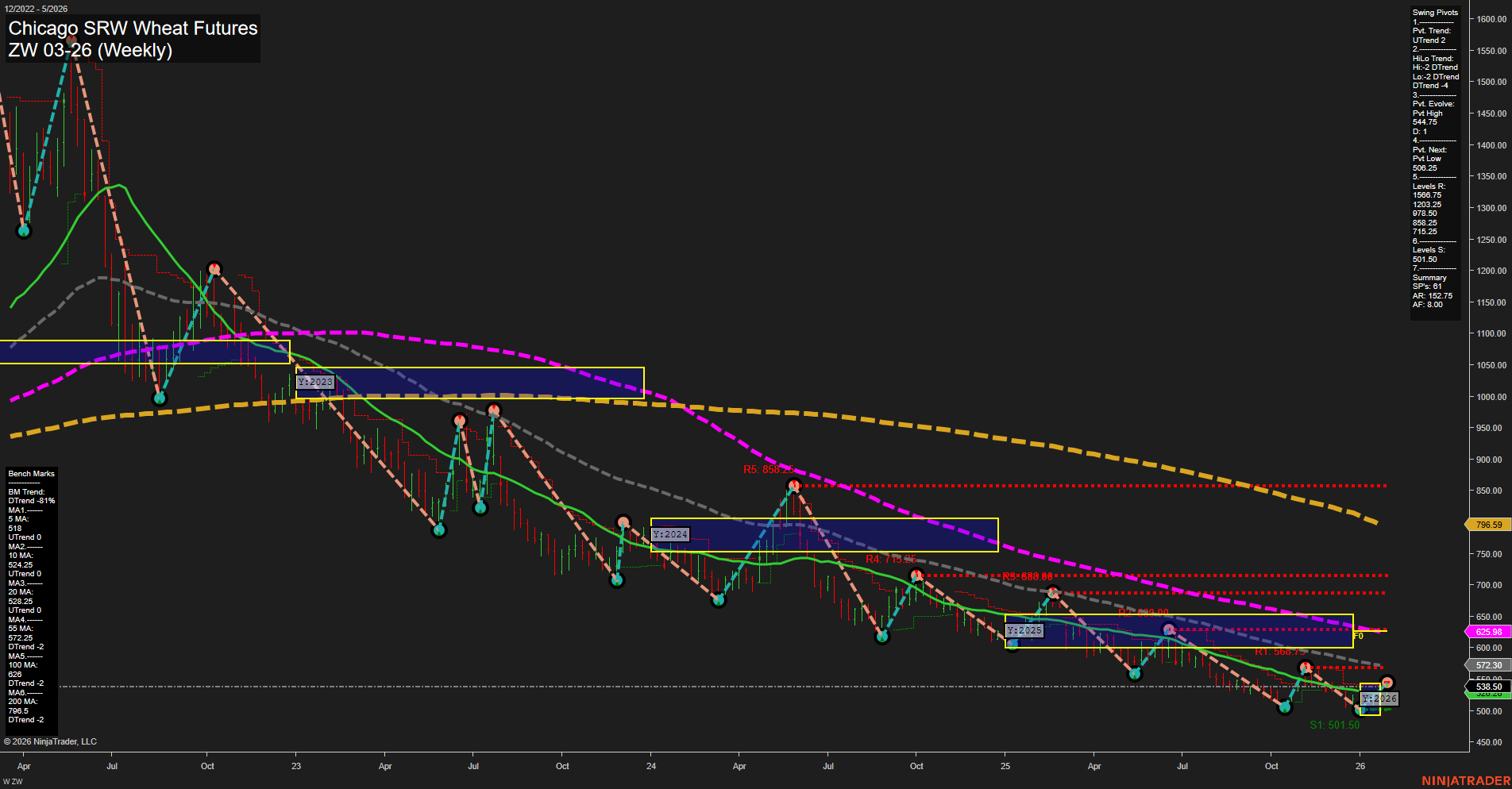

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2026-Feb-01 18:23 CT

Price Action

- Last: 538.50,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 36%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 62%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 543.75,

- 4. Pvt. Next: Pvt Low 505.25,

- 5. Levels R: 688.00, 677.25, 620.25, 588.25, 543.75,

- 6. Levels S: 501.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 538.25 Down Trend,

- (Intermediate-Term) 10 Week: 552.25 Down Trend,

- (Long-Term) 20 Week: 577.25 Down Trend,

- (Long-Term) 55 Week: 706.00 Down Trend,

- (Long-Term) 100 Week: 796.59 Down Trend,

- (Long-Term) 200 Week: 928.00 Down Trend.

Recent Trade Signals

- 26 Jan 2026: Short ZW 03-26 @ 522.75 Signals.USAR.TR120

- 26 Jan 2026: Long ZW 03-26 @ 532.75 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures weekly chart shows a market that remains under significant long-term and intermediate-term pressure, as evidenced by persistent downtrends across all major moving averages and swing pivot trends. Despite a recent short-term bounce above the WSFG and MSFG F0%/NTZ levels, price action is characterized by small bars and slow momentum, indicating a lack of strong conviction from either buyers or sellers. The most recent swing pivot is a high at 543.75, with the next key support at 501.50, suggesting the market is at risk of retesting lower levels if selling resumes. Resistance levels are stacked above, with the nearest at 543.75 and more substantial barriers at 588.25 and 620.25. The recent trade signals show mixed short-term direction, reflecting the choppy, consolidative nature of the current price action. Overall, while there are short-term attempts at stabilization, the broader trend context remains bearish, with rallies likely to encounter resistance and the path of least resistance still pointing lower unless a sustained reversal develops.

Chart Analysis ATS AI Generated: 2026-02-01 18:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.