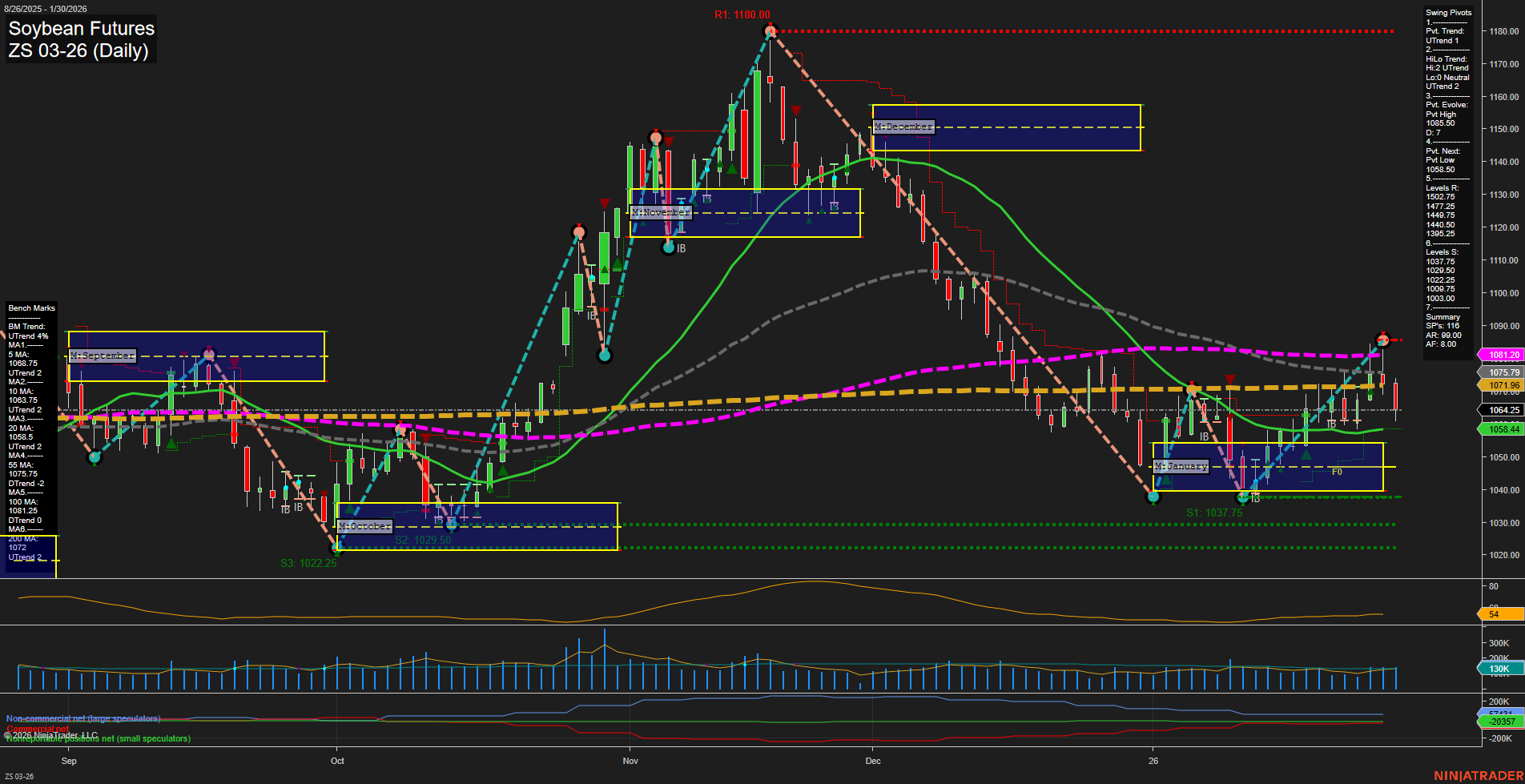

Soybean futures are currently in a mixed technical environment. Short-term price action is showing an uptrend in swing pivots and short-term moving averages, but momentum is only average and recent bars are medium-sized, suggesting a lack of strong conviction. The weekly session fib grid (WSFG) and long-term yearly fib grid (YSFG) both indicate a downward trend, with price below their respective NTZ levels, highlighting persistent bearish pressure on higher timeframes. However, the monthly session fib grid (MSFG) is trending up, with price above the NTZ, reflecting some intermediate-term strength or a possible corrective phase within a broader downtrend. Swing pivot analysis shows the current trend is up in the short-term, but the intermediate-term remains down, with resistance levels clustered above and support levels well below. The 5, 10, and 20-day moving averages are in uptrends, but the 55, 100, and 200-day benchmarks are all trending down, reinforcing the idea of a countertrend rally within a larger bearish structure. Recent trade signals have triggered short entries, aligning with the broader bearish context. Volatility (ATR) is moderate, and volume is steady, indicating neither a breakout nor a collapse in participation. Overall, the market is in a consolidation phase with a slight upward bias in the short-term, but the dominant trend remains bearish on the higher timeframes. Swing traders may interpret this as a market in transition, with potential for further choppy or range-bound action unless a decisive breakout or breakdown occurs.