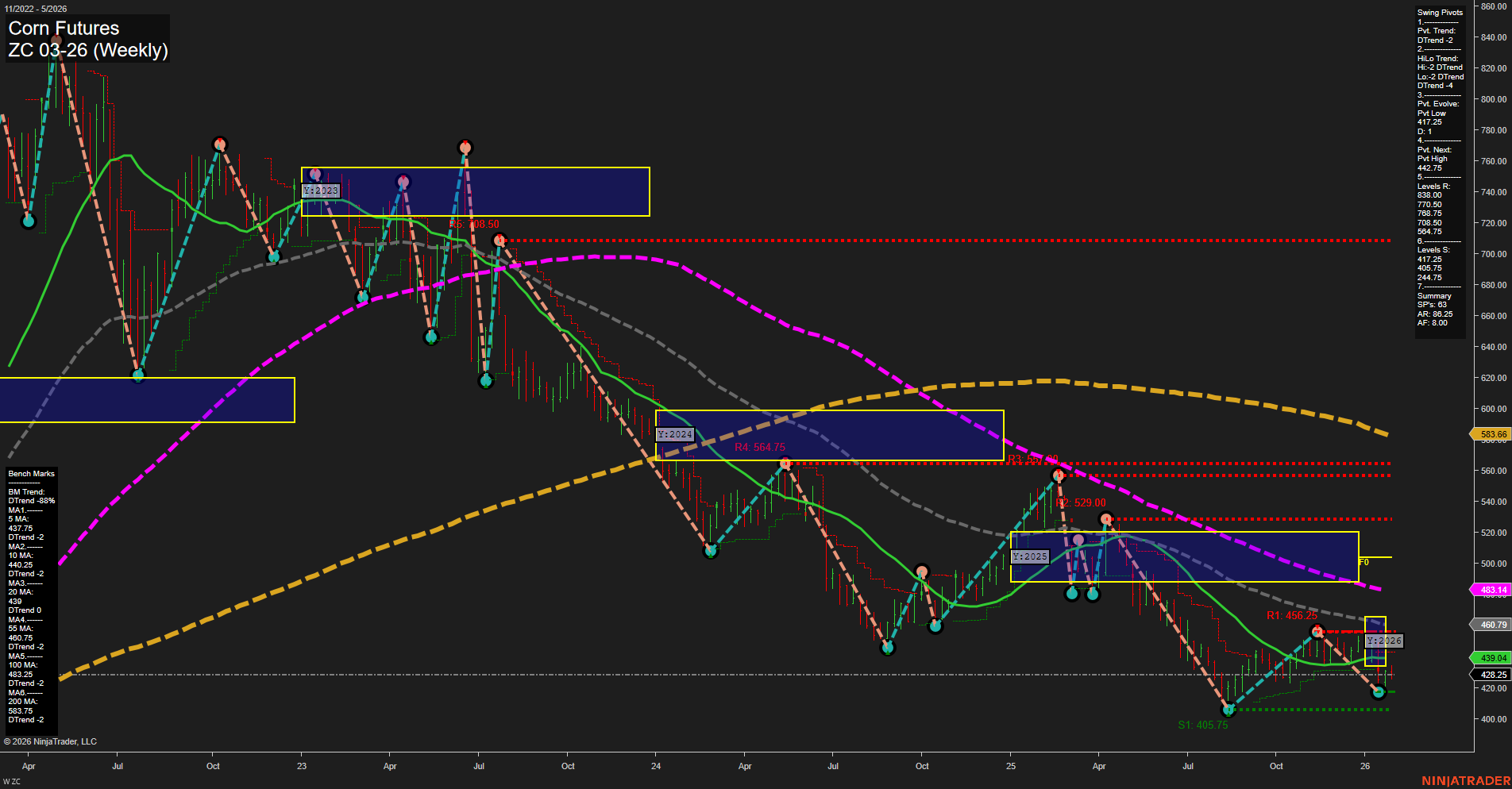

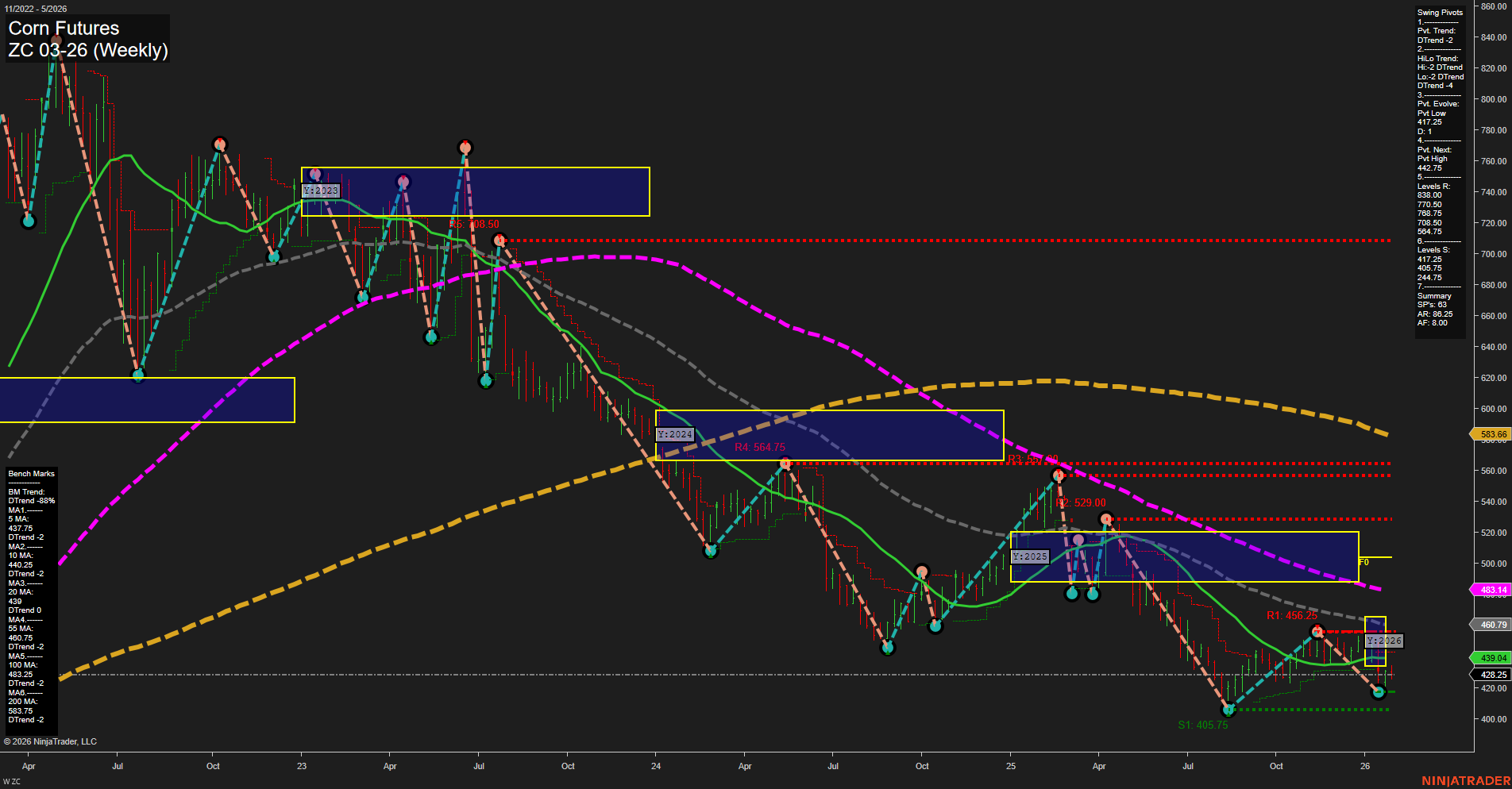

ZC Corn Futures Weekly Chart Analysis: 2026-Feb-01 18:21 CT

Price Action

- Last: 428.25,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -49%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -14%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 417.25,

- 4. Pvt. Next: Pvt high 542.75,

- 5. Levels R: 823.00, 780.50, 708.75, 654.75, 564.75, 529.00, 456.25,

- 6. Levels S: 417.25, 405.75, 244.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 437.75 Down Trend,

- (Intermediate-Term) 10 Week: 440.25 Down Trend,

- (Long-Term) 20 Week: 439.04 Down Trend,

- (Long-Term) 55 Week: 460.79 Down Trend,

- (Long-Term) 100 Week: 483.14 Down Trend,

- (Long-Term) 200 Week: 583.66 Down Trend.

Recent Trade Signals

- 30 Jan 2026: Short ZC 03-26 @ 428 Signals.USAR.TR120

- 28 Jan 2026: Long ZC 03-26 @ 432.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures continue to exhibit a persistent downtrend across all timeframes, as confirmed by the alignment of the WSFG, MSFG, and YSFG trends, all showing price below their respective NTZ/F0% levels. The swing pivot structure reinforces this bearish sentiment, with both short-term and intermediate-term trends pointing down and the most recent pivot evolving at a new low (417.25). Resistance levels remain well above current price, while support is clustered near recent lows, suggesting limited downside targets in the near term. All benchmark moving averages are trending lower, further confirming the prevailing bearish momentum. Recent trade signals show mixed short-term activity but the dominant direction remains to the downside. The market is in a consolidation phase near support, with slow momentum and medium-sized bars, indicating a pause within the broader downtrend rather than a reversal. No evidence of a significant bounce or trend change is present, and the technical landscape remains unfavorable for bullish swing setups at this time.

Chart Analysis ATS AI Generated: 2026-02-01 18:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.