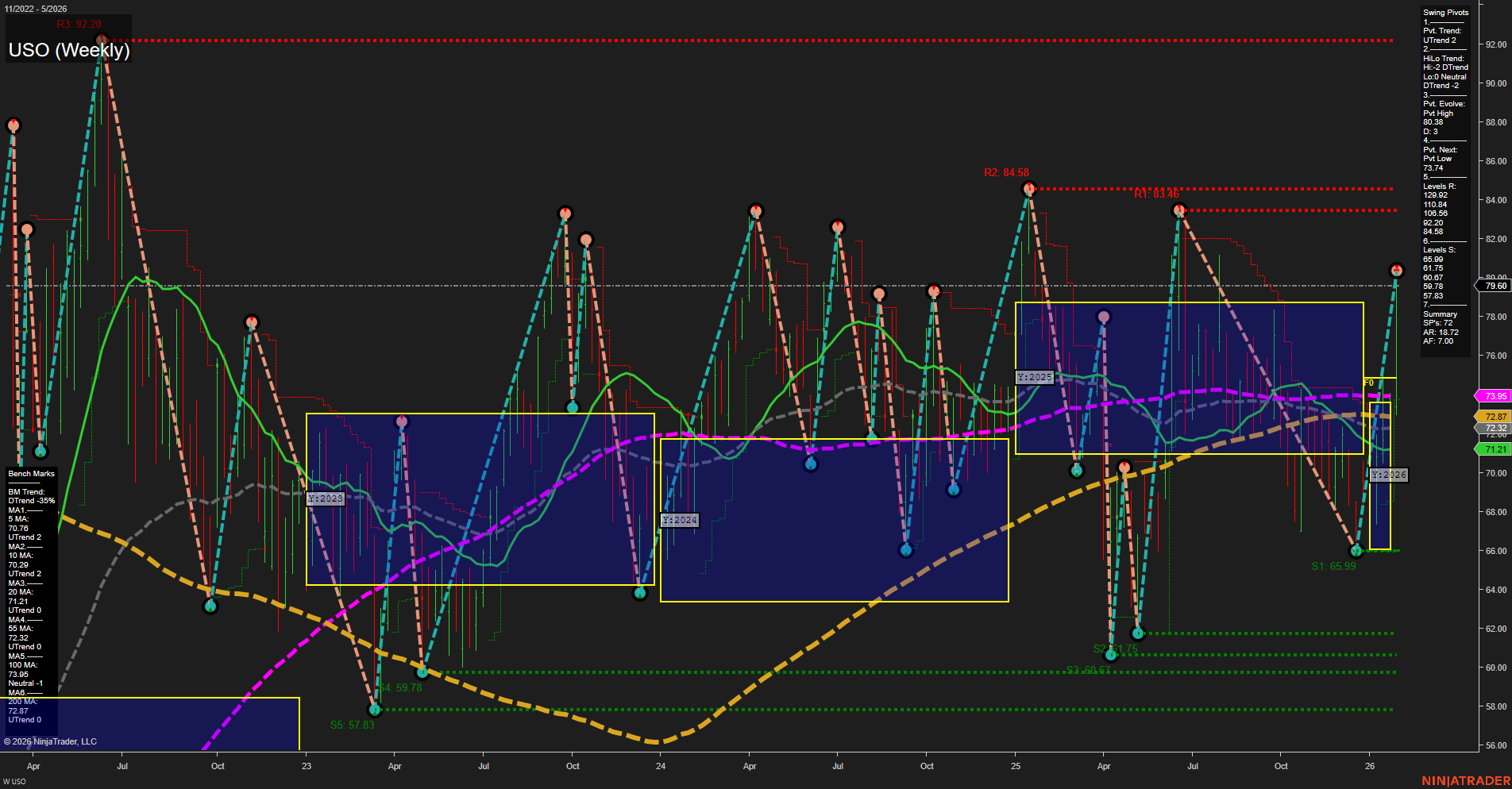

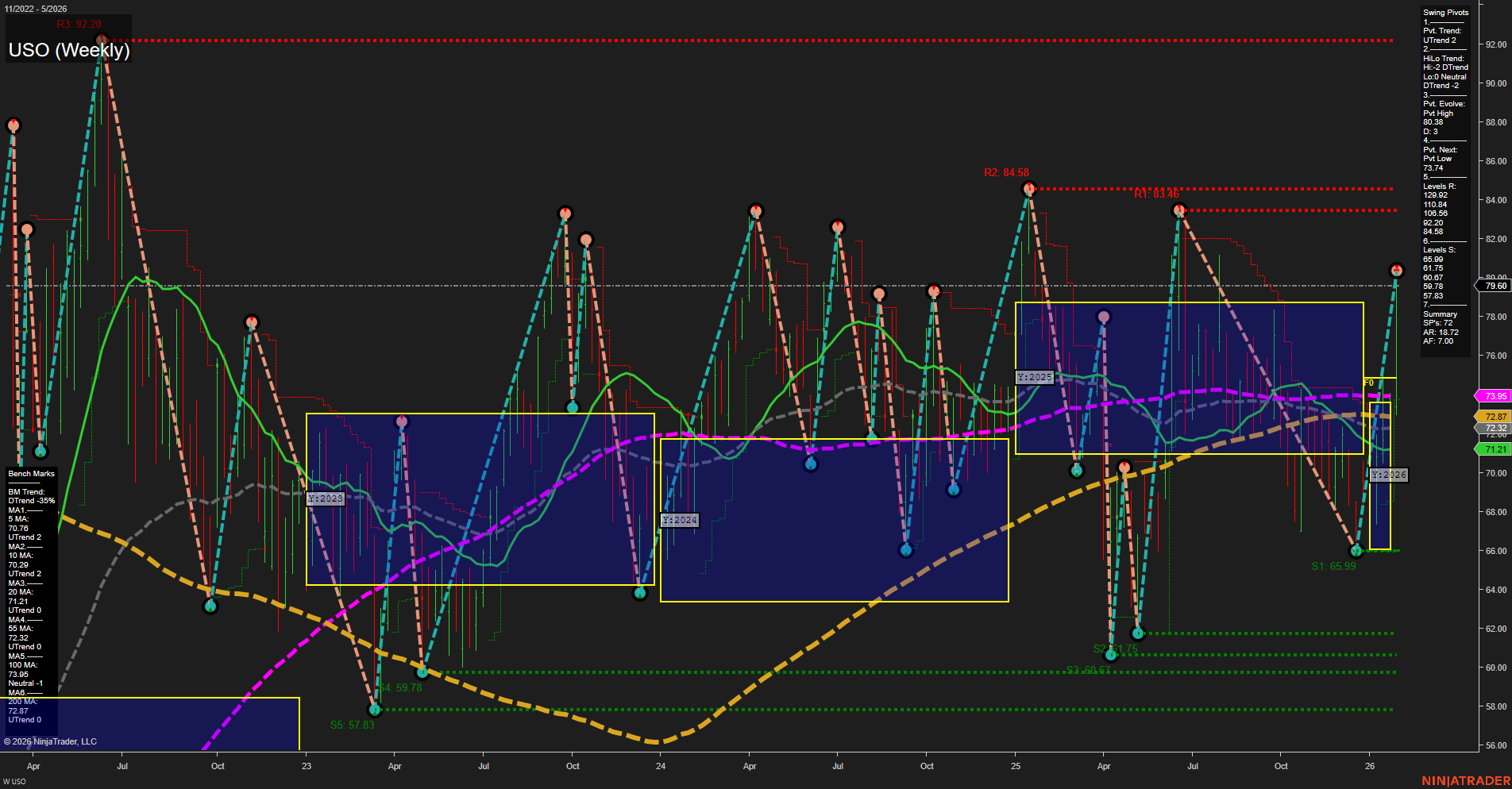

USO United States Oil Fund LP Weekly Chart Analysis: 2026-Feb-01 18:19 CT

Price Action

- Last: 73.95,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 80.36,

- 4. Pvt. Next: Pvt low 65.99,

- 5. Levels R: 92.20, 84.58, 83.36, 80.36, 79.69, 66.75, 60.75,

- 6. Levels S: 65.99, 59.78, 57.83.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 70.70 Up Trend,

- (Intermediate-Term) 10 Week: 72.23 Up Trend,

- (Long-Term) 20 Week: 72.02 Up Trend,

- (Long-Term) 55 Week: 73.22 Down Trend,

- (Long-Term) 100 Week: 73.95 Down Trend,

- (Long-Term) 200 Week: 71.21 Up Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The USO weekly chart reflects a market in consolidation, with price action contained within a broad neutral zone as indicated by the NTZ and F0% levels across all session fib grids. The last price of 73.95 sits near the 100-week and 55-week moving averages, both of which are trending down, while shorter-term benchmarks (5, 10, and 20 week) are in mild uptrends, suggesting a lack of clear directional conviction. Swing pivots show a short-term uptrend but an intermediate-term downtrend, with the most recent pivot high at 80.36 and next key support at 65.99. Resistance levels are stacked above, with significant overhead supply between 79.69 and 92.20, while support is layered from 65.99 down to 57.83. The overall technical landscape is one of range-bound, choppy trading, with no strong momentum or breakout signals present. This environment is typical of a market awaiting a catalyst, with both bulls and bears lacking dominance, and price cycling between established support and resistance. Futures swing traders may observe that the current structure favors mean reversion and range strategies over trend-following, as the market digests prior volatility and awaits new directional cues.

Chart Analysis ATS AI Generated: 2026-02-01 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.