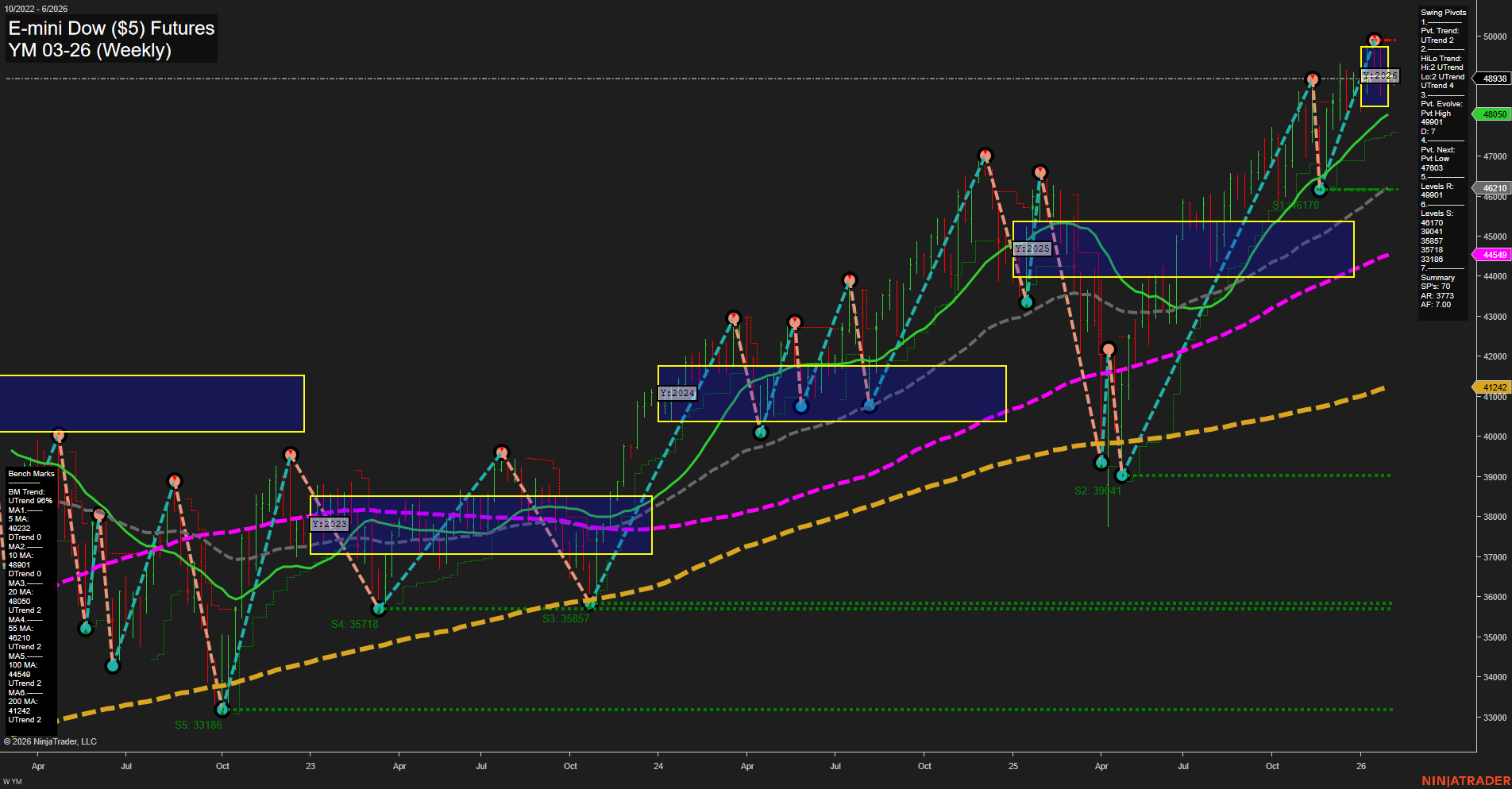

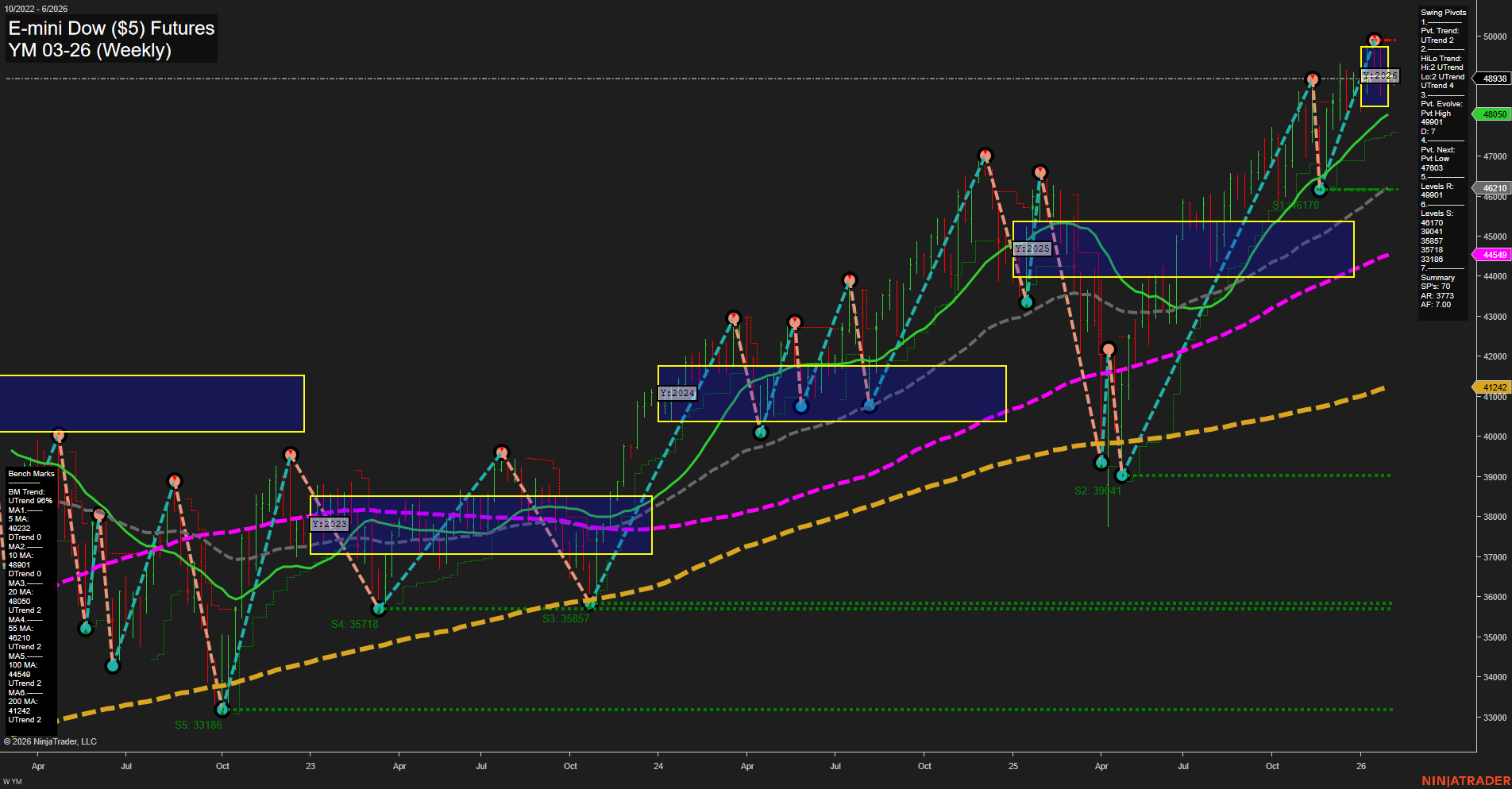

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2026-Feb-01 18:20 CT

Price Action

- Last: 48958,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 25%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 49225,

- 4. Pvt. Next: Pvt low 46210,

- 5. Levels R: 49225, 46913,

- 6. Levels S: 46210, 44549, 39817, 35718, 33186.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 48050 Up Trend,

- (Intermediate-Term) 10 Week: 46938 Up Trend,

- (Long-Term) 20 Week: 45409 Up Trend,

- (Long-Term) 55 Week: 44549 Up Trend,

- (Long-Term) 100 Week: 41242 Up Trend,

- (Long-Term) 200 Week: 40424 Up Trend.

Recent Trade Signals

- 30 Jan 2026: Short YM 03-26 @ 48901 Signals.USAR-WSFG

- 27 Jan 2026: Short YM 03-26 @ 49117 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures weekly chart shows a market that has been in a strong uptrend across intermediate and long-term timeframes, as evidenced by all major moving averages trending upward and price holding above key support levels. The short-term trend, however, is showing some signs of stalling, with recent short trade signals and price action near a swing high resistance at 49225. Momentum is average, and the bars are medium-sized, suggesting neither aggressive buying nor selling pressure at this moment. The price remains above the NTZ (neutral zone) for both weekly and monthly session fib grids, supporting the ongoing bullish structure, but the yearly grid is neutral, indicating a potential pause or consolidation phase. Key support levels are well below current price, providing a cushion for any pullbacks. Overall, the market is in a bullish posture for swing traders on intermediate and long-term horizons, but short-term traders should be alert to possible consolidation or minor retracement as the market tests resistance and digests recent gains.

Chart Analysis ATS AI Generated: 2026-02-01 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.