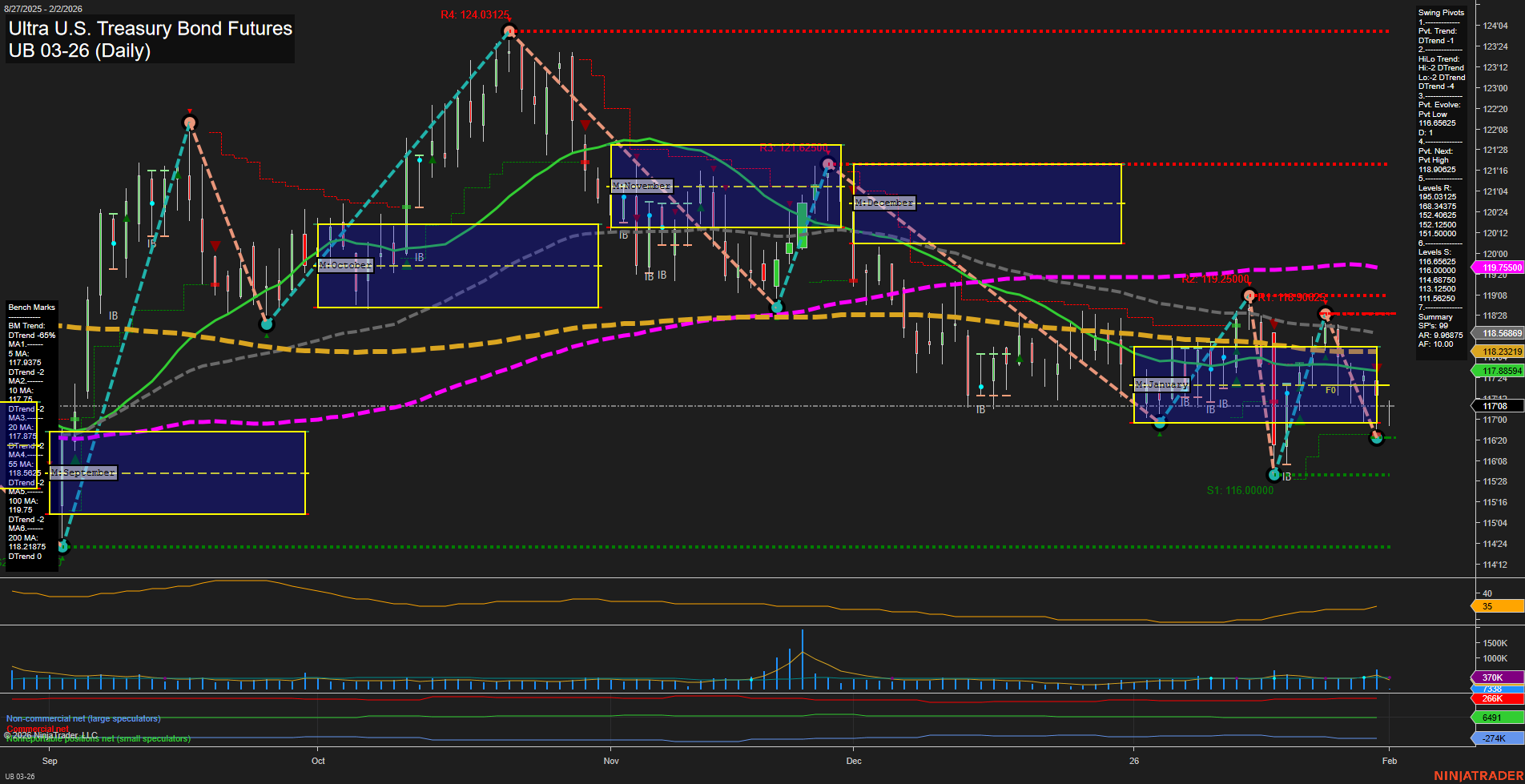

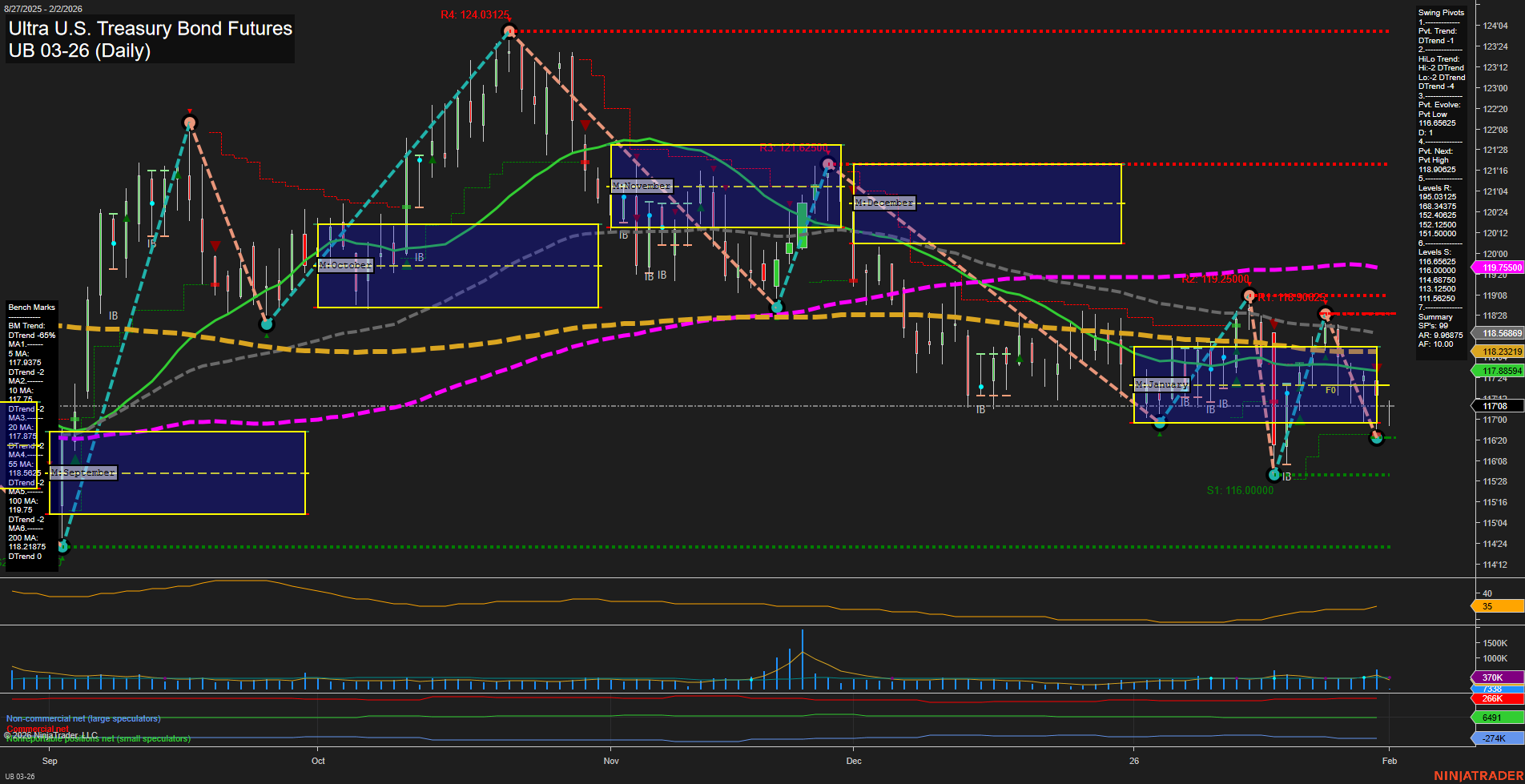

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2026-Feb-01 18:18 CT

Price Action

- Last: 117.085,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -10%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 116.6025,

- 4. Pvt. Next: Pvt High 118.90625,

- 5. Levels R: 121.025, 119.25, 118.90625, 118.6025, 118.34375, 117.90625, 117.5, 117.25,

- 6. Levels S: 116.0, 115.5.

Daily Benchmarks

- (Short-Term) 5 Day: 117.374 Down Trend,

- (Short-Term) 10 Day: 117.9375 Down Trend,

- (Intermediate-Term) 20 Day: 118.23219 Down Trend,

- (Intermediate-Term) 55 Day: 118.56689 Down Trend,

- (Long-Term) 100 Day: 119.755 Down Trend,

- (Long-Term) 200 Day: 118.28478 Down Trend.

Additional Metrics

Recent Trade Signals

- 30 Jan 2026: Short UB 03-26 @ 116.875 Signals.USAR-MSFG

- 27 Jan 2026: Short UB 03-26 @ 117.59375 Signals.USAR.TR120

- 27 Jan 2026: Long UB 03-26 @ 118.625 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart is showing a clear bearish structure across all timeframes. Price is trading below the key F0%/NTZ levels on the weekly, monthly, and yearly session fib grids, confirming persistent downside pressure. Both short-term and intermediate-term swing pivot trends are in a downtrend, with the most recent pivot evolving at a new low (116.6025) and the next potential reversal only above 118.90625. Resistance levels are stacked above, while support is thin and lower at 116.0 and 115.5, suggesting risk of further downside if these levels are tested. All benchmark moving averages from short to long-term are trending down, reinforcing the dominant bearish momentum. Recent trade signals have favored the short side, and the slow momentum with medium bars and moderate volatility (ATR 46) indicate a controlled but persistent selloff rather than a panic move. Volume is steady, not spiking, which aligns with a methodical trend continuation rather than a capitulation event. The market appears to be in a sustained downtrend, with no immediate signs of reversal or strong counter-trend activity.

Chart Analysis ATS AI Generated: 2026-02-01 18:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.